Trump Tax Cuts Weren't 'Rocket Fuel' For Economy. More Like A Wet Fart.

Burnin' out his fuse up here alone.

For all of Donald Trump's repeated insistence that the 2017 Big Fat Tax Cuts For Rich Fuckwads would pay for themselves by supercharging the economy, the evidence keeps piling up that while they were really really good for the rich, and for corporate profits, the cuts didn't have a hell of a lot of impact for either the economy, which was already growing, or for ordinary Americans' wages, which haven't increased anywhere near as much as corporate profits. Those are among the conclusions in a report released yesterday by the nonpartisan Congressional Research Service, which will nonetheless be ignored by Republicans because the CRS is not Of the Body of true believers in voodoo economics.

At the time the cuts passed, Donald Trump insisted they'd boost economic growth into the stratosphere, and even now, he loves saying they're the main reason the economy is continuing to grow. Just last month he took credit for the wonderful outcome of chopping federal revenues by over $1.5 trillion over the next decade.

"At the heart of America's revival are the massive tax cuts that I signed into law a year ago," Trump said at an event for the National Association of Realtors in May. "And they are like rocket fuel for America's economy."

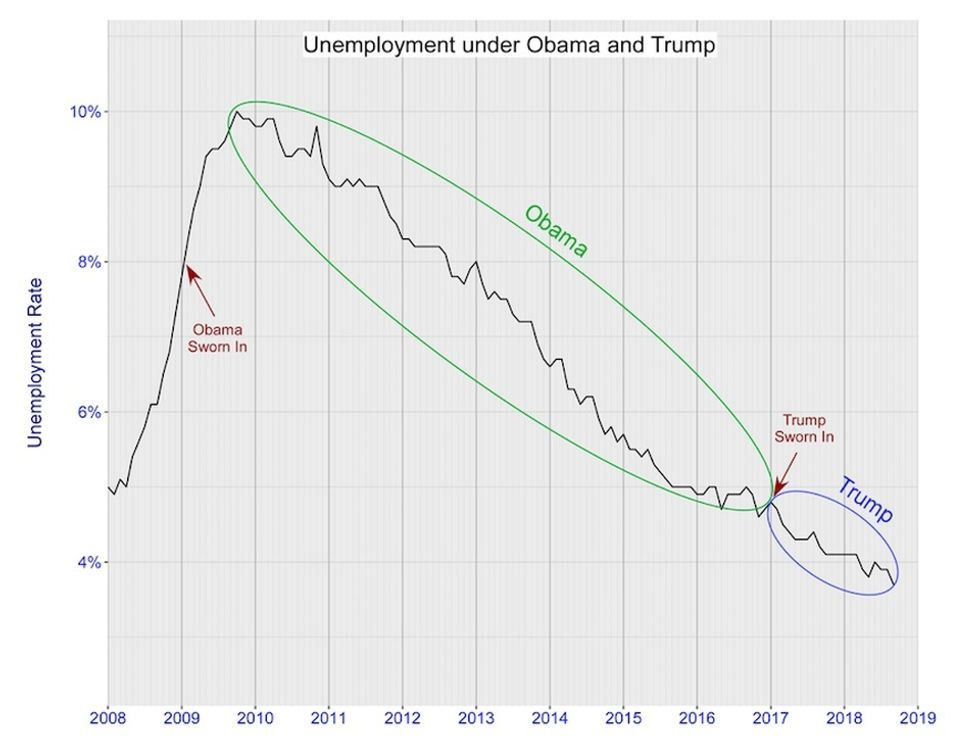

If so, that's some seriously shitty rocket fuel, since there's been a steady decline in the unemployment rate since the Obama administration, and the pace of that decline didn't noticeably change after the cuts went into effect. Here, lookie this chart from Forbes in October 2018:

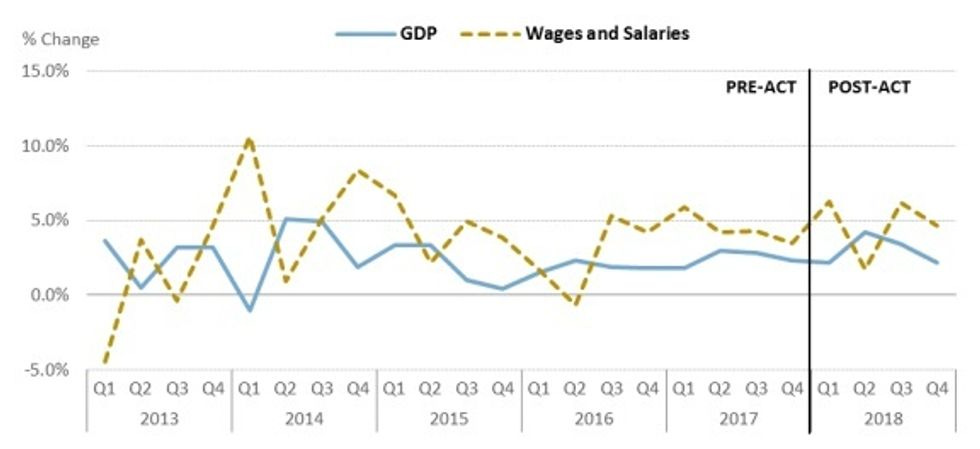

The CRS report notes that economic growth has been nice and steady, but nah, it's clear the tax cuts didn't rocket much of anything:

In 2018, gross domestic product (GDP) grew at 2.9%, about the Congressional Budget Office's (CBO's) projected rate published in 2017 before the tax cut. On the whole, the growth effects tend to show a relatively small (if any) first-year effect on the economy. Although growth rates cannot indicate the tax cut's effects on GDP, they tend to rule out very large effects particularly in the short run.

As for long-term claims about the effects of the tax cuts, the CRS cautioned there's reason for skepticism.

Although investment grew significantly, the growth patterns for different types of assets do not appear to be consistent with the direction and size of the supply-side incentive effects one would expect from the tax changes. This potential outcome may raise questions about how much longer-run growth will result from the tax revision.

See? They simply gotta BELIEVE, and also they need to ignore the fact that tax cuts for the rich have never, ever created the boom times their supporters insisted would happen.

OK, but how about all the new revenue that will come rolling in as a result of the economic growth? Surely that justifies blowing a giant hole in the national debt -- remember, this gift to the rich was gonna pay for itself!

The data appear to indicate that not enough growth occurred in the first year to cause the tax cut to pay for itself [...] Rather, the combination of projections and observed effects for 2018 suggests a feedback effect of 0.3% of GDP or less—5% or less of the growth needed to fully offset the revenue loss from the Act.

Yeah, but just wait until taxes are cut even more steeply and the money REALLY starts rolling in!

Now, where did the money from all those tax cuts end up? Probably in the pockets of everyday working people, just like the Republicans promised, right? The report notes that an October 2017 report by Trump's Council of Economic Advisers (CEA) predicted the tax plan's scheme to allow companies to repatriate overseas assets without any taxes was supposed to "eventually increase the average household's income by a conservative $4,000 a year," and that another CEA report claimed the combination of corporate tax cuts and repatriation would mean up to $9,000 in higher wages per household.

So how did wage-earners really do in 2018? Not nearly so well, oopsies! Instead, "There is no indication of a surge in wages in 2018 either compared to history or relative to GDP growth," and real wage growth sometimes waddled along a little faster than GDP growth, or a little slower.

Funny, that $4000 to $9,000 per household didn't materialize in the first year, at least.

Wages, assuming full-time work, increased by $1,248 annually. But this number must account for inflation and growth that would otherwise have occurred regardless of the tax change. The nominal growth rate in wages was 3.2%, but adjusting for the GDP price deflator, real wages increased by 1.2%. This growth is smaller than overall growth in labor compensation and indicates that ordinary workers had very little growth in wage rates.

But maybe that rocket will take off later, huh? You just have to have faith!

Say, how about those highly publicized bonuses for some workers, which Trump insisted proved the tax cuts resulted in immediate, rapid wage growth? Sure, naysayers like Yr Wonkette said the bonuses were smoke and mirrors, especially since companies like AT&T and Walmart paired them with layoffs and store closures. Still, there were a lot of bonuses, right, Congressional Research Service?

[A] number of firms announced bonuses, which in some cases they attributed to the tax cut. One organization that tracks these bonuses has reported a total of $4.4 billion.

$4.4 billion sure is a lot of money, so hooray! Or maybe not?

With US employment of 157 million, this amount is $28 per worker. This amount is 2% to 3% of the corporate tax cut, and a smaller share of repatriated funds.

Well how's that for a fine howdy-do. The report also noted that whatever the companies said about their reasons for giving bonuses, there are lots of other possible explanations, like a desire to take tax deductions for them before the lower corporate tax rates kicked in, or simply because the labor market was already tightening and bonuses to keep workers happy could be "attributed to the tax cut as a public relations move." Ya think?

We suppose next the report will point out that most of the tax cuts and repatriated assets went into stock buybacks, which only made the rich a lot richer, and that the amount of money involved dwarfed the bonuses, huh?

Much of these funds, the data indicate, has been used for a record-breaking amount of stock buybacks, with$1 trillion announced by the end of 2018.A similar share of repurchases happened in 2004, when a tax holiday allowed firms to voluntarily bring back earnings at a lower rate. [emphasis added -- Dok]

Quick, cue the Fox News footage of some rich asshole getting resentful about Democrats describing thousand-dollar bonuses and slight tax cuts for ordinary workers as "crumbs" compared to how well the wealthy made out. They're the best crumbs ever, and why are Democrats trying to steal my Freedom Crumbs?

Over at the Washington Post, columnist Philip Bump says the tax cuts' economic effects don't so much amount to rocket fuel as they're merely "water poured onto concrete." We respectfully disagree! We'd say they're far more like dumping a railroad car full of liquefied cowflop onto a backyard garden. Might stimulate some growth, but the domestic product is pretty gross, and only palatable to a bunch of shit eaters.

Fine, so we'll never get a job as economic metaphor czar.

[ Congressional Research Service report via Harry Stein on Twitter / WaPo / Forbes / Brookings Institution ]

Yr Wonkette is supported 100 percent by you, the readers! Please send us money, which we will never fritter away on stock buybacks. We'll fritter it away on paying the staff and keeping the poo jokes coming!

Why not both?

OK, so if the bonuses (for those who got them) amounted to $28 per lucky recipient and if that is only about 2% to 3% of the tax breaks going to the the already super-rich, then, to really reflect the tax breaks, the bonuses should have been between $933.33333... and $1,400.00 apiece.

That's a sizable difference but still not enough to rocket fuel the economy, especially when the price of everything starts going up 30% or more as Trump's dumb tariffs kick in.