Joe Biden Cancels Another $7.4 Billion In Student Debt, Just To Troll The Haters

They're just so cute when they start pouting and saying it's 'not fair.'

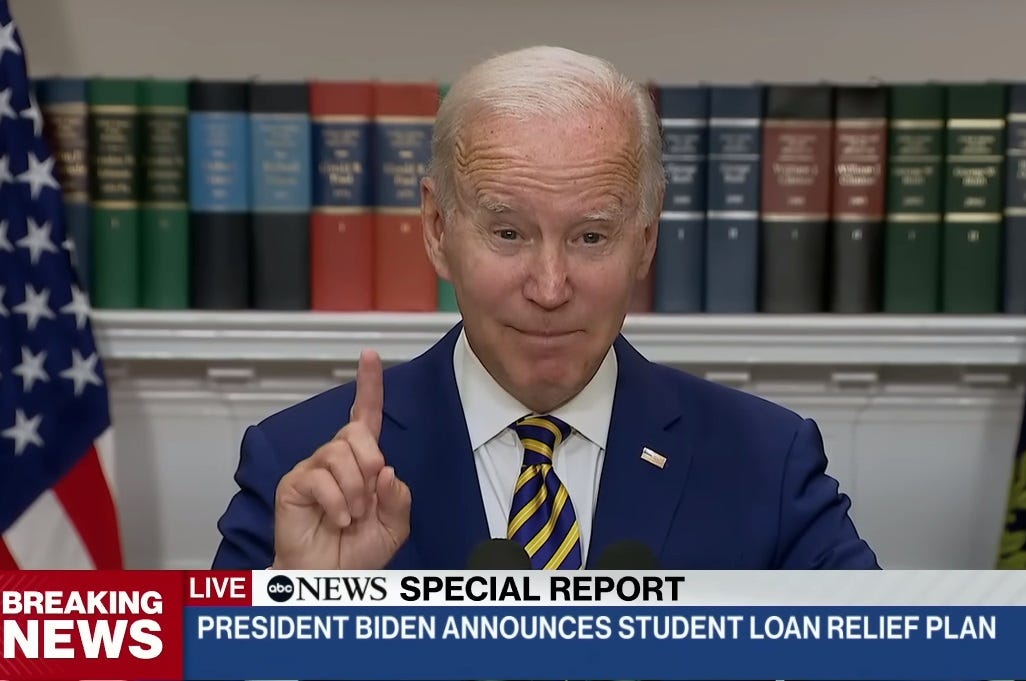

That scamp Dark Brandon is at it again, reminding us that one party is out to make life better for everyday Americans, and the other one worships an orange urinal cake. You may recall that on Monday, Biden announced his plans for a wide-ranging program of student debt relief, the long-awaited replacement for the 2022 debt-forgiveness proposal that the Supreme Court murderized last summer.

Friday, perhaps for the sake of making all the rightwing crazies mutter “vote buying!” and “LAWLESS RADICAL” all over again, Biden announced another round of student debt forgiveness, eliminating 7.4 billion in debt for some 277,000 borrowers, hooray!

This new tranche of debt forgiveness, the Washington Post explained (gift link) — in a first paragraph that no rightwingers read at all before going to the comments section to gripe about it — is “another round of loan cancellation through existing debt relief programs.” We’ve bolded that to emphasize that this isn’t just something Joe Biden made up while doing the Wordle puzzle during breakfast: It’s a regular thing that occasions periodic reports, because people don’t always pay attention to good stuff like this and need the occasional reminder.

Now, if you’re among the 277,000 lucky duckies, you may have already received an email telling you that your remaining student debt is being cancelled, and you are more than welcome to share that in the comments, because isn’t that a great feeling?

Secretary of Education Miguel Cardona said in a statement Friday that the new round of debt relief demonstrates that the

“Biden-Harris Administration is not letting up its efforts to give hardworking Americans some breathing room. As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country.”

As of Friday’s announcement, the administration has now approved $153 billion in student debt forgiveness of various kinds, reducing or eliminating altogether the student debt burden for nearly 4.3 million Americans, the statement said.

So let’s look at the deets here, and see who’s looking under their seat and finding an envelope with a letter saying CONGRATULATIONS: YOU WIN NOTHING! THAT’S YOUR NEW STUDENT LOAN BALANCE! ZERO! (This is not the actual wording of the email. But shouldn’t it be?)

And again, keep in mind that this debt relief is in line with programs that Congress has already passed. For all the “Joe Biden can’t do that!” whining, this is all entirely in keeping with existing law, mostly through the Higher Education Act and its various reauthorizations through the years. The debt relief announced Friday is going to help three categories of borrowers:

Enrollees In The SAVE Repayment Plan

This is the biggest chunk, with $3.6 billion in loan forgiveness going to about 206,800 borrowers in the administration’s new “Saving on a Valuable Education” (SAVE) repayment plan, whose mechanics we ‘splain here. It’s the administration’s big effort to bring some sanity to student loan repayment for people who don’t have a lot of income yet. Monthly payments are keyed to borrower’s income and family size, and unlike pretty much all prior student loan programs, it’s designed so that nobody will ever see their loan balance balloon out of control due to interest rates. If interest due is higher than the required monthly payment, then any interest over that payment just poofs out of existence instead of piling up and accruing to the overall balance.

Borrowers whose balance totals less than $12,000 are eligible to have their loans forgiven after 10 years instead of the usual 20, and that’s who’s getting this round of debt relief. This is the second round of forgiveness for qualifying SAVE borrowers; the first, in February, erased the loan balances for about 153,000 Americans.

Loans What Qualify For The ‘One-Time Adjustment’

This is another round of the loan-forgiveness program that helped out me and 807,000 of my closest friends last summer, by correcting long-standing accounting problems in the student loan program.

$3.5 billion will go to 65,800 borrowers who should have had their loans forgiven through enrollment in IDR plans going back 20 years or more, but who either 1) were wrongly shunted by loan servicers into forbearance, which freed them for a time of payments but made their balances explode due to interest that kept accruing, or 2) actually were enrolled in IDR plans and making payments, but never got the loan forgiveness they were entitled to because of crappy record-keeping by loan servicers, the Education Department under previous presidents (of both parties), or both.

It was a huge scandal, really, or should have been. A 2021 report found some 4 million loans that qualified, but only 32 people who received the loan forgiveness they should have. So far, the IDR adjustment program has approved $49.2 billion in loan forgiveness for more than 996,000 borrowers. When the total gets to a million, we should all meet for drinks!

Fixes To The Public Service Loan Forgiveness (PSLF) Program

The PSLF program was designed by Congress to encourage young people to go into teaching and other public service jobs by offering them a faster path to loan forgiveness: Work for 10 years in a qualifying job and make 120 monthly payments, and the remaining balance on your loan is forgiven. Passed during the George W. Bush administration, the first people who did their decade of service and payments became eligible in 2017, during the Trump administration, but under then-Secretary Betsy DeVos, the Education Department looked for any excuse possible to deny applications, so out of the first pool of 28,000 applicants, only 96 people had their balances written off.

It was awful, and compounded by crappy record-keeping similar to the fuckups that plagued the IDR program. Secretary Carmona’s Ed Department cleaned up the process, started processing applications honestly, and is still working through the backlog from the Trump years to approve loan forgiveness for teachers and other public servants whom the government let down.

How well has that fix been going? Well enough that of the groups announced yesterday, this update is the smallest, with $300 million in forgiveness going to 4,600 borrowers this time around. In total, the administration has approved $62.8 billion in PSLF loan forgiveness for nearly 876,000 borrowers.

Also too, as I mentioned in the comments last week when the new debt relief program was announced, if you think you qualify for loan forgiveness that you haven’t received, or for that matter if you aren’t sure whether your old loans might qualify, go look into it at the studentaid.gov website, and if you still aren’t sure, don’t be shy about contacting the Ed Department’s amazingly helpful and knowledgeable customer support staff. They know their stuff. Be kind to them!

PREVIOUSLY!

[WaPo (gift link) / Education Department / studentaid.gov]

Yr Wonkette is funded entirely by reader donations. If you can, please subscribe, or if you prefer a one-time donation, then just look at this button we have right here!

>> and the other one worships an orange urinal cake <<

I was watching an NBC news clip about the AZ 1864 abortion law and they cut to Trump making a video statement about it. Trump's makeup was the typical orange, but with more brown mixed in, almost like mud got in his makeup.

But here's the weird bit: like normal, they didn't do his ears, and with the makeup so dark the transition from face to hairline & ears was super obvious to the point where even I, who almost never criticizes anyone based on appearance, thought, "Wow, that looks sooooo bad, I wonder if the the anchor will comment on it. They have to comment on it, right? Because everyone wears makeup on video, but this looks so bad that it seems like it has implications for his brain functioning which is a legit realm of criticism."

But no, NBC did not comment on it. And, again, I don't want to attack Trump for looking bad, but the makeup stopped a bit before the hairline, not right at it (maybe he was afraid to get any in his hair and ordered them not to get too close?) and his ears were sticking out so white, and this particular shade of orange mud was so dark that it just cried out for a little blending at the edges -- blending which just ndid not happen. It was horrible, is what I'm saying, and yet it was also fixable by any makeup artist. If you can't use a lighter shade b/c Trump is certain that orange-mud makes him look tan, then you can add a little to his ears or taper off the amount of makeup as you approach the hair line instead of creating a solid, obvious line that is orange-mud on one side and bright white on the other.

No competent makeup artist would leave it like that unless they were ordered to, is what I'm saying, and the man who would order them to leave off the blending and tapering and whatever is a man who is not making sound decisions, is my point.

It was a makeup job so horrifically bad it makes you think the guy is more brain-injured than he was last week, and he was pretty fucked up last week.

Seriously, that video would have me questioning my life choices if I were wearing that makeup job.

Stepdaughter got busy on the phone after I forwarded Dok's last article on the subject to her. Looks like she's going to get her entire outrageous debt for under- and post-grad forgiven. Dok really is best pony!