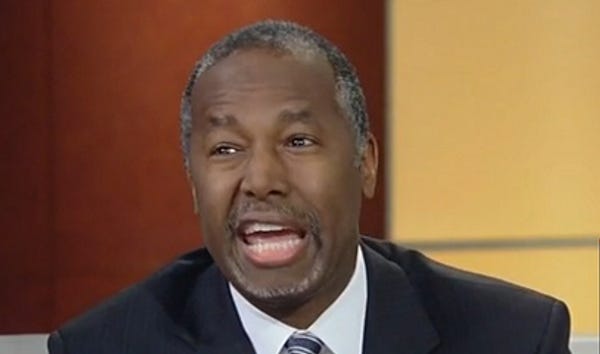

Ben Carson Sick Of People Donating To His Charity And Getting Away With It

He's as slightly miffed as heck and maybe he won't even take it anymore that much

Aw, adorable. Dr. Ben Carson has a "tax plan." You can read all about it on his website , where he doesn't offer any details, but he does complain that the current code is "74,000 pages" long, which is "an abomination," and President Carson will come up with "a fairer, simpler, and more equitable tax system, with a form you can complete "in less than 15 minutes," which "will enable us to end the IRS as we know it." We have been promised a more detailed plan in the coming month or so, but at Tuesday's debate, Carson sneak-previewed a few more specifics for us of his Bible-inspired tithing-based tax plan because, as he's previously said, "I think God is a pretty fair guy," so let Him write our tax code:

Everybody should pay the same proportion of what they make. You make $10 billion, you pay a billion. You make $10, you pay one. You get same rights and privileges.

I don't see how anything gets a whole lot fairer than that. But you also have to get rid of all the deductions and all the loopholes because that is the thing that tilts it in one direction or another.

Allthe deductions, Dr. Carson? Including this kind ?

The Carson Scholars Fund, Inc. is a 501 (c)(3) nonprofit organization. Donations are tax deductible to the fullest extent allowed by law.

As you might have sussed out, that nonprofit -- to which donors may give money to exploit our tilted, unfair system and receive deductions President Carson will eliminate -- is none other than the scholarship program started in 1994 by Dr. Carson and his wife, Candy, "to address the education crisis in the United States."

As the Charity Navigator explains , Doing Good is the best reason to make charitable donations, but "great tax benefits exist for those who give." And:

As your income tax bracket increases, the real cost of your charitable gift decreases, making contributions more attractive for those in higher brackets. The actual cost to a person in the lowest bracket, 15%, for a $100 contribution is $85. For a person in the highest bracket, 35%, the actual cost is only $65. Not only can the wealthy afford to give more, but they receive a larger reward for giving.

Our current tax system rewards rich people for giving lots of money to charities, but we assume everyone who donates to Carson's scholarship fund does so out of the goodness of their hearts, and not because of those terrible tax deductions Carson opposes. In fact, as Carson explained at the debate, if we get rid of those kinds of loopholes, people will probably give even more!

And they say there will be no more charitable giving. We had churches before that and charitable organizations before that. The fact of the matter is, I believe if you put more money in people's pockets that they will actually be more generous rather than less generous.

Care to wager your own charity on that, Dr. Carson?

In addition to his loophole-slashing, his suggested flat tax rate of 10 percent doesn't exactly add up -- unless a $1.1 trillion hole is a feature, not a bug. But at least it will give huge tax cuts to the rich and stop encouraging them to make charitable donations. Seems fair. And godly too.

[ Carson Scholars / Transcript via WaPo / Charity Navigator ]