What Part Of FREE Don't TurboTax Bitches Understand?

How a 'free' IRS program makes Intuit an assload of money.

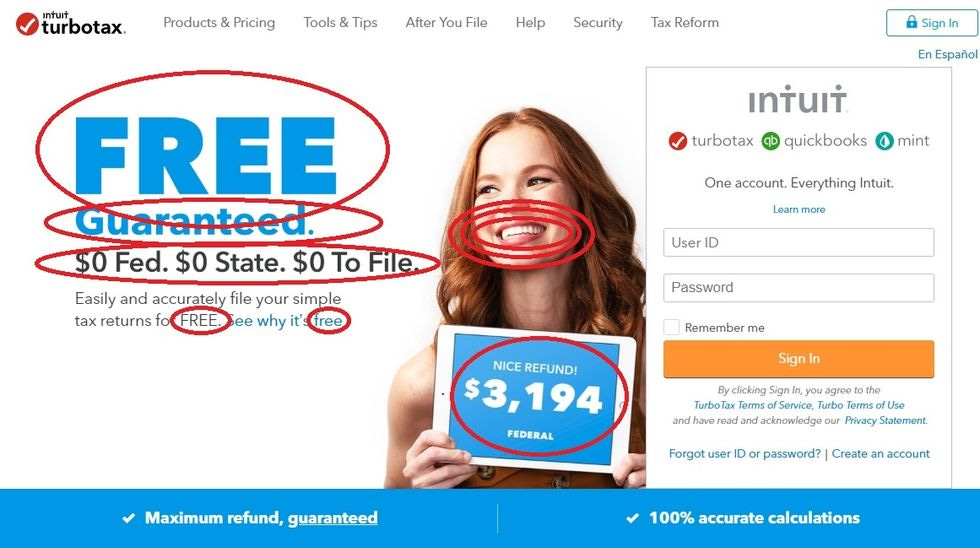

In the weeks leading up to tax day, you may have seen one of TurboTax's many amusing adsfor its "free" income tax filing product. Quite humorously, the dialogue is nothing but the word "Free," so you get the point, ha ha -- if you meet certain qualifications, you can file your taxes for FREE. Of course, in practice, those troublemaking busybodies atProPublica explain, actually getting to the completely free tax filing site is made very tricky by Intuit, the publishers of TurboTax software. For instance, if, like some idiot, you saw the ad and went straight to Turbotax.com , it's very difficult for lots of taxpayers to actually find the free product, because Intuit's website is designed to steer them toward versions that require payment.

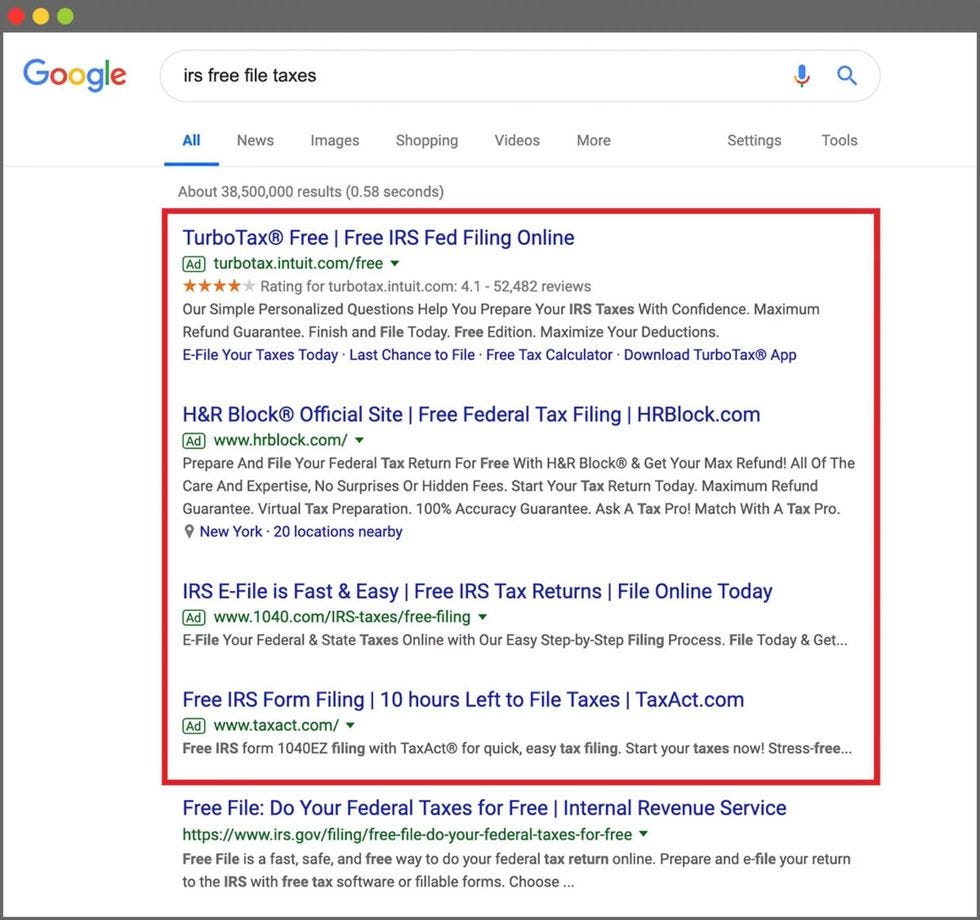

Anyone who makes under $66,000 a year should be able to file their taxes online for free. All you need to do is find the right online tax preparation company and meet whatever conditions the company might impose on customers wanting to file for free. And that's where the fuckery starts! For instance, if you're naive enough to click on the first thing that comes up in search results, you're fixing to be plucked. Tell us, troublemaking busybodies!

Our first stop was Google. We searched for "irs free file taxes."

And we thought we found what we were looking for: Ads from TurboTax and others directing us to free products.

(image by ProPublica)

As ProPublica notes, that very first ad says "free" five times, so it sure must be free, huh? (Spoiler alert: Nope, the ads suck, you really want the fifth item on the list, to irs.gov. ) But at Intuit's site, you definitely get more "free" verbiage, complete with a smiley lady who enjoys her free tax filing!

Image by Wonkette. Bet you could tell!

But then, once the reporters started a fake profile and going through the tax prep steps for a "house cleaner who took in $29,000," things got un-free very quickly.

We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances.

After all of that, only then did we get the bad news: TurboTax revealed this wasn't going to be free at all. Turns out the house cleaner didn't qualify because he is a independent contractor. The charge? $119.99.

So they backed out and tried again, this time with a new fake taxpayer,

a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

Again, TurboTax told us we had to pay — this time because there's an extra form if you don't have insurance. The charge? $59.99.

Haha, you fool! You can only file for free with TurboTax if you have a very simple tax situation, you dope. At least, from the home page -- Intuit will charge you for any exceptions, because the site is coded to steer people to the upsells.

While suckers may be born every minute, the real money goes to clever companies who figure out how to exploit those suckers:

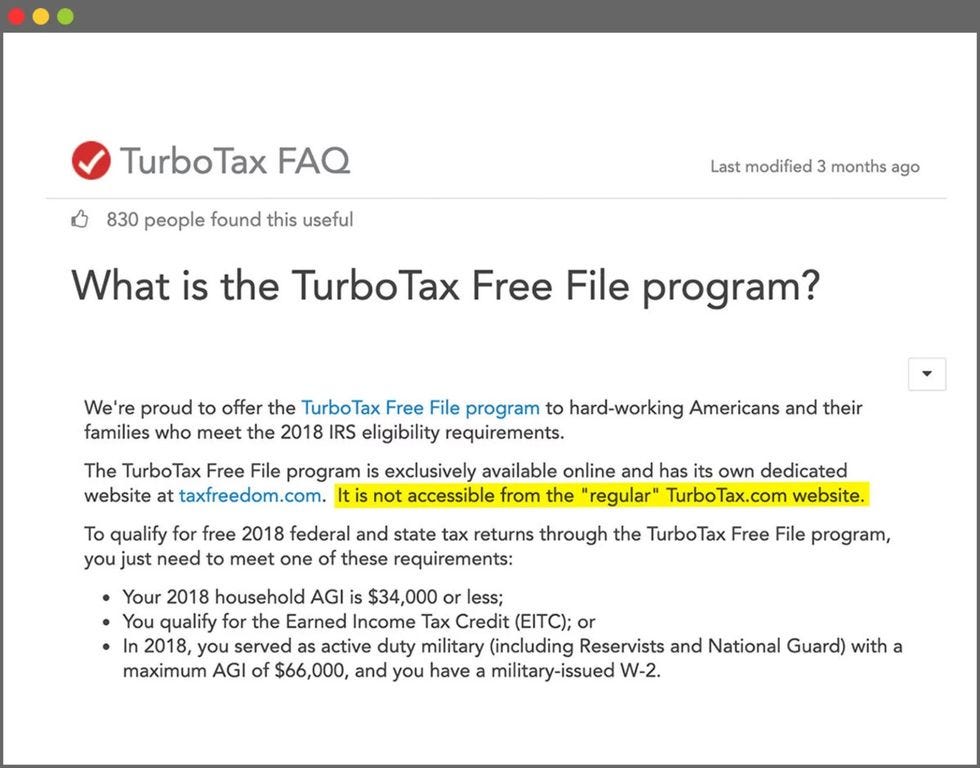

[If] you start the process from TurboTax.com, it's impossible to find the truly free version. The company itself admits this.

Propublica image

Now, there really IS an edition of TurboTax that lets any damn fool with income under $34,000 file for free, but to find it, you have to know it's called "TurboTax Freedom," and if you google THAT, you can find it. Why yes, that's a much lower income than the $66,000 maximum allowed under the IRS's free file program, because the tax prep companies get to set their own rules for which types of returns they'll process for free service. Intuit seems to be especially aggressive in such restrictions; Yr Dok Zoom uses another outfit that really is free, so it's mostly a matter of finding one that fits your situation through the IRS Free File website.

And even once you get there, the TurboTax "free" site STILL lets you click on a link that'll send you off to the pay version. Isn't that cute?

As ProPublica explains , none of this is an accident. Thanks to lots and lots of lobbying, Congress has largely done whatever the tax prep companies have asked it to when it comes to the Free File program. The House recently passed the misleadingly titled "Taxpayer First Act," which would enshrine the Free File program in law and actually prohibit the IRS from ever developing its own truly free online tax software. If the bill passes the Senate and Donald Trump signs it, taxpayers wanting free online services will have to use for-profit companies where they can be targeted for paid "upgrades."

It doesn't have to be this way -- in 2016, Elizabeth Warren and Bernie Sanders cosponsored a bill t hat would have mandated the IRS estimate people's simple returns for them automatically, since it already has our wage information anyway. Taxpayers could then either sign off on the IRS calculation or have the option of using free, IRS-developed software to pay their taxes. For-profit outfits would no longer be the default option. You can see why that went nowhere!

The tax prep industry likes to tout the fact that anyone with income under $66,000 can file for free, but makes far less noise about the percentage of those who actually do manage to: only about 1.6 percent. It doesn't help that the IRS budget for promoting Free File is exactly ZERO.

Here, have a listen to an "On the Media" interview with UC Davis tax scholar Dennis Ventry, who wrote an influential op-ed that effectively stopped the "Taxpayer First Act" in the Senate last year. You may want to make sure you don't have a tax attorney to hurl across the room.

[ ProPublica / The Hill / WNYC ]

You know who scrupulously pays their taxes? Yr Wonkette. Please send us money to help us keep bringing you the stories you love!

I always go straight to the IRS website to do my taxes. Free file for Fed, but got dinged on state. Still, the amount of my refund was worth it.

Oh fun: ProPublica has an update on how Intuit deliberately hides its free file site from Google results, too!

https://www.propublica.org/...