Medical Debt Is Actually Bad. And Guess Who It's Hurting Most Of All?

Medical debt is killing credit scores in the South.

Here's some pretty good news: The Consumer Financial Protection Bureau (thank you, Elizabeth Warren) released a report earlier this month that "shows that the number of Americans with medical debt on their credit reports fell by 8.2 million from the first quarter of 2020 to the first quarter of 2022." That's an 18 percent decrease, which is a pretty big deal. The Biden administration attributes this to "the president’s strategy of protecting and strengthening the Affordable Care Act (ACA) and lowering health care costs."

Eliminating medical debt has been a priority for the administration, along with working with federal agencies to find ways to eliminate medical debt as a factor in credit assessment for government loans. For instance, the Federal Housing Finance Agency approved the use of VantageScore 4.0, a credit scoring assessment that does not include medical debt. The Small Business Administration is "revising its lender Standard Operating Procedures to discourage consideration of medical debt and making technology investments in Lender Match to help borrowers find lenders that exclude medical debt in their credit decisions."

This is a very big deal, as Americans are frequently saddled with surprise medical debt that they have no feasible way of paying off. I myself once got a surprise bill for around $1,000 for lab work (as iron and sodium are frequently among my myriad deficiencies) that was not covered by my health insurance — which was a huge deal to me at the time. This is hardly surprising — the way insurance companies make money is by taking your money and then finding ways to not cover whatever it is you need. That is their entire business model. They employ people whose literal job it is to tell you "no."

As much as I may personally believe that this is an absolutely ghoulish system and that socialized medicine is the way to go, the only way we can really judge any system is by how satisfied people are with it, and clearly this is what the vast majority of Americans, including most Democrats, want. That being said, a full third of the country having medical debt that affects their credit score is really bad for the economy. It means that they will have difficulty getting credit cards, getting approved to rent or to get a mortgage, getting business loans and just participating and contributing to the economy in general. These are all things that contribute to income inequality across the board.

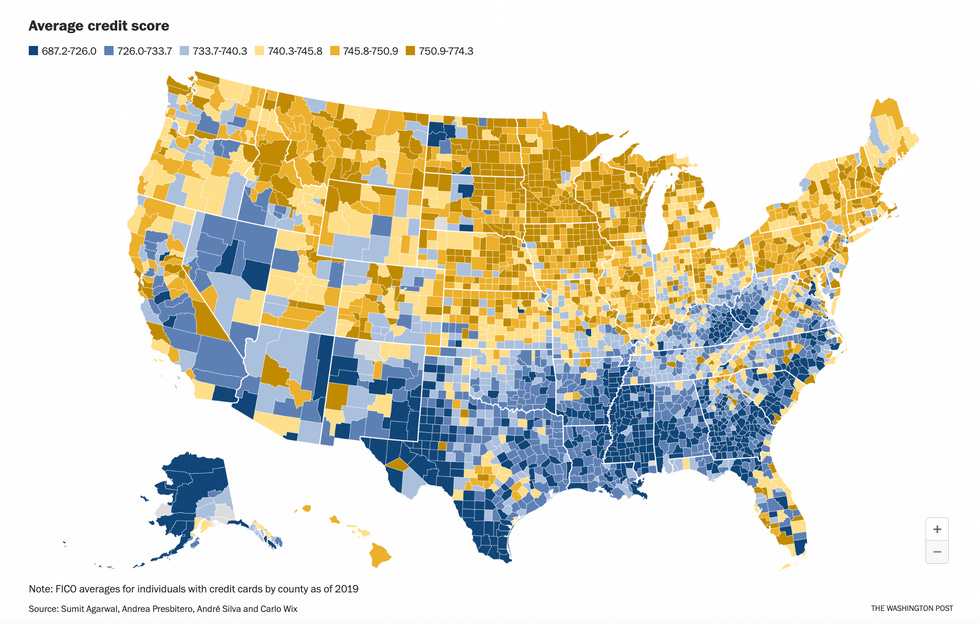

On Friday, the Washington Post published a rather jarring map of the United States showing the average credit scores for every county in the nation. It is split almost evenly along the Mason-Dixon line, with higher credit scores in the North and lower credit scores in the South.

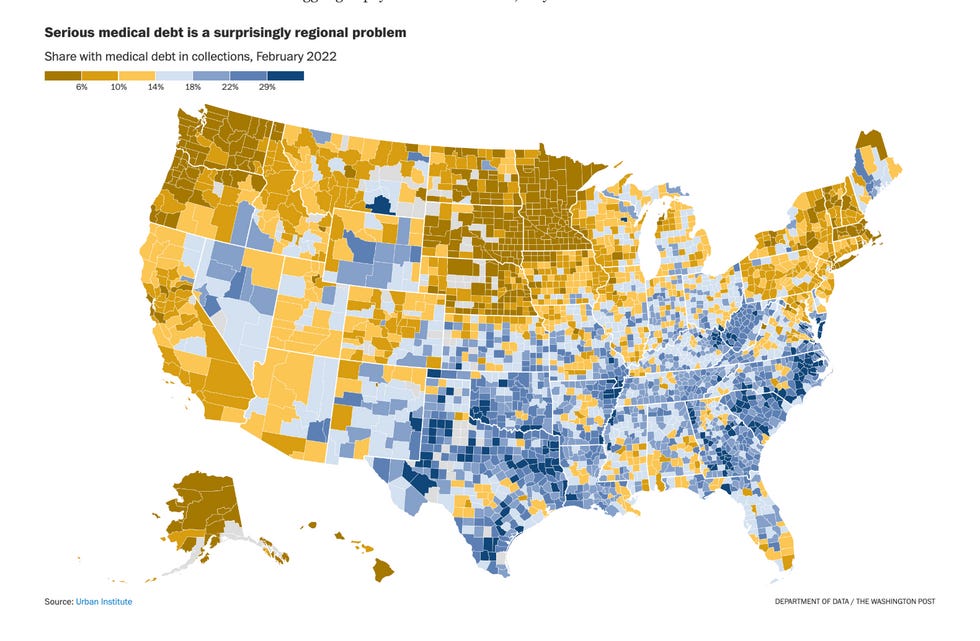

After eliminating literally every other possible factor, including race and poverty rates, the analysis revealed that the number one reason for these low credit scores was medical debt. This is likely why that map lines up so well with the map of serious medical debt.

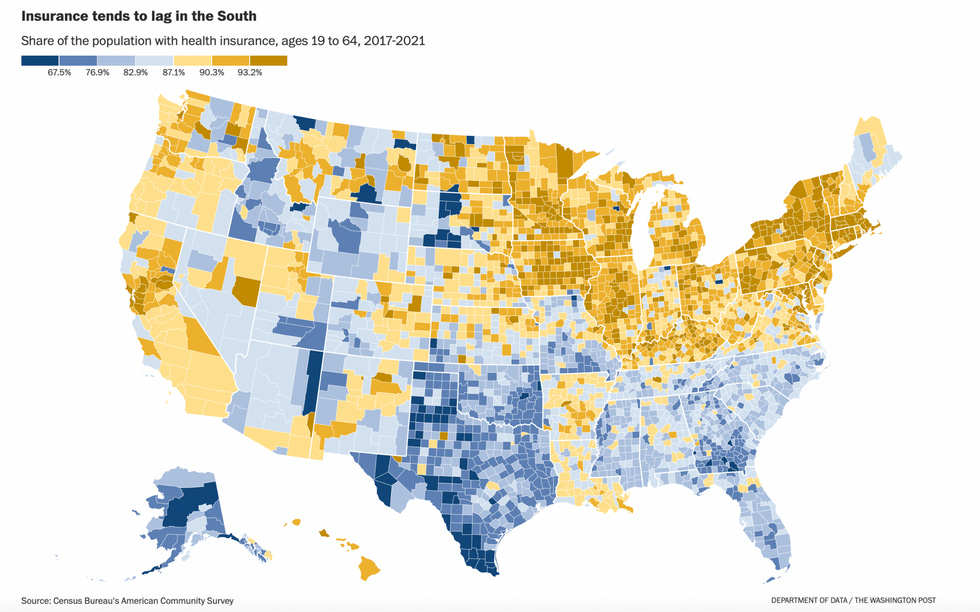

It also lines up with the map of insurance coverage — especially notable given that many of these states are states that refused the Medicaid expansion.

Indeed, the lack of Medicaid expansion is what the Post 's analysts settled on as the primary cause of this disparity.

A clue to the broader answer comes from a recent analysis in the Journal of the American Medical Association, which found that medical debt “became more concentrated in lower-income communities in states that did not expand Medicaid” after key provisions of the Affordable Care Act took effect in 2014. [...]

Of the 11 states that have yet to expand Medicaid, eight sit in the South, according to KFF , a San Francisco health-policy nonprofit. Southerners were more likely to be behind on medical debt even before the ACA, but the reluctance among the region’s mostly Republican governors to participate in the Medicaid expansion has increased the gaps between the South and the rest of the country.

In states that immediately expanded Medicaid, medical debt was slashed nearly in half between 2013 and 2020. In states that didn’t expand Medicaid, medical debt fell just 10 percent, the JAMA team found. And in low-income communities in those states, debt levels actually rose.

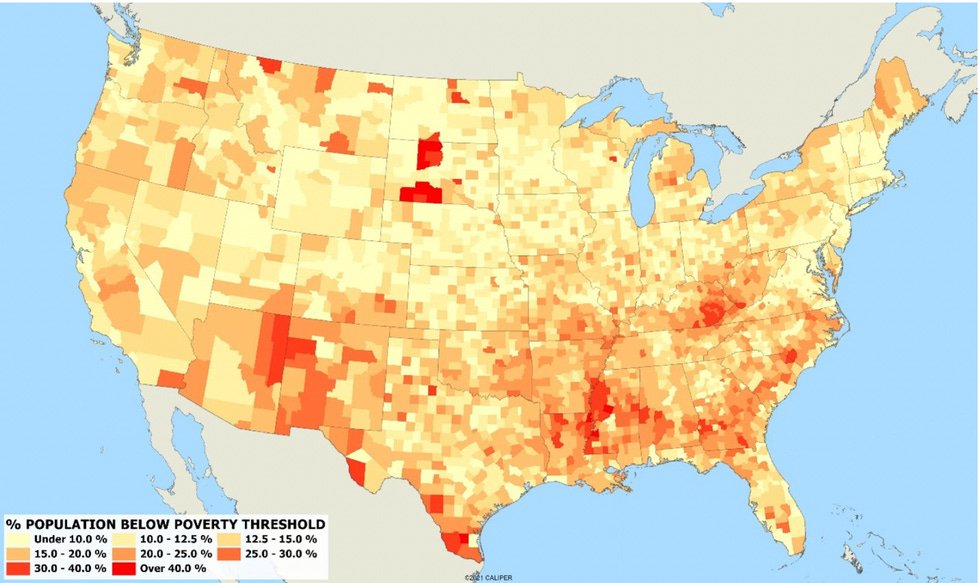

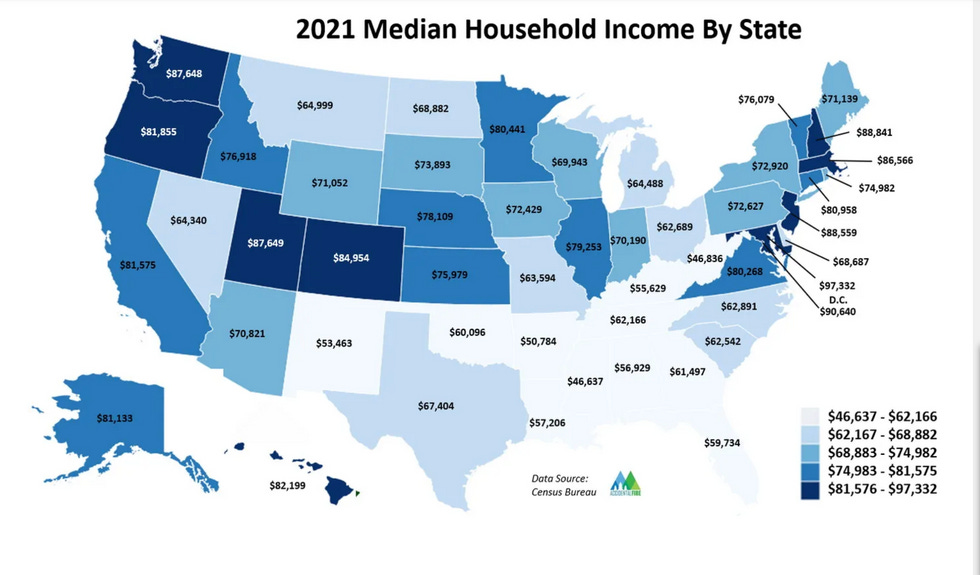

Still, the map is also strikingly similar to maps documenting the concentration of poverty in the nation.

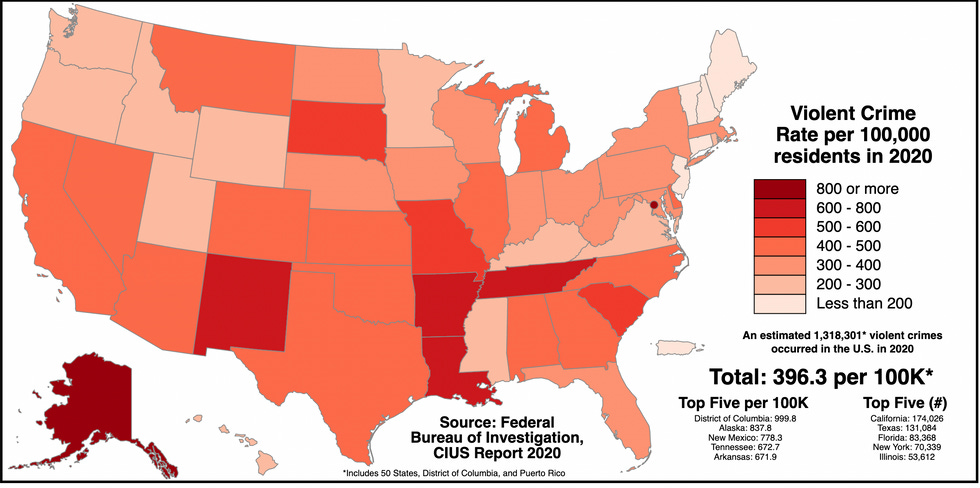

Or that different from a map documenting the violent crime rate across the United States.

Why does that matter? Well, where do people who are victims of violent crime frequently end up?

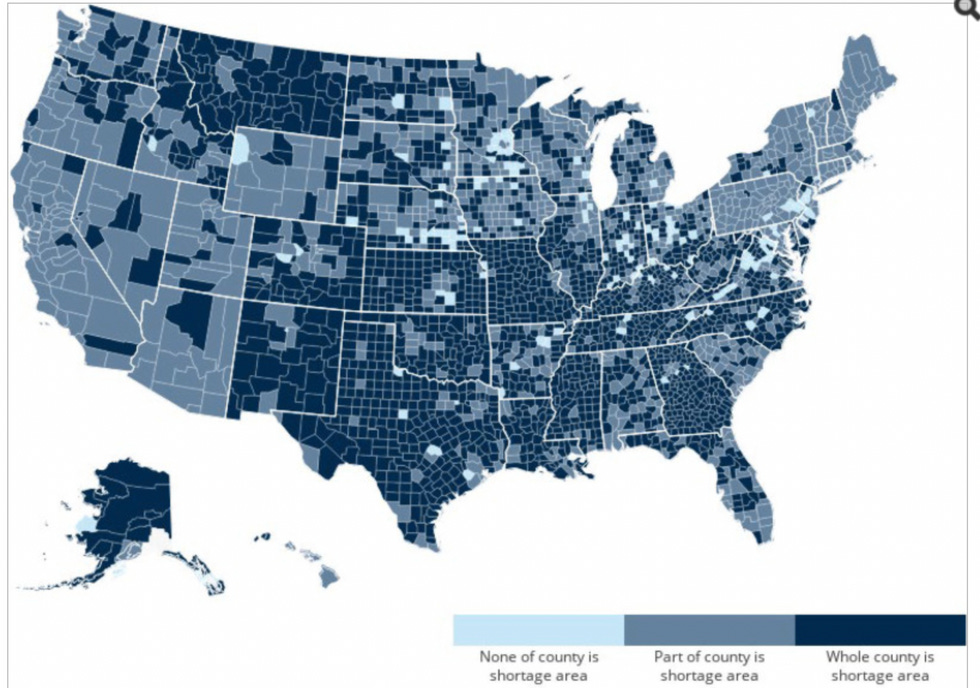

It also lines up with where the health care provider shortages are.

Why does that one matter? Because simply getting to the hospital can be one of the most expensive parts of an emergency, as ambulance rides are not always covered by insurance and the further away one is from a medical center the more that is going to cost. This is especially true in rural areas where the only way to get to people in time is by way of an air ambulance, which is almost never covered by insurance. The median cost of air ambulances is about $36,000 to $40,000, which is more than half of the median yearly household income in some of these areas.

These are all problems that feed into, exacerbate, and compound one another. Getting people to a place where they have better credit may seem like a small thing, but when it's on a massive scale like this, it's something that is going to help people build healthier communities, it's going to stimulate the economy, which will in turn create more jobs that pay a living wage.

It's a tough problem to fix when even the fixes we're planning for may not help that much.

Starting this year, medical bills under $500 will no longer affect your credit report — even after they’re sent to collections. That should wipe an estimated two-thirds of medical-debt collections from credit reports.

However, that move could push the South even further behind. According to the CFPB , “people living in the north and east are more likely to benefit” from the change, as they have debts that are more likely to fall below the $500 threshold.

Clearly, we're gonna need a bigger fix. Unfortunately, we probably won't be able to get the leaders of the state to go along with that anymore than we have been able to get them to accept the Medicaid expansion.

Do your Amazon shopping through this link, because reasons .

Wonkette is independent and fully funded by readers like you. Click below to tip us!

They still would've charged her with murder, though

The for-profit prisons want that slave labor

https://youtu.be/krfcq5pF8u8

Adam Serwer is the spokesman of the age