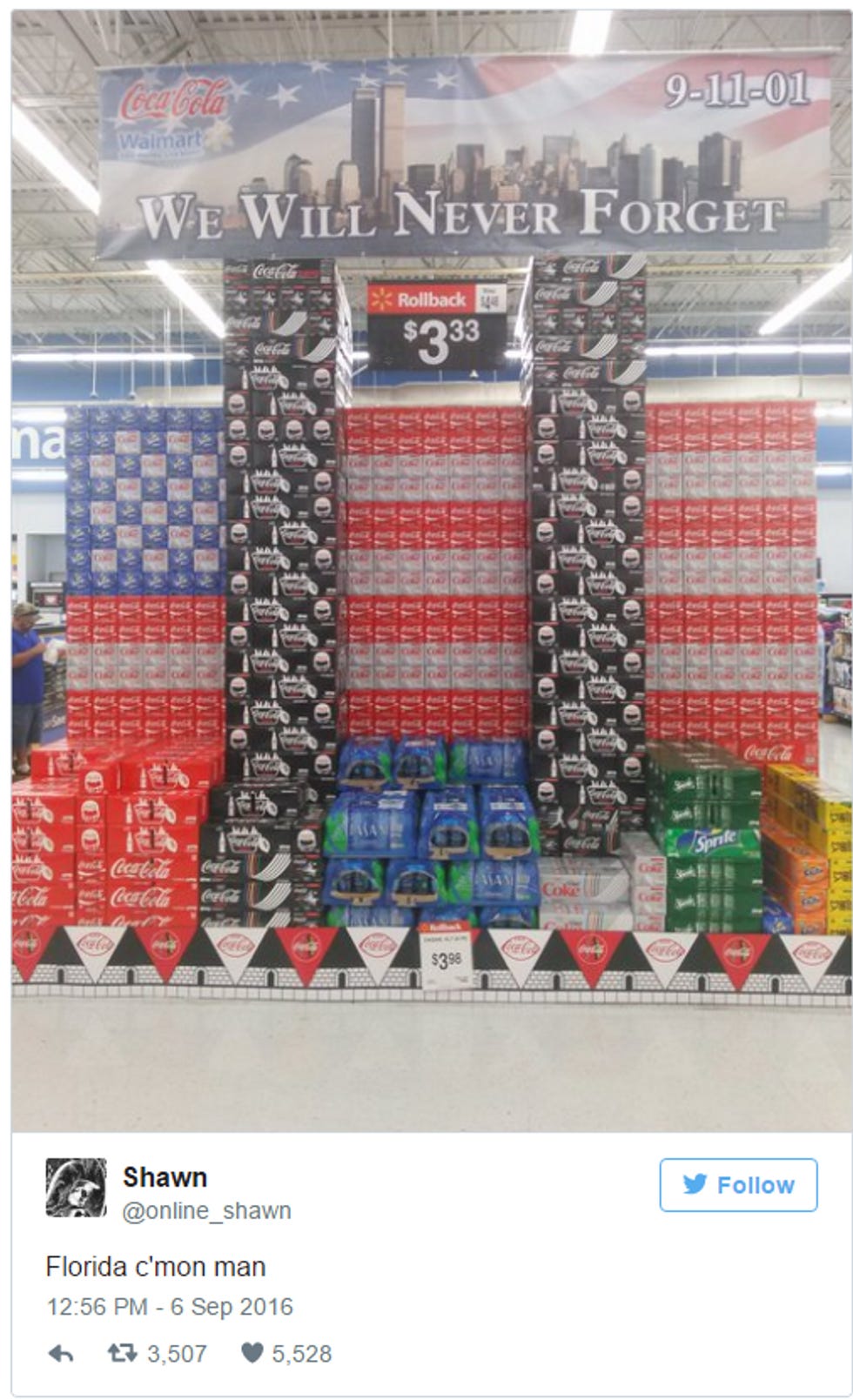

Walmart And Coca Cola Team Up For 2016's Best 9/11 Tribute!

9/11 turns fifteen this weekend. In honor of this occasion, a Florida Walmart wants you to celebrate the tragedy's Quinceanera with cases of Coca-Cola sugar water. Here's our "synergy" of the week:

In an attempt to honor a local firefighters' organization and push a shitload of discount product, the Coca-Cola supplier received permission from the Panama City Walmart's store manager to go hard with the patriotic display. People were not pleased.

After online mobs reacted with criticism, Walmart and Coca-Cola both apologized for the display and orchestrated an inside job to bring down the cases. Why? This exhibit is probably the most appropriately American tribute. Never Forget that our former cheerleader-in-chief told Americans to respond to the terrorist attacks by going to Disney World . Never Forget how he asked us to respond to a fledgling economy and never ending wars by "going shopping." Why is everyone forgetting that the appropriate way to commemorate a horrific event and honor lives lost is rampant and irresponsible consumerism?

We call on Walmart to rebuild these Freedom Displays and we'll take 1 tower of Coke Zeros.

Wells Fargo customers *might* want to check their account details

In 2008, all of the big financial institutions learned their lessons, expressed contrition, and received their bailouts. It was a new era. Wall Street banks would be chill. Wall Street bros would be polite to panhandlers and not try to fuck all of the cocktail waitresses. Anyway, we assume that's what happened. So color us shocked that Comrade Warren's Consumer Financial Protection Bureau and state agencies fined Wells Fargo $185 million dollars after discovering that Wells Fargo employees secretly issued a bunch of new accounts and credit cards without customers' consent. But maybe it was an accident when they created fake email accounts to open online accounts for customers who didn't ask for them.

In all, Wells Fargo employees opened roughly 1.5 million bank accounts and applied for 565,000 credit cards that may not have been authorized by customers, the regulators said in a news conference.

As for Wells Fargo, the Corporate Person totally didn't know about this. In response, the bank fired thefew5,300 bad apples who committed these acts. Thankfully, the underfunded government agencies were able to discover the fraud as the country's third largest bank undoubtedly didn't have the resources to prevent or discover the widespread malfeasance.

How would the bank know their people were stealing from customers? Were they supposed to believe Jenny Q. Account-Holder who called out the bank for inappropriate fees and the receipt of debit cards she didn't want? Or listen to Johnny J. Customer who complained about relentless debt collectors hassling him about accounts he didn't recognize? What do those two even know about banking? Why couldn't they know their place and ignore or misidentify these fees like good banking consumers. Let the professional service providers provide their professional services.

Wells Fargo is famous for its culture of cross-selling products to customers — routinely asking, say, a checking account holder if she would like to take out a credit card. Regulators said the bank’s employees had been motivated to open the unauthorized accounts by compensation policies that rewarded them for opening new accounts; many current and former Wells employees told regulators they had felt extreme pressure to open as many accounts as possible[...]A bank spokeswoman declined to say whether any senior executives had been reprimanded or fired in the scandal.

Wells Fargo totally didn't encourage this practice since it was probably just a couple hundred rogue Mister Managers and their underlings. Again, everyone is rushing to villainize the bankers and we don't like it. The problem is that the average customer doesn't know that he needs these extra accounts and additional credit cards. It's not about the fees and the commission. It's about drawing upon their savvy expertise. Instead, we're discouraging a hallmark corporate person worth almost $2 trillion from doing its patriotic duty on behalf of uninformed customers. And we're going to put these people in jail for a little bit of fraud??? Oh wait, no one is going to jail? They were just stealing "money" from "people." Maybe next time hahaha. Luckily, this fine will deter future misdeeds.

Stock of Wells Fargo [...] rose 13 cents on Thursday, to $49.90 a share.

Lesson learned!

Never Forget (r) that Donald J. Chump collected state of New York "small business" 9/11 relief money even though he stated his company suffered no losses as a result of 9/11!

I have been known to put a bit of sugar in spaghetti sauce for the acid thing, but maybe I will give it a try. Maybe it reminds me a little of the Mexican mole sauce.