Elizabeth Warren Proposes New 'Eat The Rich' Tax

Now no one will ever have any money again :(

Elizabeth Warren is about to call for an itty bitty extra tax on the super-wealthy that would only apply to those with over $50 million in assets, according to one of the economists advising her. The "wealth tax" -- which really needs a flashier name, like the "eat the rich tax" -- would impose a two percent tax on wealth over the $50 million threshold, and and a three percent tax on those with assets over a billion dollars. Get ready for Trump supporters whose net worth is less than what Mark Zuckerberg spends on home-slaughtered goats to vow they'll NEVER let Warren come and take their F-150 pickups away, goddamn her socialist hide.

Unlike an income tax, which only affects the money you make in a year, a wealth tax would require rich fuckers to declare their total worth each year (all assets vs liabilities) and then pay a teeny-tiny sliver of that in taxes. The slogan could be "Two Percent From the One Percent," although really it would only be the .1 Percent.

UC Berkeley economists Emmanuel Saez and Gabriel Zucman have been helping Warren develop the plan in their spare time, when they're not out causing apoplexy among Republicans just by being "economists" from "Berkeley." Saez estimated the Spit-Roast The Rich Fuckwads tax would affect less than a tenth of a percent of households (about 75,000 nationwide), but would raise $2.75 trillion over a decade. "And it would all go to blacks to get abortions!"Saez very pointedly did not say to the Washington Post, although Republicans were already thinking it. As of yet, the Warren campaign hasn't commented on the plan, since her staff are all busy drawing up lists of patriots whose guns will be seized.

"The Warren wealth tax is pretty big. We think it could have a significant effect on wealth concentration in the long run," Saez said in an interview. "This is a very interesting development with deep root causes: the fact inequality has been increasing so much, particularly in wealth, and the feeling our current tax system doesn't do a very good job taxing the very richest people."

In addition to the tax, Warren would also seek to prevent tax avoidance by the very rich through increasing funding of the IRS, mandating that a certain portion of those required to pay the Fuck You, Rich Fuckers tax be audited each year, and -- to prevent bejillionaires going all Exile on Main Street -- a one-time tax penalty on anyone with over $50 million who tries to avoid taxes by renouncing their citizenship or hiring the Hell's Angels to provide concert security.

Saez and Zucman played around a bit with various versions of a plan for Warren, including one that would kick in with a lower rate (one percent) and hit more rich fuckers (annual income over $10 million), according to a letter to the candidate WaPo obtained. Does the story offer any insight as to why the two percent on wealth over $50 million was chosen instead? It does not. We are left wondering.

The story also notes that while "taxation of wealth has fallen out of favor in the world's richest countries," it's really a fairly recent (read "post-Reagan/Thatcher" and the rise of fucking western oligarchs writing the goddamn laws ) development.

In 1990, 12 member countries of the Organization for Economic Co-Operation and Development imposed some form of wealth tax.

By 2017, that number had fallen to just four: France, Norway, Spain and Switzerland. That decline has been mirrored by a decline in the taxation of high incomes, as well as a rise in inequality, according to the OECD.

Of course, wealth inequality isn't really a problem, say rich bastards and their pet political party.

The piece also dutifully notes that different think tanks have different projections of how much taxing the very wealthiest can raise:

The Institute on Taxation and Economic Policy, a left-leaning think tank, published a report on Wednesday finding that a 1 percent wealth tax on the wealthiest 0.1 percent of Americans would raise $1.3 trillion over a decade . That would affect U.S. households with wealth above $32.2 million.

By contrast, the righty Tax Foundation warns that Alexandra Ocasio-Cortez's plan to reimpose a 70 percent top marginal rate on those earning over $10 million would so shatter the economy that it would raise less than $200 billion a year or actually cause the federal government to lose $63.5 billion. That's because no one would ever innovate or work again, and then you'd come crying back to Wall Street to save you, but the disgusted billionaires would say "NO" and move to Galt's Gulch, where they'd all die after no one checked their food for salmonella.

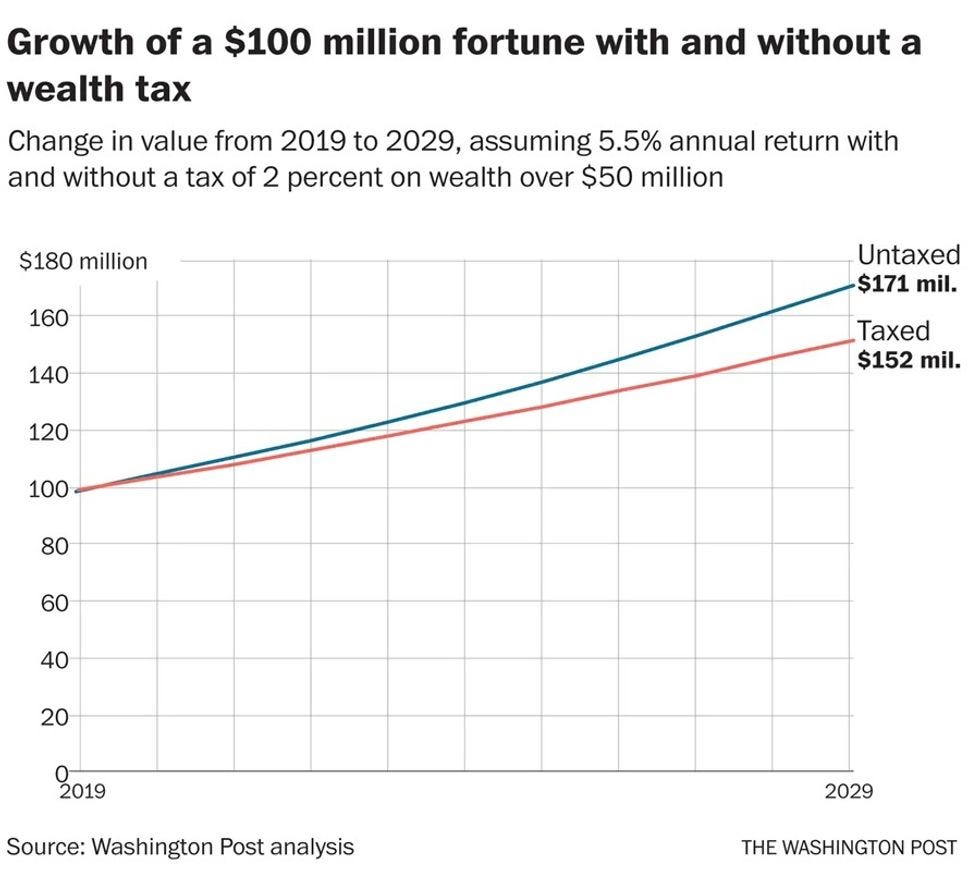

Heavens, just look at the bleak outlook for someone with a fortune of $100 million if they somehow had to slave away under Warren's total confiscation of two percent of their riches a year!

Facing $19 million less in earnings over a decade, the super-rich would almost certainly give up on America and just spend their days writing sad poetry to the money that never came to be, and then they'd fly their Gulfstream jet into the ocean in grief. Or they would, if they weren't suddenly POOR now. If the obscenely rich have to settle for being merely disgustingly rich, how will they even know who won?

Still those crazy Berkeley radicals seem to think this is a good time to talk about taxing the rich, what with "inequality," as if that were even a thing that matters:

The wealthiest 1 percent of families currently face a total tax burden, including state and local taxes, of about 3.2 percent relative to wealth, Saez and Zucman write in [their letter.

The bottom 99 percent of families currently has a tax burden of 7.2 percent relative to their wealth, the economists say.

"One of the key motivations for introducing a progressive wealth tax is to curb the growing concentration of wealth," Saez and Zucman wrote to Warren in their Jan. 14 letter. "The top 1 percent wealth share has increased dramatically from about 22 percent in the late 1970s to around 40 percent in recent years. Conversely, the wealth share of the bottom 95 percent of families has declined from about 50 percent in the late 1970s to about 40 percent today."

Yes, that may be true, but these are new times and thinking like this is clearly false and wrong, according to WaPo's fact checker, whom we have provoked enough already today.

[ WaPo / Photo: Tim Price, Creative Commons License 2.0 ]

And have we mentioned Elizabeth Warren 2020 lately? No? Well, we just did.

https: //wonkettebazaar.com/collections/elizabeth-warren-2020

And now this is your OPEN THREAD!

Yr Wonkette is supported by reader donations. Please send us money, and when we finally mulch the rich, we will invite you to the harvest.

Oh, I misread the non-comment. It's not always easy reading Wonkette on a small phone.

3 Monkeys except all three do all three bad actions?