Don't Try To Bullsh*t Elizabeth Warren

The rich will always be with us, and always a burden.

CNBC invited Sen. Elizabeth Warren (D-Massachussetts) to its "Closing Bell" program yesterday to discuss theGameStop fuck-tussle . After Warren excoriated the investor class for finally complaining about terrible, terrible gaming of the stock market when gaming is basically how the investor class makes its money in the first place, cohost Sarah Eisen asked Warren a question about Joe Biden's call to repeal the 2017 Big Fat Tax Cuts for Rich Fuckwads.

That provided Warren a fine opening to say that if we really want to do something to unskew the economy away from prioritizing the investor class above everyone else in the economy, we should go beyond just raising corporate taxes; we also should pass her proposed wealth tax . But oh dear, fretted Eisen, wouldn't that just make all the rich people load their Bentleys onto their yachts and go somewhere else?

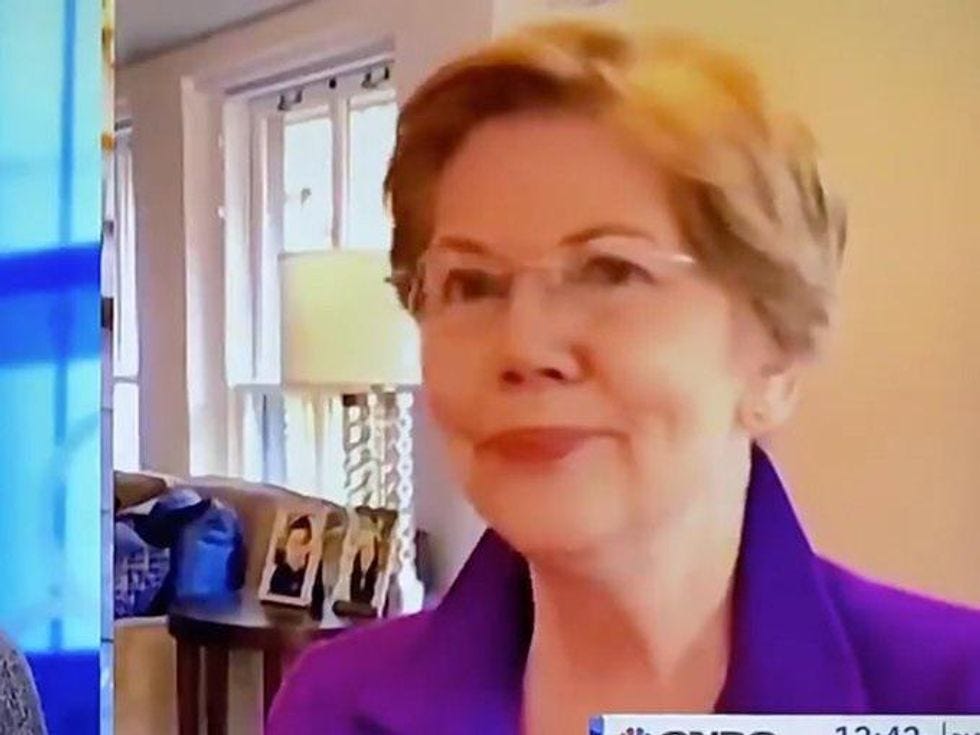

The great thing about the video, shared on Twitter by Sawyer Hackett (Julián Castro's comms director), is seeing Warren's face as Eisen asks the question. Enjoy! The audio is entirely too low, so please remember to turn your volume back down if you crank it to hear (and we have a transcript, too, if you just want to just run the video to enjoy Warren getting her "don't you try that with me" face on).

[ia_video https: //s3.amazonaws.com/roar-assets-auto.rbl.ms/runner%2F22151-warren%2Bcnbc.mp4 source="https://s3.amazonaws.com/roar-assets-auto.rbl.ms/runner%2F22151-warren%2Bcnbc.mp4" feedbacks=true shortcode_id=1611931674499 expand=1 ]

Oh, it is on:

Also,remember to turn down your volume againso you don't terrify the cat when you click on something loud.

It's really kind of beautiful, and could only be improved by having David Attenborough walk us through the ensuing carnage.

Eisen really seems to think she has a heck of a gotcha, here, suggesting that raising taxes on the richest Americans

might also chase wealthy people out of this country as we've seen has happened with, with other wealth taxes. You just said how much we need the economy to be revitalized right now for companies to start adding jobs and not subtracting them anymore.

Get out of here with that nonsense. The investor class is not about to go abroad, crash with Mick Jagger, and record Exile on Wall Street.

Warren: I'm sorry. There is no evidence that anyone is going to leave this country because of the two-cent wealth tax. Can we just keep in mind right now in America who's paying taxes. You know the bottom 99% last year, paid about seven and a half percent of their total wealth in taxes. That's what it pays. The top one tenth of 1%, you know how much they paid, they paid about 3.2%. If they added a two-cent wealth tax, they'd still be paying less than most of the people in this entire nation.

It's true that rich people hate taxes, which is why they've invested so much in skewing the tax code to their advantage already. But moving to another country won't relieve the very rich of their US tax obligations, and even renouncing US citizenship involves tax penalties. Plus, there's the little detail that no matter how much they might grumble, actually giving up citizenship isn't an attractive option for a lot of people. It's fairly rare, because family and identity and voting and all that.

Warren went on, explaining that there's just such a thing as paying your fair share, and noting that we've all been subsidizing the very wealthy for decades:

Look, someone has to pay to keep this nation going and right now, what the top one tenth of 1%, the wealthiest people in this country, have said is, "let's let everyone else pay for it." Because what they want to do is not only keep their wealth, they want to keep building their wealth faster than anyone else. All I'm saying is can we have just, just a little fairness here: two-cent wealth tax so that we can have universal childcare…

Eisen interrupted, saying that she simply wanted to present a "counter argument," and Warren wasn't having any of that , either: "Well, how about a counter argument , though, based on fact? " And then, as public health experts have encouraged us to do, Warren washed her hands:

The wealthiest in this country are paying less in taxes than everyone else. Asking them to step up and pay a little more and you're telling me that they would forfeit their American citizenship, or they had to do that and I'm just calling her bluff on that. I'm sorry that's not going to happen.

And she's right: Rich people sometimes threaten to Go Galt with their money, but they seldom actually bugger off like they say they will. Sure, some may move around more inside the US to chase lower tax rates. But pulling up roots, even from state to state, is a pain in the ass, even if you don't have to ask a friend with a pickup truck to help but can buy your own (pickup truck, friend, etc).

The conversation continued a bit past the video, with the other cohost, Wilford Frost (which cannot possibly be a real name) mentioning the state-to-state moves that corporations make, but Warren wasn't impressed, pointing out that a national wealth tax would apply in all the states, and that it would even apply to assets squirrelled away in the Cayman Islands, so shut up with that.

And we say good for Warren, and now we will close this piece without even looking up whether there actually are any squirrels in the Caymans. We bet there are, those guys show up everywhere.

[ CNBC transcript / Sawyer Hackett on Twitter / Guardian ]

Yr Wonkette is funded entirely by reader donations. Please donate $5 to $10 a month if you can, and we'll pay every cent of tax on it we owe, because paying taxes is patriotic, damn it.

Do your Amazon shopping through this link, because reasons .

EWar will always be president of my heart.

Agreed, but make them pay if they want to do any business inside the country. They take their businesses oversees? Tax them if they want to sell good in the US. The US is the major market for goods and services, if they leave they give up profits and there are plenty of competitors who will take their place.