Economy Added 272,000 Jobs In May, Please Cheer Or Panic!

Lousy stinking strong economy!

It’s the first Friday of the month, so you know what that means: Dok’s kicking himself for forgetting to buy a bunch of groceries yesterday at the supermarket that gives you 10% off on the first Thursday of the month if you’re over 55. Also it means the Labor Department’s May employment report is out, showing Joe Biden’s economy created 272,000 new nonfarm jobs. That’s up from April’s 165,000 jobs, and quite a bit higher than the Dow Jones forecast of 190,000.

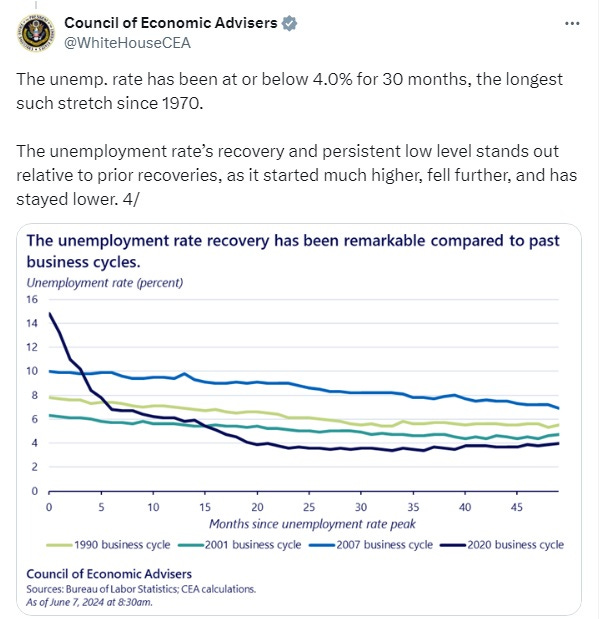

The unemployment rate edged up just a tenth of a percent, from 3.9 percent to four percent, breaking a near-record streak of 27 consecutive months of unemployment below that number. So fine, go ahead and phrase it, as Biden’s Council of Economic Advisers did this morning, as “at or below 4.0% for 30 months, the longest such stretch since 1970.” They managed to get a couple extra months in that way!

Wow, a record from 1970? Is that Freedom Rock? Well turn it up, man! (No, not the unemployment rate, silly.)

Some good news for workers, too, as CNBC explains:

[A]verage hourly earnings were higher than expected as well, rising 0.4% on the month and 4.1% from a year ago. The respective estimates were for increases of 0.3% and 3.9%.

When wages rise ahead of the inflation rate — which is the case here — that means more buying power for consumers, at least in the aggregate, although any one person’s situation can vary a lot. Again, those jolly Biden advisers note that we’ve seen “wage growth outpacing inflation for 12 months in a row,” and that while May’s inflation numbers aren’t in yet, “wages likely outpaced inflation over the year in May too.”

Also regarding that wage growth, the New York Times points out that it was especially strong among “production and nonsupervisory workers, at 0.5 percent.” Remember how Joe Biden has said all along that his policies are aimed at growing the economy “from the bottom up, and the middle out”? Here we are again with gains at the lower end of the income spectrum, which has been the trend in this recovery all along. Times reporter Lydia DePillis adds, however, that “Lower-income workers had been seeing slower pay increases after the big surge of 2021 and 2022.”

And now, prepare for the heel turn necessary for any report on hot jobs numbers: This month’s report probably means the Federal Reserve, ever worried about inflation, won’t cut interest rates anytime soon. The Fed said in December that it anticipated up to three rate cuts in 2024, but inflation would have to cool its shit before any cuts.

Accordingly, here’s the mandatory quote from an economist from CNBC, since jobs numbers like these are perfect for a bunch of “howevers” and similar hedges.

“One step forward, two steps back. Today’s data undermines the message that other recent economic data have been giving of a cooling U.S. economy, and slams the door shut on a July rate cut,” said Seema Shah, chief global strategist at Principal Asset Management. “Not only has jobs growth exploded again, but wage growth has also surprised to the upside, both moving in the opposite direction to what the Fed needs to begin easing policy.”

Oh, get out of here with your “exploded.” We’re going to go hang out with Biden’s economic advisers, they’re more fun.

Also, stocks dipped a little after the report was released, but then went right back up again, which must mean it’s Friday, is what we think.

[Bureau of Labor Statistics / CNBC / NYT]

Yr Wonkette is funded entirely by reader donations. If you can, please become a paid subscriber! But if a one-time donation is better for you, Professor Prettypaws will happily accept it and purr so very loudly.

OT: Meanwhile, in Gilead...

𝗧𝗲𝘅𝗮𝘀 𝗔𝘀𝗸𝘀 𝗣𝗲𝗼𝗽𝗹𝗲 𝘁𝗼 𝗔𝘃𝗼𝗶𝗱 𝗨𝘀𝗶𝗻𝗴 𝗧𝗵𝗲𝗶𝗿 𝗖𝗮𝗿𝘀

𝘛𝘦𝘹𝘢𝘴 𝘰𝘧𝘧𝘪𝘤𝘪𝘢𝘭𝘴 𝘢𝘳𝘦 𝘶𝘳𝘨𝘪𝘯𝘨 𝘳𝘦𝘴𝘪𝘥𝘦𝘯𝘵𝘴 𝘪𝘯 𝘴𝘰𝘮𝘦 𝘢𝘳𝘦𝘢𝘴 𝘵𝘰 𝘶𝘴𝘦 𝘥𝘪𝘧𝘧𝘦𝘳𝘦𝘯𝘵 𝘮𝘰𝘥𝘦𝘴 𝘰𝘧 𝘵𝘳𝘢𝘯𝘴𝘱𝘰𝘳𝘵𝘢𝘵𝘪𝘰𝘯 𝘰𝘵𝘩𝘦𝘳 𝘵𝘩𝘢𝘯 𝘵𝘩𝘦𝘪𝘳 𝘤𝘢𝘳𝘴 𝘰𝘯 𝘍𝘳𝘪𝘥𝘢𝘺 𝘢𝘴 𝘰𝘻𝘰𝘯𝘦 𝘱𝘰𝘭𝘭𝘶𝘵𝘪𝘰𝘯 𝘪𝘯 𝘵𝘩𝘦 𝘴𝘵𝘢𝘵𝘦 𝘳𝘦𝘢𝘤𝘩 𝘤𝘰𝘯𝘤𝘦𝘳𝘯𝘪𝘯𝘨 𝘭𝘦𝘷𝘦𝘭𝘴.

https://www.newsweek.com/texas-officials-warn-popular-activity-poses-risk-endangered-species-1909674

My young friend filled one of those jobs.

And she went from a crappy, part time, low wage retail job to working in a food lab for a major company here. Solid middle class wage with real benefits. This is the economy I like to see.

And we do need people to work in retail. They need full time hours, set schedules, benefits and good wages. They also need people to be nice. Just to be nice.