Senate Republicans Can't Wait To Cut Taxes For The Rich, Kill Your Healthcare, Screw Your Mom

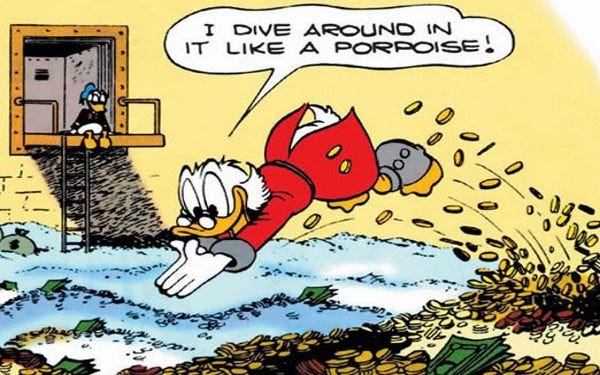

Fact: Gold is denser than a porpoise or a duck. Either would be severely injured. EAT THE RICH

The Republicans' great big Fuck-everybody-but-the-wealthy tax cuts bill is slouching toward a vote by the end of the week, as Senate Rs all voted yesterday -- every last one of them -- to advance the bill to debate on the Senate floor. There'll now be a whopping 20 hours of a debate on a bill that isn't even in written form yet. Following the extensive "debate," the bill will go to the exciting "vote-a-rama" stage, where senators will propose all sorts of fun amendments, some of which will probably be thrown into the bill, and, for Democrats at least, many of which will be used to slow the bill's advance and to force Republicans to go on the record with votes against Having Nice Things. There may also be a swimsuit competition and a Japanese game-show segment in which senators will have to carry their proposed amendments over a swinging bridge while volleyballs full of bees are fired at them. We can dream, can't we?

The goal for Senate Rs is to rush through any goddamned thing so they can say they passed "tax reform" and to reward their super-rich megadonors -- oh, and themselves. And while a few Republicans have yet to go on record as supporting the damned thing, there isn't a single declared opponent. This horrorshow seems very likely to pass.

We already know the basic outlines of this abomination: Huge tax cuts for corporations and the rich, gutting the Affordable Care Act's individual mandate -- which will leave 13 million people unable to afford insurance -- and actual tax increases on lower income workers. But what fresh new samples of hell are we looking at as the bill moves through the Republican sausage factory?

Marco Rubio thinks it would be a swell idea -- to keep the deficit down, you know -- to cut Medicare and Social Security to offset the tax cuts for the rich. But don't worry! He knows old people in Florida vote, so he explained at a speech to lobbyists yesterday that he won't screw over anyone who's already retired: He'll just fuck people who haven't yet retired, who'll barely even notice the fuckery if the benefits are reduced by the time they actually start thinking about it.

“I analyze this very differently than most,” Rubio told the crowd. “Many argue that you can’t cut taxes because it will drive up the deficit. But we have to do two things. We have to generate economic growth which generates revenue, while reducing spending. That will mean instituting structural changes to Social Security and Medicare for the future,” the senator said [...]

“We don’t need to reduce benefits on current retirees or even near-term retirees, but we can make changes for future generations such as mine, and do so in a way that people can prepare for, so the changes will barely be felt,” Rubio said.

Translation: Those of us in our 50s should stock up on cat food to feed ourselves now and avoid the rush. Also, the really great thing is that the tax cuts will give everyone a job, so there'll be more people paying into Social Security and maybe the cuts will be smaller, you see. Besides, Rubio also wants to nudge the child tax credit up just a little bit, so that will make up for the pain other people will feel. He'd pay for that by setting the corporate tax rate at 22 percent, instead of the 20 percent already in the bill, so that's unlikely to fly -- the one thing Donald Trump knows about the bill is that 20 percent corporate rate, and he's dead set against any liberals like Rubio messing with it.

Susan Collins says she's still not absolutely decided on whether to vote for the bill, but that Mitch McConnell gave her a "personal commitment" from Mitch McConnell that the bill would definitely not result in Medicare cuts, which would be triggered automatically by the federal "Pay-as-you go" (PAYGO) law. Except McConnellcan't really promise that,because the PAYGO waiver he's proposing would have to be passed in a completely different year-end government spending bill that may or may not pass at all, which is why we're looking at a possible government shutdown even though Republicans control the government. Fun, huh?

Collins has also said she would be OK with the repeal of the ACA's individual mandate if it were followed by passage of the Patty Murray-Lamar Alexander plan to stabilize some federal subsidies for the individual market, but that wouldn't really balance out anything: The Congressional Budget Office has already said, in a letter to Sen. Murray, that even if Murray-Alexander passes (far from a guarantee), the number of people losing insurance due to the repeal of the individual mandate would not change (click the tweet to read the letter):

BREAKING: CBO: Alexander-Murray would do nothing to mitigate repeal of the individual mandate.

cc: @SenatorCollins #mepolitics pic.twitter.com/3yjMV0spYe— Topher Spiro (@TopherSpiro) November 29, 2017