Job Growth Frighteningly Stable, What Ever Shall We Do Now

Damn you Joe Biden!

The US economy added 150,000 nonfarm jobs in October, according to the monthly Labor Department report, and the unemployment rate nudged up a teensy bit to 3.9 percent, a tenth of a percentage point from the September rate. The jobs gains were lower than the surprisingly strong 336,000 new jobs reported in September (more on that in a moment), and fell a bit short of the Dow Jones forecast of 170,000.

Not surprisingly, the report is generating headlines saying the new jobs are “lower than expected” or that the report “misses expectations.” Even the tiny increase in unemployment prompted doomy talk from CNBC, calling it “the highest level since January 2022,” although the New York Times gets a pat on the head for noting in its subhed that the growth numbers were in fact “not too different from monthly job gains before the pandemic.” Fox Business called the minute increase in unemployment “unexpected.”

For its part, the White House issued a statement emphasizing that since Joe Biden came to office, the economy has created 14 million jobs, and noting that the

“unemployment rate has been below 4% for 21 months in a row, the longest stretch in more than 50 years, at a time when the share of working-age Americans with jobs is higher than before the pandemic.”

Also as is common in jobs reports, the numbers for August and September were revised downward a bit: August’s job growth was down 62,000 jobs from the initial report of 227,000, to 165,000, while September’s initial report of 336,000 new jobs was revised down 30,000, to a total of 297,000 (which still beats the September forecast for 170,000 jobs, if anyone’s counting).

In other words, we’ve got pretty normal but slowing job growth considering the Federal Reserve has been raising interest rates for over a year to cool inflation. But now that the Fed’s getting precisely the cooling jobs numbers it wanted, we need to fret about it, eek!

Or maybe yay! because that cooling seems likely to head off any more interest rate hikes, according to the obligatory economist comment at CNBC:

“After years of incredible strength, the labor market could finally be slowing. The topline miss, plus downward revisions and higher unemployment, deliver a strong message to [Chair] Jerome Powell and the Fed,” said David Russell, global head of market strategy at TradeStation. “Further tightening is now highly unlikely, and rate cuts could be back on the table next year.”

Clearly that will require a major shift in media and Republican messaging, emphasizing the cooling job growth, and maybe insisting inflation is still terrible even if the numbers suggest it’s easing. God damn it, Joe Biden.

It’s also worth pointing out that the new jobs report comes right on the heels of the third-quarter GDP report, which showed strong economic growth that was simultaneously reassuring because it makes a recession look unlikely, but also terrifying because what if that growth slows and there’s a recession?

The New York Times also points out that, at the time the monthly jobs surveys were taken, the UAW auto strike was in full swing and expanding, so next month’s report may show adjustments now that the strike is settled. The Times economist of the month offered a classically oh no, things are fine take:

“This is mildly concerning but for now, these are still strong numbers,” said Sonu Varghese, chief market strategist at Carson Group, an asset management firm. “I think this is still just normalization.”

All in all, it seems the economy is chugging along pretty well, so we should all be preparing for our inevitable doom.

[Bureau of Labor Statistics / CNBC / NYT]

Yr Wonkette is funded entirely by reader donations. If you can, please subscribe, or if you’d prefer to make a one-time donation, we’d love that too. We’re certain we can all get through this period of frightening economic stability together.

Looking for a story saying unemployment "jumped" by a tenth of a point in October.

And I'll prolly find one.

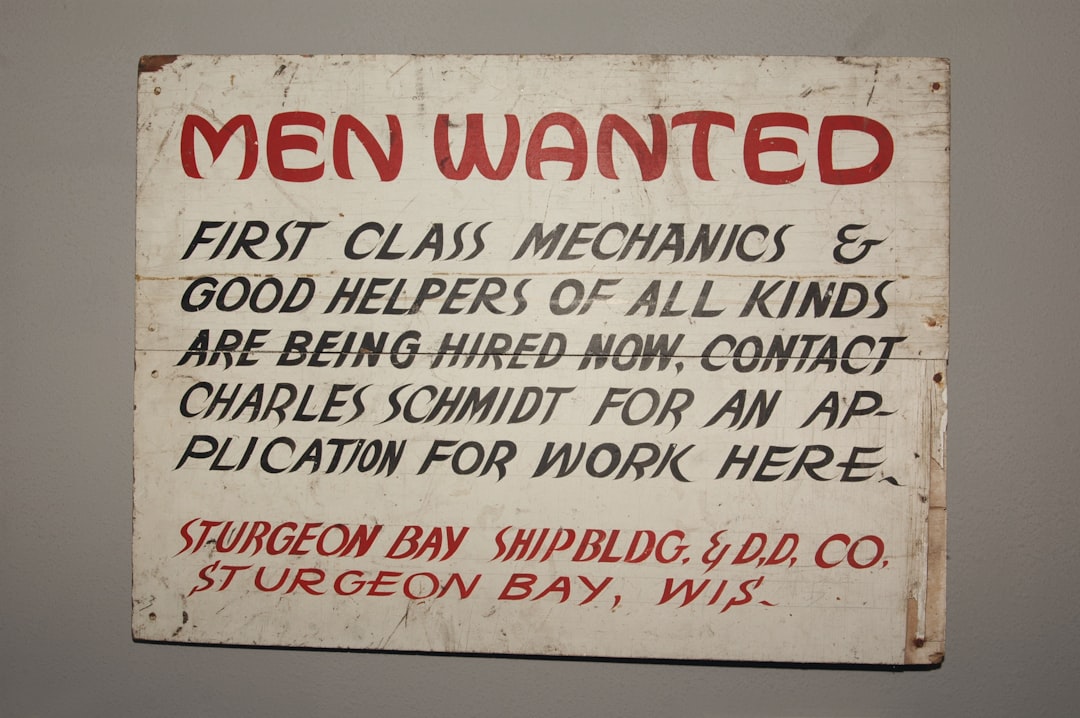

Well it's hell trying to hire right now. Everyone who wants to work and has the skills/knowledge seems to be working. Others are jumping ship to other companies for higher pay.

Still, I see companies offering wages that were low years ago and just a joke today and I hear their managers whining that "no one wants to work anymore" because, dude, you're $10/hr short to get that level of skill. That includes the company that acquired us this year--their idea of a pay scale *might* have been market value ten years ago. So I get resumes that I can't hire because the company down the street will pay significantly more for the same job.

Now new jobs numbers are flattening. Surprise! If you've hired everyone who is willing and skilled to work the available jobs, and you are unwilling to hire people unqualified and/or not willing to train new employees to become qualified, then OF COURSE new job numbers are going to go down.

Sheesh. This isn't all that complicated. Pay market wages, be willing to train, and get off your victimhood high horse.