America First Patriot Kristi Noem Smears California, Which Is In Fact Part Of America

That’s just how a Republican runs for president these days.

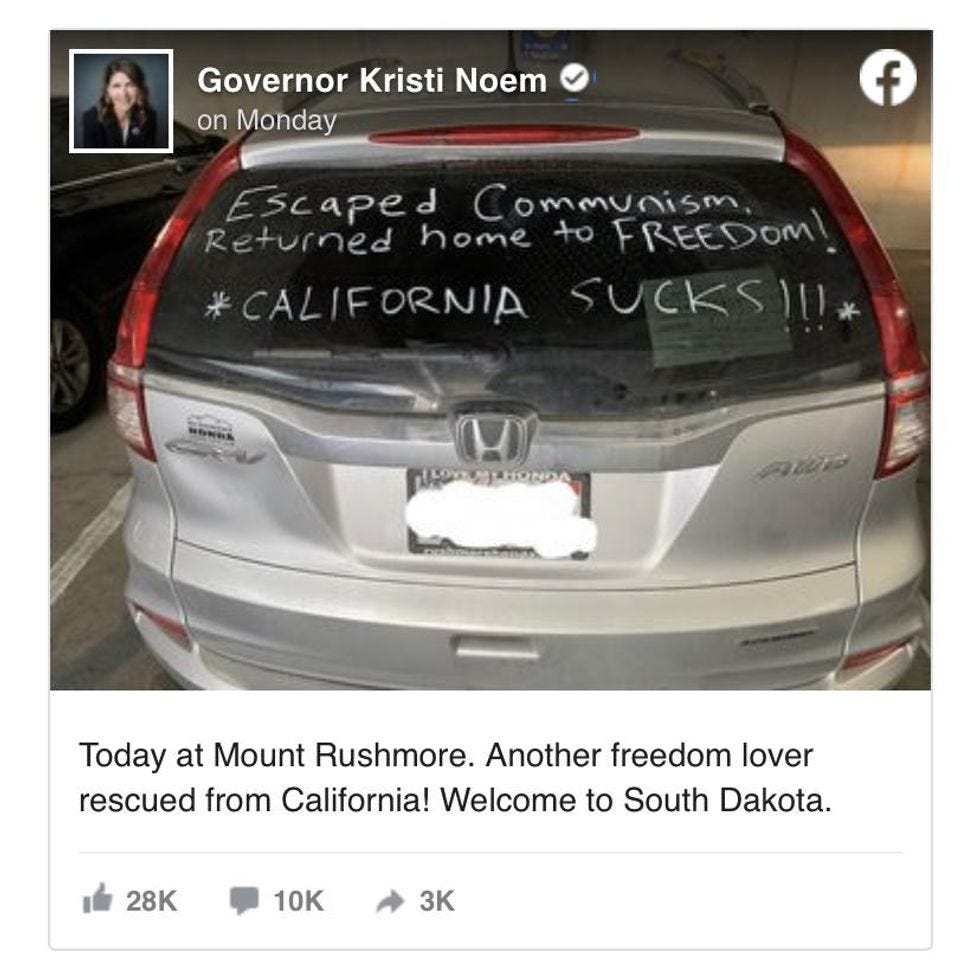

South Dakota GOP Gov. Kristi Noem is somehow a 2024 presidential contender, and she thought it might help her electoral prospects if she insulted at least 11,110,250 Californians. Last week, she posted on her official Facebook account a photo of car she claims was spotted in a parking garage near Mount Rushmore. The owner had presumably defaced their own rear windshield with the following screed: "Escaped Communism, Returned home to FREEDom!" and "CALIFORNIA SUCKS!!!"

Facebook

Noem is the governor of a US state and not a high school Mean Girl, but she added the caption: “Today at Mount Rushmore. Another freedom lover rescued from California! Welcome to South Dakota!" Someone on Noem's social media team apparently blotted out the car's license plate number but failed to obscure the alleged California refugee's temporary paper license in the rear windshield.

That's what the Electoral College gets you. Republicans feel comfortable smearing the country's largest state as inherently “anti-freedom" because they don't need its 55 electoral votes to win the White House. We're warned that if the president was elected through a direct popular vote or at least a process as democratic as the selection of the Pope, candidates would never visit small states like, well, South Dakota, with its population roughly equal to San Francisco. Presidential campaigns might seem like they last 12 years, but admittedly a candidate's time is limited. Still, if every vote literally mattered as part of the calculus for victory, maybe politicians wouldn't feel so free to completely dismiss millions of people.

We said Noem had insulted at least 11,110,250 million Californians, the number who voted for President Joe Biden, but the remaining 6,006,429 residents who supported Donald Trump might not appreciate some right-wing, COVID-promoting asshole implying that they're a bunch of commies. Even they might have standards.

Noem recently declared — on the anniversary of George Floyd's murder — that public universities in her state shouldn't teach critical race theory or The 1619 Project,or probably even that episode of "Growing Pains" where Mike's boss is racist, because it'll convince students America is "evil or was founded upon evil." It's hard to keep track of what Republicans believe these days other than Trump's ass tastes like ice cream -- ALLEGEDLY! -- but don't they believe communism is evil? That's supposedly why they oppose universal healthcare and any reasonable environmental legislation. Claiming a tenth of the US population is actively under communist rule is probably worse than saying the majority of people who signed the Declaration of Independence enslaved other humans and profited off their labor, which is actually true.

Noem demands the South Dakota Board of Regents "preserve honest, patriotic education," which she defines as promoting both a "profound love of our country and a realistic picture of its virtues and challenges." It's neither honest nor patriotic to call your fellow Americans communists and Nazis because they cared enough to prevent the spread of COVID-19. Noem hardly promotes a “realistic picture" of California's “virtues and challenges." California's property tax rate is below the national average, and the supposed Stalin state has no estate or inheritance tax.

This might legitimately come as news to Noem, but California is part of the United States, a rather important part. Aside from containing Disneyland and wine country, California accounts for 14 percent of the nation's economy. If California were its own nation, it would rank between Germany and the United Kingdom in the world's top economies, with a gross domestic product of $2.9 trillion. It's quite the communist success story. (California's also been a US state 39 years longer than South Dakota. Just sayin'.)

Even if the photo Noem peevishly shared is authentic, it doesn't reflect some widespread exodus from California. Fed-up, freedom-loving Americans leaving the state en masse is all myth, researchers confirm. Conservatives don't have to appreciate California and they're certainly welcome to leave if they don't like its laws and policies. They can even take obnoxious photos with an iPhone (designed in California) and post them on Facebook (a California-based company). But maybe they should stop claiming they love America.

[ SF Gate ]

F ollow Stephen Robinson on Twitter.

Keep Wonkette going forever, please, if you are able!

argle bargle blue states bad.

they really have nothing else, do they?

I’ll mention this again. A couple filing jointly with a TAXABLE (after deductions) income of $100,000 would owe less in state income tax in California than a comparable couple in Utah, Idaho, Oregon, or Colorado.Easy explanation: Utah has a flat income tax rate, 4.95%. Easy math for the Utah couple; their tax is $4,950. Colorado has a similar flat tax rate. Idaho and Oregon tax lower incomes at higher marginal ratesThe California rate for that couple is a bit under 3.9% or less than $3,900.Median California family income is a bit below $78,000.California does, as we all know, tax high incomes at higher rates, but middle incomes benefit from a progressive system with lower rates on lower incomes.