Brother, Can You Spare Two Literal Dimes For Donald Trump’s Tax Bill?

Get lost, deadbeat.

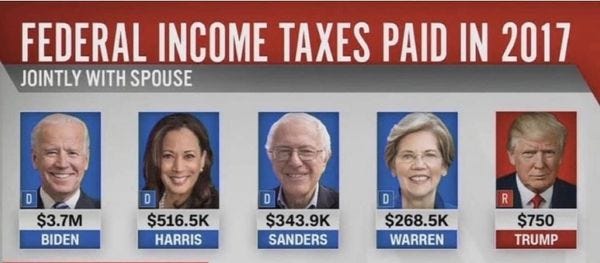

It's not quite October but this is still a pleasant surprise. The New York Times dropped a bomb on Donald Trump's overpriced head Sunday. The paper obtained Trump's tax information for more than two decades, and it's a doozy: Trump paid no — as in zero — taxes for 10 of the 15 years prior to his presidency. However, President Deadbeat wrote Uncle Sam a big check for $750 in 2016. That's right. He paid the federal government less than his cable provider. He paid another $750 in 2017. If your income was greater than $20,000 last year, you likely paid more in federal income tax.

How did he pull this off?

His reports to the I.R.S. portray a businessman who takes in hundreds of millions of dollars a year yet racks up chronic losses that he aggressively employs to avoid paying taxes.

That's not the description of a “businessman." It's the plot of The Producers . Trump is a walking one-man Ponzi scheme who plays everyone he meets for a sucker. This includes the current first lady, who negotiated a fat prenup settlement on the taxpayer's dime, but Trump could never pay it. He's really, most sincerely broke.

.@HillaryClinton: “Why won’t Trump release his tax returns? Maybe he’s not as rich as he says he is. He owes $… https://t.co/PXdW6G73i1

— chris evans (@chris evans) 1601268392.0

Give the lady credit; she was four for four.

Alan Garten, a lawyer for the Trump Organization, responded defensively to the Times expose.

GARTEN: Over the past decade, President Trump has paid tens of millions of dollars in personal taxes to the federal government, including paying millions in personal taxes since announcing his candidacy in 2015.

Is Garten finished? Well, allow the Times to retort:

With the term "personal taxes," however, Mr. Garten appears to be conflating income taxes with other federal taxes Mr. Trump has paid — Social Security, Medicare and taxes for his household employees. Mr. Garten also asserted that some of what the president owed was "paid with tax credits," a misleading characterization of credits, which reduce a business owner's income-tax bill as a reward for various activities, like historic preservation.

During his reign of terror, everyone's been after Trump's tax returns with limited success. The information that the Times got its hands on is what Trump's personally disclosed to the IRS and it still makes him look like The Biggest Loser instead of the Apprentice, unless you want to learn from the master how to dodge taxes.

But it's inaccurate and unfair to compare Trump to Al Capone, who was a successful if not legitimate businessman. He was, in today's dollars, a real billionaire. Trump avoided taxes by shamelessly taking advantage of every available loophole for rich creeps. Your idiot Trump-supporting relative might defend him as a savvy businessman, but he flat-out loses more money than he ever earns. And he manages money like a twentysomething credit card surfer.

In 2012, he took out a $100 million mortgage on the commercial space in Trump Tower. He took nearly the entire amount as a payout, his tax records show. His company has paid more than $15 million in interest on the loan, but nothing on the principal. The full $100 million comes due in 2022.

Trump's primary “business" was fooling people into thinking he was a businessman, so he perhaps believed it justified to write off every single penny of his living expenses as a “business expense." Or he's just a cheat. That last one also works.

Take for instance, as the IRS eventually will, Trump's Seven Springs estate in Westchester County, New York. Trump lists it as an investment property but the law requires that you have "an actual and honest objective of making a profit." You can't just live in it like a common poor person while writing off $2.2 MILLION in property taxes as a business expense, which Trump does, while limiting other people's deductions for all state and local taxes to $10,000.

Eric Trump, his second idiot son, doesn't bother hiding that Seven Springs is a personal residence.

In 2014, Eric Trump told Forbes that "this is really our compound." Growing up, he and his brother Donald Jr. spent many summers there, riding all-terrain vehicles and fishing on a nearby lake. At one point, the brothers took up residence in a carriage house on the property. "It was home base for us for a long, long time," Eric told Forbes.

Trump originally planned to develop Seven Springs into one of his tacky hunting lodges for rich weirdos, but the residents thwarted him. Stuck with the property, he settled for a more reliable mark, the government. He agreed not to develop the property, which he couldn't do anyway, in exchange for a $21.1 million tax deduction. This is called "a conservation easement," and the Seven Springs deduction is one of four that he's claimed over the years. This is the bulk of his "charitable giving" — about "$119.3 million of roughly $130 million in personal and corporate charitable contributions reported to the I.R.S." He's like a Santa Claus who instead of giving toys to children agrees not to leave the North Pole at all in exchange for a significant tax break.

Mr. Trump has written off as business expenses costs — including fuel and meals — associated with his aircraft, used to shuttle him among his various homes and properties. Likewise the cost of haircuts,including the more than $70,000 paid to style his hair during "The Apprentice."Together, nine Trump entities have written off at least $95,464 paid to a favorite hair and makeup artist of Ivanka Trump.

Schoolteachers are paying for school supplies out of their own pocket but at least Trump's gotten a break on his onerous personal hair care expenses.

The Trump Corporation also recently wrote off as a "business expense" legal fees related to representing Donald Trump Jr.'s dumb ass during the Russia investigation. This is not entirely on the up-and-up because that had nothing to do with the running of his business. Although, it's long been argued that Trump only ran for president in the first place so he could improve his fading brand.

Trump's most successful turn as a businessman was playing one on TV. The Times reports that "The Apprentice" earned Trump a total of $427.4 million. Johnny Depp made more money from those pirates movies, and he lost it all in more entertaining ways. Trump's investment in golf courses was another stinker. He's reported losses of $315.6 million. He also desperately sold off most of his stocks just before he might've made real money from them. So much winning!

He’s broke, he lives in our house, and he’s been stealing from us.

— Jason Kander (@Jason Kander) 1601247474.0

Trump has gotten away with paying zero taxes, even while boasting of how wealthy he was during his presidential campaign, because he's leveraged almost $1 billion in business losses, effectively pleading poverty to the government while living a life of luxury. Ronald Reagan would've called him a “welfare queen," but he's not a poor Black woman.

The Times can't confirm how legitimate most of Trump's deductions are, though many look fishy. Ivanka Trump reported payments totaling $747,622 from a consulting company she co-owned. Those payments “coincidentally" match tax deductions the Trump Corporation claimed. Considering Ivanka was already a paid employee, this would seem like double-dipping and raises the “legally perilous" question of whether Trump was illegally transferring wealth to avoid gift taxes. His best defense is that he has no real wealth to transfer.

The true threat to Trump and the nation is that his party is ending. Trump is on the hook personally for loans and debts totaling $421 million, most of which come due in the next few years. He's in trouble unless he can unload some magic beans in a hurry. It's somewhat important that Americans know just who has that great a hold over the president. The piper is set to be paid. If he were to win re-election, his creditors could be in the position of having to foreclose on a sitting president. While that's hilarious, it's likely Trump would do anything to avoid financial ruin and that makes him compromised.

Any normal person in such dire financial straits would rightly be considered a security risk. And even if Trump loses in November, he still has access to national security secrets and information that are of greater value than anything Trump owns. It's very tempting collateral for yet another foreign bailout.

Follow Stephen Robinson on Twitter.

Do your Amazon shopping through this link, because reasons .

Yr Wonkette is 100 percent ad free and supported entirely by reader donations. Please click the clickie, if you are able!

The Martians? https://uploads.disquscdn.c... https://exopolitics.org/tag...

Buying Greenland just before the last of the ice melts makes sense in a Trump world.