Another Head Rolls In Equifax Breach

The SEC is charging the former CIO of Equifax with insider trading. Good.

When Equifax announced it lost the drivers licenses and Social Security numbers of more than 143 million people, people were righteously angry. When Equifax upped that number by another two million, nerds created new words to swear with. But when the news came out that Equifax executives had tried to hide the breach, AND sold off their stock just before the news went public, Uncle Samfinallyrolled up his sleeves and got his ass to work.

This morning the SEC announced civil and criminal charges against a former EquifaxCIOsoftware developer Sudhakar Reddy Bonthu for insider trading. In a press release, the SEC states that Bonthu was contracted by Equifax to build a website for people who'd been victims of a data breach. When Bonthu realized it was Equifax who'd been breached, he spent $2,100 in put options on Equifax stock that he sold for $75,000 a few weeks after the news of the breach went public.

Bonthu was fired back in March after he refused to cooperate with an internal investigation into insider trading allegations related to the breach.

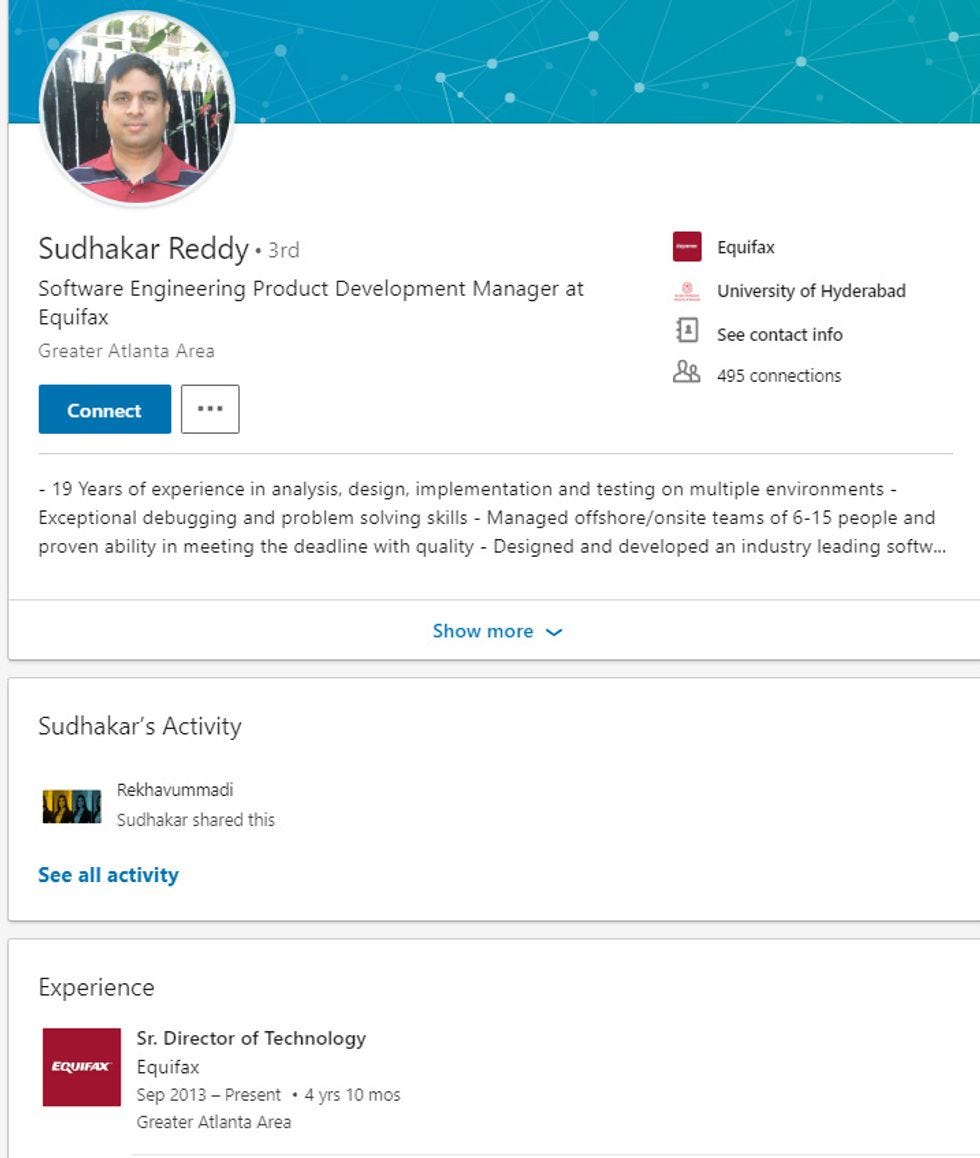

Fun Fact: Bonthu has yet to update his Linkedin profile.

PROBABLY should update that résumé...

Bonthu is the second Equifax executive to face charges of insider trading after Jun Ying, another member of the company's brass, was indicted -- though Ying tried to run off with $950,000. Four other top executives were suspected of netting a cool $2 million days before the breach went public, but the Equifax board says their internal investigations couldn't find that they did anything wrong. Of course not!

Republicans in Congress and the Trump administration have gone out of their way to protect Equifax. In February, CFPB head Mick Mulvaney used his greasy sausage fingers to choke a federal investigation on how Equifax tried to hide the breach. Republicans in Congress killed a consumer protection rule that allowed people to join class action lawsuits, forcing them to abide by snakey arbitration clauses. Florida Democratic Sen. Bill Nelson did have a bill to help people who've been victims of data breaches, but it got lost in legislative hell.

On the bright side, there's still a massive 50-state class-action lawsuit, and a couple of state regulatory agencies slapped Equifax with new rules . At least there's some faction of the government that's going after corruption and grift. Well, for now anyway.

photo by Dominic Gwinn

Wonkette is 100% ad-free and reader-supported. We don't do Wall Street.

And a bundt cake.

We don't have the law on our side now that Repubs have used Trump to pack the courts with "conservatives."

All you people who could have voted for Clinton and didn't? That was really dumb.