Who Wants To Cut Into Some Excessive CEO Pay?

AOC, Barbara Lee, and Sheldon Whitehouse do!

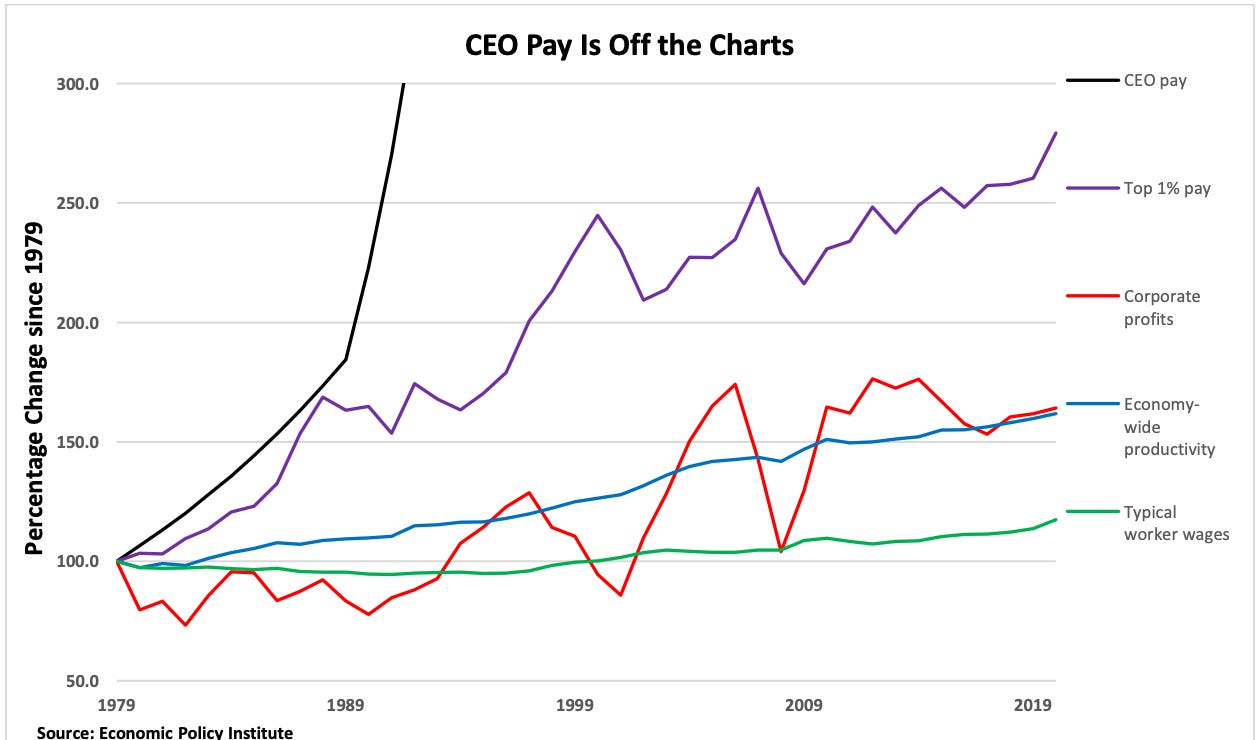

In 1965, the average CEO made 21 times what the average worker made. In 2021, the average CEO made 399 times what the average worker made. That’s a very big difference — and some Democratic lawmakers think perhaps it’s time to do something about it.

Reps. Alexandria Ocasio-Cortez (New York) and (the prematurely correct) Barbara Lee (California) along with Senator Sheldon Whitehouse of Rhode Island announced a bill on Thursday titled the Curtailing Executive Overcompensation Act (CEO Act) that would apply an excise tax to companies with $100 million in gross receipts and $10 million in payroll, if CEO pay is more than 50 times what the average worker makes.

The amount of the tax would be proportional to executive compensation and how much it exceeds the 50:1 ratio.

As an example for how this would work, the legislators explain that, for instance, in 2022 “Coca-Cola CEO James Quincy made $22.8 million in compensation, 1,883 times the compensation of Coca-Cola’s median worker. Coca-Cola would pay a tax of $407.2 million.” The tax would not exceed more than one percent of the company’s gross receipts. (One percent would add up quickly for these massive companies; one percent of Apple’s nearly $400 billion in gross receipts would be … some money!)

Had this tax been applied in 2022, it would have generated $10.1 billion from the Forbes 100 top US companies alone. That is a big deal!

The proposal explains:

Are CEOs simply 399 times more productive than their workers? The evidence suggests otherwise and that large pay disparities between CEOs and their workers are bad for business. Studies have found that large disparities are associated with higher levels of employee dissatisfaction and turnover, lower sales, and are disfavored by consumers. Peter Drucker – often referred to as the founder of modern management – believed the ratio should not exceed 20:1 and decried extreme pay inequality as socially corrosive.

Moreover, excessive CEO pay propels economic inequality, which corrodes our democracy as the rich and powerful use that wealth and power to cement their status. If CEOs were paid less or contributed more in taxes, our society would be freer and our economy would be fairer, while being no less productive.

We do have to acknowledge, however, that part of the reason for this huge discrepancy is the existence of massive conglomerates and the fact that many CEOs are simply sitting on a much bigger pile of businesses than they once were. Nestlé alone owns more than 2000 brands. Macy’s owns all of the department stores, practically. A CEO of a company that owns 2000 brands and has 275,000 employees is obviously going to make more than the CEO of a company that owns one brand and has 200 employees. Especially if they’re not getting “salaries” so much as being paid in stock dividends.

The thing is, these giant conglomerates did not make sense at one point, because there really was only so much one could earn before it was taxed away. Corporate tax rates under Eisenhower were 30 percent before $25,000 (about $280,000 today) and 52 percent after. The top marginal rate on personal income was 91 percent over $200,000 (about $2,296,932 today) — so if you made a million dollars, after the first $200,000, 91 percent of that would be going to the government. It wasn’t just Eisenhower either. The year he came into office it was 92 percent.

So if you had a super successful company, it made more sense for you to pay your workers more than it does now and it didn’t make as much economic sense to own 2000 brands. Dig?

Today, the corporate tax rate is 21 percent (thanks, Trump!) and the highest personal income tax bracket is 37 percent (after about $580,000). It totally makes all kinds of sense to screw over one’s workers and amass a collection of smaller companies, ensuring the vast majority of wealth is concentrated among a very small number of people. And it does not “trickle down.”

We’re probably not ever getting the good tax brackets back. But this tax, and anything that makes it less advantageous for companies to allow these disparities (and take over other businesses) will lead to a better and less “socially corrosive” society — especially if that money is specifically earmarked for things that will help the economically disadvantaged. And that would be pretty nice.

The real fucking pisser of the whole thing is that Uncle Sam reaches into my pocket for 6.2% of my gross earnings for Social Security, week in and week out. I don't get a break for the Holiday season, I don't get time off for good behavior.... I just do my duty to my fellow man and pay my taxes.

These motherfuckers here making 399 times the average employee's pay or more wind up capping out on Social Security some time in the early spring.... sometimes in the FIRST WEEK OF JANUARY....

so not only do I subsidize their grotesque wealth by being paid less than my due, not only do most of them pay a lower tax burden as a percentage of their overall income than I do, but they get to say "WOO HOO!!!! I earned too much to pay any more of this one tax!"

fuck that noise, save the system, pop the cap.

"Are CEOs simply 399 times more productive than their workers?"

I hereby request committee hearings featuring Katie Porter and her whiteboard of doom.