Happy Juneteenth! Let's Talk About The Racial Wealth Gap!

Having a Juneteenth cookout? Eat the rich!

Saturday will be Juneteenth, the now-national holiday marking the arrival in Texas — two years late — of the news of the Emancipation Proclamation. The nice class traitors at Patriotic Millionaires, who have long called for the government to raise their taxes please, have some thoughts on Juneteenth. They'd like to remind you that the holiday is both an opportunity to celebrate how far this dumb country of ours has come from the Worst Old Days, and to note that there's a hell of a long way to go before we reach real equal opportunity for all Americans.

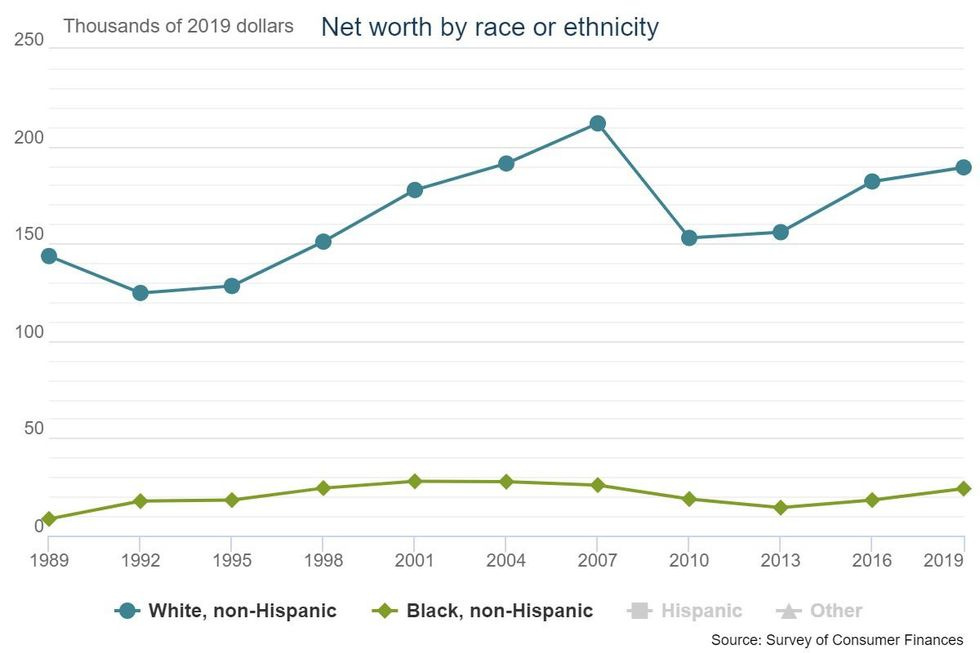

As any honest history class should teach the youngs, the legacy of enslavement didn't end with the Civil War, but was built into the social and economic fabric of post-Reconstruction America. And thanks to deliberately discriminatory policies, an economic version of Jim Crow, we still have a terrible racial wealth gap. Oh, look, here is a chart!

Wealth in the U.S. is disproportionately owned by White families; In 2019, the net worth of a typical White family was $189,100, over 7 times more than the $24,100 average of the median Black family. These extreme inequities are a result of generations of policies enacted solely to protect White wealth.

The U.S. government intentionally blocked Black families from wealth-building ventures and opportunities; whether that be through denying FHA loans and GI bill benefits, astronomical student loan debt with little forgiveness, or various other banking or business programs offered only to white Americans.

You see, first came the explicitly racist policies that prevented Black families from building wealth in the first place. On top of that, you can pile the tax code's favoritism when it comes to how rewarding wealth over work (see the recent ProPublica reporting on how the richest Americans avoid taxes) locks in the disparities caused by policies like redlining or federal housing loans. While you're at it, you can add in things like the GI Bill's nominally race-neutral mortgage subsidies , which relied on local banks that definitely did discriminate against nonwhite loan applicants.

What you end up with is a tax code that may not say one word about race, but which locks in the racial disparities in wealth that did result from open discrimination in the past. As the Millionaires point out, "Thanks to the significant wealth gap, any loopholes that give an advantage to pre-existing wealth puts Black families at a disadvantage."

And that's what systemic racism is all about, Charlie Brown.

For a case in point, consider

tax preferences like a substantially lower tax rate on capital gains, and loopholes like the stepped-up basis. The stepped-up basis allows inheritors of large fortunes or assets, to avoid paying taxes on their assets or inheritance while folks who earn their living through a paycheck (as many Black families do in the U.S.) end up paying a higher tax rate than the wealthy heirs. How are Black families ever supposed to catch up when the money they earn is taxed more harshly than the money that already wealthy white families accumulate?

Another example, as noted by Emory University tax law professor Dorothy Brown in a recent podcast interview with MSNBC's Chris Hayes: When people sell their homes, the first $500,000 in profit is free from capital gains taxes. That seems perfectly race neutral until you remember that for most of the 20th century, Black families were structurally locked out of home ownership, AND that homes are the single biggest source of wealth (and equity) for most American families. And while you're at it, you can add in the fun fact that since most public schools are funded by local property taxes, the home-value inequities of the past have reinforced gaps in school funding and educational disparities right up to now.

Brown notes other ways in which the tax code, which is facially completely unconcerned with race, ends up reinforcing the racial wealth gap, like the assumption that the norm for American families is a single breadwinner and a stay-at-home mom. Historically, more Black families have had two breadwinners making roughly the same pay, so the "marriage penalty" has a larger effect on Black families as a group. (Brown realized this when she was a brand-new accountant and did her parents' taxes; she couldn't believe they owed roughly the same in tax as she did, although she made much more than both parents combined.)

Damn right I've bought Brown's book, The Whiteness of Wealth: How the Tax System Impoverishes Black Americans — and How We Can Fix It . Should we do a Wonket book club?

In any case, the Patriotic Millionaires have some suggestions, since they seem to have read Brown and other scholars on all this. Without getting too specific, they call for Congress to "prioritize ambitious changes to the tax code that has been rigged against poor Black families for decades," and have some advice for the Biden administration:

In order to combat the widening racial wealth gap, we must reconstruct our tax code. We need wealthy folks to pay their fair share in taxes, we need to eradicate unfair loopholes, and we need to get serious and really crack down on our enforcement of tax cheats.

Sounds good to us, and way more useful than censoring US history or banning protesters from burning the occasional flag.

[ Patriotic Millionaires / Why is This Happening? on YouTube / The Whiteness of Wealth / Daily Kos / Photo: Grace Murray Stephenson, Austin History Center. ]

Yr Wonkette is funded entirely by readers like you, because even if you aren't millionaires, you're the right kind of patriots. Please money us if you can! And if you are a millionaire, hello please come say hi.

Do your Amazon shopping through this link, because reasons .

My net worth is irrelevant. I have kids who need braces and college, and I’m pretty much illiquid because most of my money is tied up in real estate and mutual funds and I have zero interest in realizing capital gains.

Plus, that divorce foisted upon me was not fucking cheap.

We do have many little ponds and sloughs in this area.