SHUT UP LARRY. American Middle, Working Classes Got Some $$$ In Their Pockets!

Something something Alanis Morissette lyric.

While Fox News is busy telling us that inflation will be the death of America — an economy-crippling burden that Joe Biden did because he hates America — the real economic news is actually pretty damn good. Yes, Inflation is real, and if you have a very large family that drinks a dozen gallons of milk a week, that can be a (fake) worry. But here's the thing: This pandemic recovery is weird, but more American families are doing a lot better, thanks to Biden's American Rescue Plan, and are in far better shape to weather what's still expected to be a temporary increase in overall inflation — much of it driven by the high cost of new cars due to supply chain issues.

Yes, we just did what Fox News would call "downplaying the crisis" and what normal folks would call "putting inflation in context." On the whole, the economy is doing well, and average Americans are doing a lot better now than we were during the slow recovery that followed the Great Recession. And damn straight, much of that is due to Biden's American Rescue Plan, which got money into the hands of ordinary Americans, and thence into the cash registers of grocery stores and retailers.

Most importantly, the economic lessons of history should be that now is not any time to be cutting back on help for the middle and working classes. When the Roosevelt administration pulled back on New Deal spending in 1936, that was followed by a big economic contraction from 1937 to 1938, and the Great Depression really only ended with the federal spending boom of WWII.

How about we not do that this time around? One reason the recovery from the Great Recession was so shallow was that Obama advisors like Larry Goddamn Summers fretted about inflation, which never happened. We should be passing the Build Back Better reconciliation bill to keep the economy growing, so that working Americans really can build up their economic security, and to put the economy on a sounder, more equitable, and yes, much greener footing.

The inflation hawks who claim that the Rescue Plan overheated the economy are just plain wrong, as economist Claudia Sahm explains in a data-rich Substack column (and an accompanying Twitter thread ). In fact, Americans are doing pretty damn well:

If you look broadly at what’s happening in the U.S. economy—inflation-adjusted consumer spending, jobs, business investment, and household balance sheets—it’s clear that Americans are winning. That was not the case after the Great Recession when some of today’s hawks led policy.

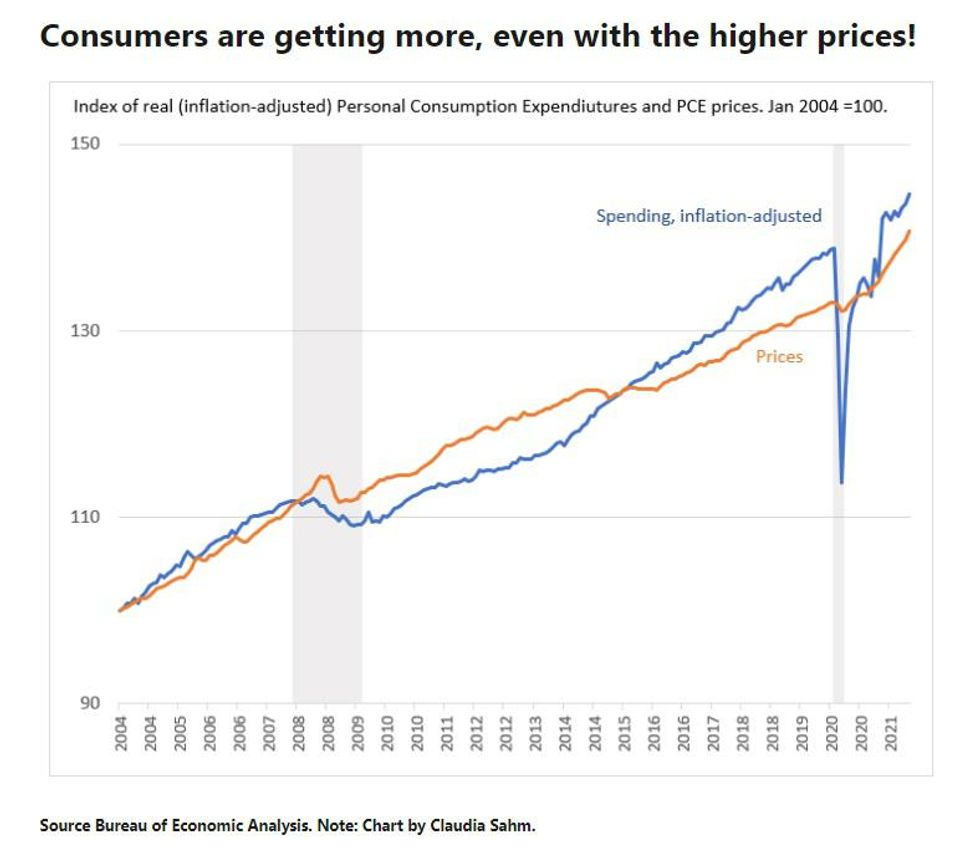

Sahm, a former Federal Reserve policy wonk who's now a senior fellow at the Jain Family Institute, shares a bunch of economic charts based on federal data making clear that in context, we're really doing pretty well. Take consumer expenditures: Even with higher prices, we're buying more stuff, and that's driving economic growth.

Jobs keep growing, with an average for 2021 of a half million new jobs per month. (And remember, the seeming slump in job growth during the summer wasn't real — businesses were just late in getting data to the feds, and the revised reports were far better than expected. You want that to continue? Keep increasing vaccination rates in the US, and for Crom's sake, vaccinate the damn world. It'll pay off.)

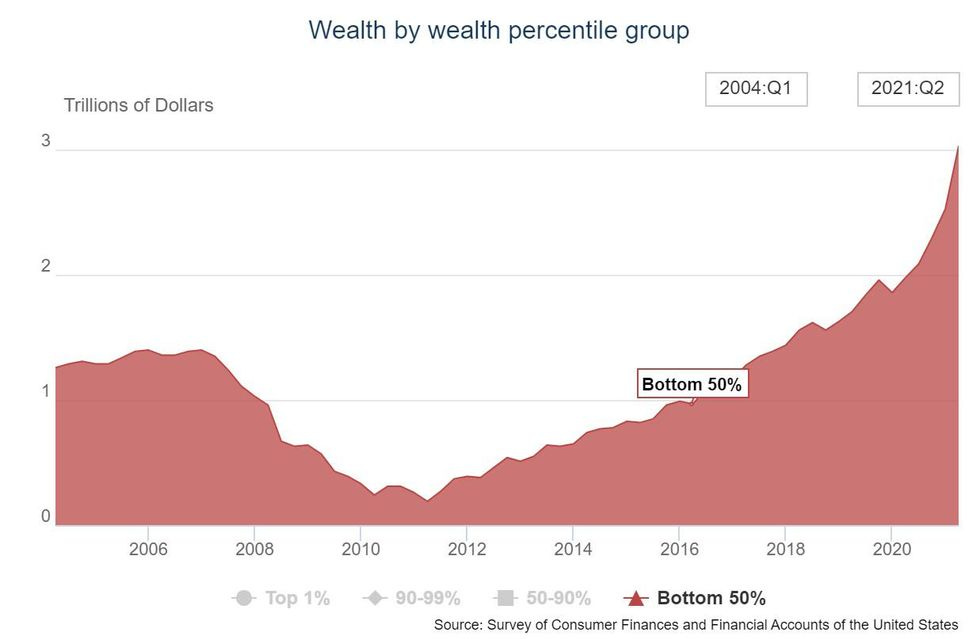

Perhaps most importantly, the wealth of Americans in the bottom half of the wealth distribution has increased considerably — especially compared to how the least-wealthy 50 percent were doing following the Great Recession, but also in comparison to how low-income families were doing before the pandemic .

This is a hell of a big deal.

Sahm says on Twitter that this chart actually "brings tears to my eyes," because she worked on the Federal Reserve's initial 2012 study that measured Americans' ability to handle a relatively small, sudden emergency expense of $400, the cost of a significant car repair or unexpected medical bill (for like, a Tylenol in a hospital we guess). Nearly 40 percent of Americans in the 2019 edition of the survey said they either couldn't afford it at all, or would have to borrow money, sell some possessions, or skip paying other bills. (That was still an improvement from 2015, when 50 per cent of us would be in difficult straits.)

Following the first round of direct payments and enhanced unemployment benefits in the 2020 CARES Act, the July 2020 survey found that the percentage of folks who'd have trouble covering an emergency expense of $400 had dipped to just 30 percent, although for the full year of 2020 it averaged out to around the same as the 2019 numbers. That's pretty freaking good, considering that at the end of 2020 the economy was still a long way from adding back the jobs lost during the pandemic, and long-term unemployment numbers looked grim.

The various stimulus packages kept American families from disaster. Over the course of the first year of the pandemic, a family of four received $11,400 just in stimulus payments, and that's before the enhanced unemployment benefits, increased food aid, rent help (when it was at least distributed) and other assistance that a lot of people relied on. It cushioned the blow, and that's a hell of a larger positive than the inflation we're seeing now. We should keep raising Keynes for now.

And the absolute last thing we need now is to slash investments in making America work for working families. The government spending that will come from Build Back Better isn't designed to goose the economy like a stimulus bill would; rather, it's aimed at creating stable, steady growth, and should in fact help limit inflationary pressures, according to analysis by Moody's Analytics, hardly a bunch of raving Marxists.

And it's not a moment too soon to pass Build Back Better's continuation of the Child Tax Credit, and its help with child care, community and home care for folks with disabilities and for elders, and other assistance to working families. The New York Times reports that the savings that many people had been able to build up due to the stimulus packages are starting to wane, so this would be a fine time to keep the economy growing. Nobody should be one car repair away from losing their home.

[ Stay At Home Macro / Claudia Sahm on Twitter / Federal Reserve Bank of Dallas / Federal Reserve Bank of Minnesota ]

Yr Wonkette is funded entirely by reader donations. If you can spare an extra $5 or $10 a month to help sustain our economy, we'd be very grateful.

Do your Amazon shopping through this link, because reasons .

That's what we do too. I haven't gotten a Christmas present for years, since I just buy myself Playstation 5's and XBoxes and massage chairs and TV's. I'd much prefer that go to someone who needs it. I don't have kids either, but we do spoil the hell out of our nieces and nephews. Adults do not need gifts.

Refail Crooz?