This Is A Love Letter To The Estate Tax

Let's talk about the Estate Tax, Wonkers! But first, a word from our friends at School House Rock.

Only a Republican could look at American history and think, "Thank goodness, the colonists overthrow the monarchy so we could establish a hereditary aristocracy! The founders clearly intended for a few families to mop up all the assets so that two hundred years later they would own everything."

( Hey, Paul Ryan! Maybe check out No More Kings and Three Ring Government while you're home on break avoiding your constituents! )

In fact, the founding fathers thought generational accumulation of wealth was a cancer on society . Thomas Paine proposed to level the playing field by taxing large estates and distributing the proceeds among men when they reached age 21. Thomas Jefferson supported an inheritance tax, quoting Adam Smith to support his belief that,

A power to dispose of estates for ever is manifestly absurd. The earth and the fulness of it belongs to every generation, and the preceding one can have no right to bind it up from posterity. Such extension of property is quite unnatural.

But today's Republicans see that the wealthiest 1% of the world's population owns 50% of its total assets and think, "TIME TO GIVE THE RICHEST AMERICANS A HUGE TAX BREAK." So they're beating the drums to repeal the so-called "Death Tax" as part of their tax reform plan. Their argument goes something like this:

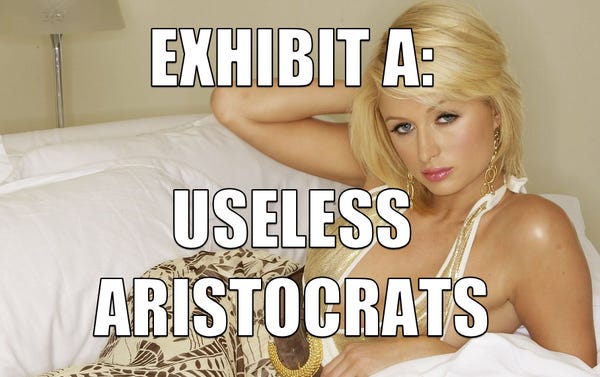

Paris Hilton's great-grandfather started a chain of hotels in 1919.

The Hilton family fortune is now worth upwards of $4 billion.

If we only allow Paris Hilton's family to inherit $2.4 billion, then the terrorists win .

My dogs live in this two-story doggy mansion that has air conditioning, heating, designer furniture, and a chandelier. Loves it pic.twitter.com/4dXAf5XPXV

— Paris Hilton (@ParisHilton) August 25, 2017

Decades of irreplaceable marine research gone in a day.

And while we're at it, it seems that the capital gain stock option income pyramid tax avoidance scheme is worth serious reconsideration... Am I right in thinking that tech zillionaires accumulate their stock riches tax-free until they sell particular shares of stock? And then, with good planning, it passes (under the estate tax) without ever having been taxed as income... Am I right about that? If so, THAT needs to be re-thought, also too.