Trump's New Tax 'Plan' Shakes Money Tree All Over Donald Trump! We Are Killed Of Shock!

Oh, screw it, you can just pass "GO" as much as you want

The White House and Republican leaders have finally unleashed a new tax plan on the world, or at least a bigger outline than the pathetic one-page wish list Trump released in April. Now it's up to a whole NINE pages, and it's not really a tax bill either, because it isn't written in legislative language, but it is a much more detailed trickle-down wish list that will slash taxes for the wealthy and corporations, blow up the deficit, and be paid for by closing unspecified tax loopholes and all the growth that will happen when rich people pay fewer taxes and buy stables full of unicorns that fart money.

In an amazing show of fiscal responsibility, the dream document wishes for the corporate tax rate to be cut from 35 percent to 20 percent, not the 15 percent Trump has been fantasizing. The proposal would also allow corporations to bring money earned overseas -- at other countries' lower tax rates -- into the U.S. without paying extra US tax, so it can "create jobs," at least for brokers and investment bankers, because when there have been previous attempts at tax holidays to "repatriate" those funds, the money went to investors, not to job creation or pay raises for workers.

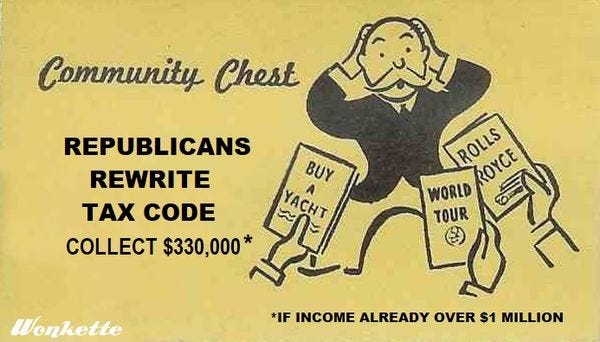

The current seven individual income tax brackets would be reduced to just three brackets, with the biggest benefits going to the very, very wealthy -- the top bracket would be cut from 39.6 percent to 35 percent. People making over a million dollars annually could look forward to an extra $329,530 in tax savings, while middle class losers making between $50K and $70K a year would get to take home a whopping $270 extra every year, so they can start a small business maybe.

In addition, the proposal would eliminate the estate tax and the Alternative Minimum Tax (AMT), which would be a huge windfall for the very wealthy. As we saw in that one leaked 2005 tax return, the AMT was the only reason Trump paid much of anything that year; Mother Jones notes,

In 2005, the AMT increased Trump’s effective tax rate from 4 percent to 24 percent, a $31 million difference.

The huge cut in corporate tax rates will be sold as a necessity to keep American businesses "competitive," with the misleading claim that our corporate tax rate is among the highest in the world. On paper, it seems high, but once corporations do their accounting magic,

the amount that corporations actually pay is roughly in line with other developed economies. The conservative-leaning Tax Foundation estimates that the corporate cut will cost $1.6 trillion in lost government revenue over the next decade.

Oh, and low-income earners? Joke's on them! They actually would get a tax increase with the new rates:

Trump’s plan would raise taxes on the low-income workers by 2 percent and only offset that with a $1,600 increase in how much individuals can deduct along with unspecified “additional tax relief.”

Donald Trump and his family will benefit yugely from another part of the plan, a drop in the tax rate for "pass-through" income. We'll let Mother Jones do the heavy 'splainering:

The second major shift is dropping the rate for businesses known as pass-through corporations from 39.6 percent to 25 percent. These are companies like LLCs whose income is “passed through” to the owner and taxed as individual income. Trump runs about 500 pass-throughs, according to his lawyers.

As Mother Jones has written, few owners of pass-through companies make enough to be subject to the top individual rate, which goes into effect after a couple makes more than $466,000. Nearly 80 percent of the benefits of cutting the pass-through rate to 25 percent would go to millionaires, the Tax Policy Center found.

But don't worry about top income earners getting their tax attorneys to convert their salaries into "pass through" business income, because the administration pinky-swears it will make sure the new rules won't allow that. How? It's secret! But they'll totally keep that provision from being abused by rich people with clever accountants and lawyers.

Now, sure, there are a few minor details not included in the nine-page "plan" (which is so good that this time, we thinkthey didn't even have to play around with extra-large font sizes to make it fill out a page). [UPDATE: Like hell they didn't! The margins, like the tax cuts for the rich, are HUGE!] Like for instance the messy details of what income levels would go into each of those three brackets, or how Congress is supposed to decide whether to include a hinted-at fourth bracket for the very top incomes. (If Congress wants to. Not that Congress does.) And some other stuff that liberal radical Jennifer Rubin seems to think matters to actually turn this from a letter to Fiscal Claus into a real live bill:

What deductions go away or are limited?

How much debt will it create, and what assumptions will the GOP use?

The corporate tax rate is supposed to go from 35 percent to 20 percent, but how is that paid for? (Is it paid for?)

Does the tax burden shift from corporations to individuals? From richer to poorer Americans?

Is Trump breaking his word that the rich wouldn’t get anything from the bill?

Oh, that last one is a laugh. Let's not even pretend anyone took that one seriously.

Still, it's a terrific plan, and at the rate the GOP is going, they're sure to have a workable tax reform bill that's revenue neutral ready to go any day now, just as long as nobody insists on seeing it before they pass it.

Clowns Are Fucking Scary: Exhibit #1

Whose swamp is getting drained again?