Don't You Dare Link Inflation To Corporate Profits, Or Instagram'll Get Ya

Guess all the Nazis must be off the internet now.

We guess Meta, the corporate parent of the Face Books and the Insta Grams, must have completed its cleanup of vaccine and disinformation and hate groups on its platforms. We're all for correcting disinformation on social media, because lord knows it can kill people. But according to examples posted to Twitter, Instagram now appears to be going beyond simply correcting provable untruths about science, and has branched out to providing "context warnings" on a far less definite topic: the causes of inflation.

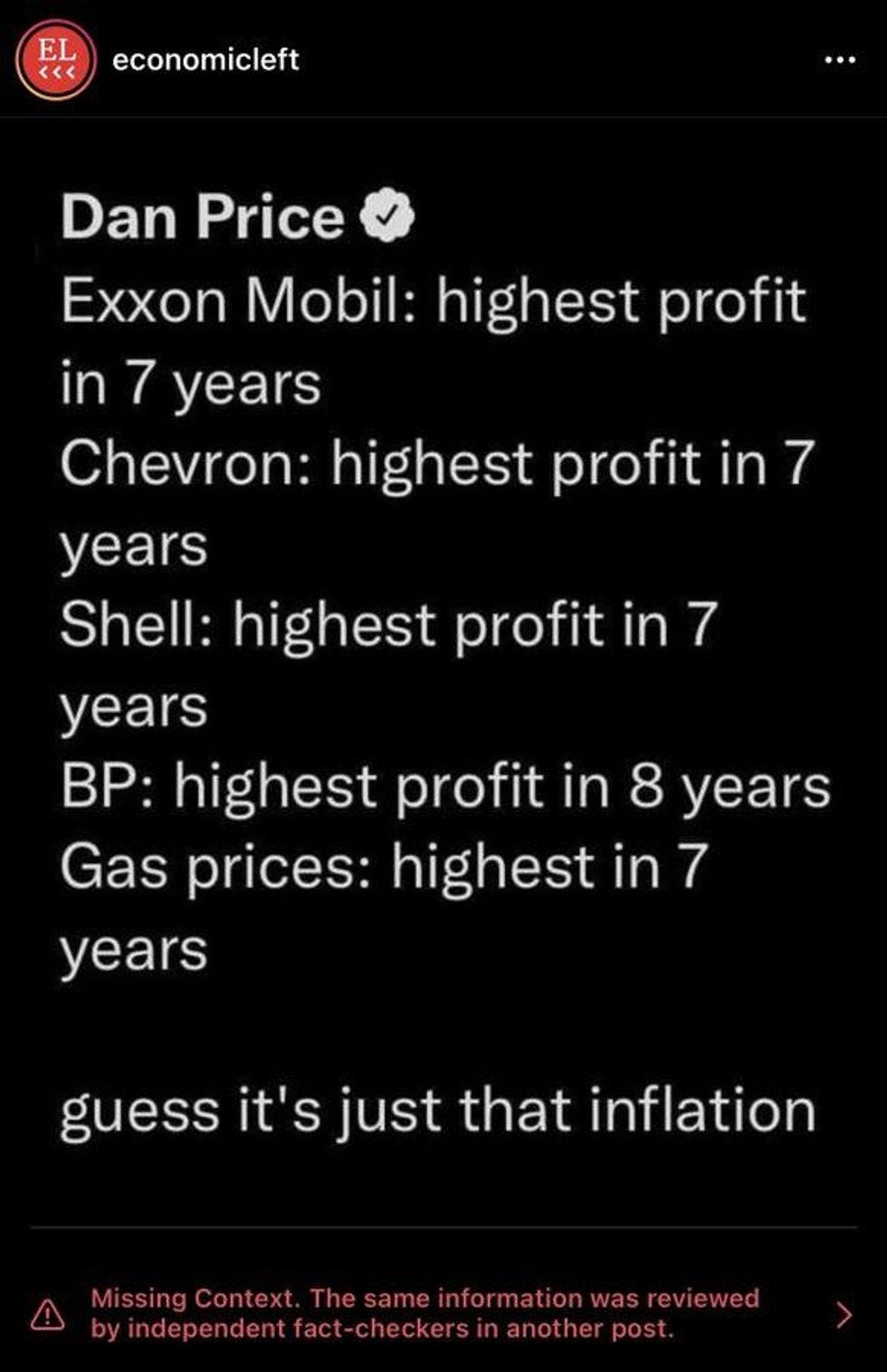

A snarky post notes recent record corporate profits for several huge oil companies, then points out that gas prices are also at a seven-year high. The comment then adds, "guess it's just that inflation."

Below that, Instagram adds the warning, " Missing Context. The same information was reviewed by independent fact-checkers in another post."

Another tweet captured the full warning from Instagram:

Missing Context

The same information was reviewed in another post by fact-checkers. There may be small differences.

Independent fact-checkers say information in this post is missing context and could mislead people.

The warning reminds yet again that the post was "missing context," and provides a link to an AFP United States story headlined "Corporate price hikes are not root cause of soaring US inflation." That's followed by a cheery admonition to "Learn more about how Instagram is working with independent tact-checkers to reduce false information."

Again, this is kind of nuts. Yes, AFP America did a story in which several economists said rising inflation was primarily caused by "big federal spending, heightened demand, and supply problems, all of which have accompanied the pandemic."

But as a great economic expert once said, "That's just, like, your opinion, man." Unlike virology or epidemiology or climate science, the field of economics is a far less exact science — it's even a dismal one, we hear. The notion that inflation is the result of "big federal spending" is especially contentious and rooted in ideology; it implies that we might somehow be in much better shape with inflation if only Congress hadn't passed the economic stimulus programs that kept people from falling into poverty and sparked a robust recovery , which has had the related effect of creating impressive job growth, with millions of jobs in 2021.

Read More:

SHUT UP LARRY. American Middle, Working Classes Got Some $ In Their Pockets!

Hey, Look At The 467,000 New Jobs In January! Thanks A Lot, Biden!

Yes, that also contributed to inflation, particularly as workers saw better pay and stronger negotiation power. But it's a hell of a lot better to have strong employment and growth, with some inflation, than to have slow growth, high unemployment, and little to no inflation.

This is where we add that that's an opinion — and a fucking well-supported one — not a simple "fact."

So, is corporate greed a factor in the current rise in inflation? Sens. Bernie Sanders and Elizabeth Warren certainly argue that it's pretty fishy that corporate profits are at record levels, even as consumer prices are also way up. The White House is also looking at whether companies are taking advantage of the pandemic and supply chain issues to reap excessive profits

In an interview with NPR, University of Massachusetts Amherst economist Isabella Weber said that while the biggest driver of inflation right now is the mismatch between demand and the ability of manufacturers to meet it — made even worse by ongoing supply chain snags — it's also not surprising that corporations would want to maximize profits, since that's what they do .

In the current context, they suddenly cannot deliver as much anymore as they used to. And this creates an opening where they can say, well, we are facing increasing costs. We are facing all these issues. So we can explain to our customers that we are raising our prices. No one knows how much exactly these prices should be increased. And everybody has some sort of an understanding that, oh, yeah, there are issues, so, yes, of course companies are increasing prices in ways in which they could not justify in normal times.

But this does not mean that the actual amount of price increase is justified by the increase in costs. And as a matter of fact, what we have seen is that profits are skyrocketing, which means that companies have increased prices by more than cost. In the earnings reports, companies have bragged about how they have managed to be ahead of the inflation curve, how they have managed to jack up prices more than their costs and as a result have delivered these record profits.

Professor Weber just better not say that on Instagram, though, or she'll get slapped with a warning that higher prices have nothing to do with corporate greed.

This all reminds us of the bizarre fact-checks of Bernie Sanders that the Washington Post and others used to enjoy so much. While Donald Trump was spewing lies at a near-untrackable rate, the Post and other facty-checky outfits went out of their way to admonish Sanders for saying things that were true, but perhaps not nuanced enough, or completely true but somehow not true the right way . Let's hop in Barack Obama's time machine and look!

Read More:

Bernie Sanders And The Case Of The Absolutely True Campaign Message, You Fact Checker DICKS.

WaPo Fact Checker's New Bernie Sanders Category: TRUE BUT I DON'T LIKE IT

When It Comes To Bernie Sanders, America's Fact-Checkers Suddenly A Bunch Of Existentialists

There was that time when WaPo's glenn Kessler gave Sanders three goddamn Pinocchios for saying that roughly half a million Americans go bankrupt annually because of medical debt, even though the author article Sanders got the number from said Sanders had cited him accurately — and that the true total might even be higher. (Kessler didn't like the survey's methodology; the researcher said nuts to that .)

In another "fact" check, WaPo complained that Sanders had told the truth in a debate — that America's three richest men have more wealth than the entire bottom half of the US population — but that he wasn't really telling the truth, because people in the bottom half of the economy "have essentially no wealth, as debts cancel out whatever assets they might have." We're still scratching our head over that one.

Our favorite, though, might be the time that the Associated Press and FactCheck.org accused Sanders (and other Dems) of exaggerating the threat of climate change as an "existential crisis," because not even the most dire climate projections say humanity will go extinct as a species. Sure, the worst consequences of unchecked global warming would include massive death, famines, historical economic upheaval and migration, potential wars, and parts of the planet becoming mostly uninhabitable for humans, but that would only be a civilizational catastrophe , we guess.

In conclusion, treating economic arguments as if they have the same level of certainty as medical science is pretty fucking stupid, and having an opinion on corporate greed is not the same as saying the coronavirus is a hoax, the end.

[ NPR / Reuters / Teddie on Twitter / Joe Weisenthal on Twitter]

Yr Wonkette is funded entirely by reader donations. If you can, please give $5 or $10 a month, to help us keep up with the rising price of fart jokes — talk about inflation! And sudden deflation.

Do your Amazon shopping through this link, because reasons .

I think that's a life lesson we can all live by.

It's ridiculous to assert that corporate greed and price gouging haven't played a role in inflation. As an admittedly anecdotal example, the US recently cut off avocado imports from Mexico due to credible death threats to our ag inspector there. The article noted that this would likely impact stock in about two weeks, however local markets are already charging $2.50 for a single avocado. I live in Los Angeles; California has its own robust production of avocados. There is zero reason for a price jump like that to happen other than grocery chains trying to make a buck.