Joe Biden Keeps Fixing Those Crazy Stupid Student Loans!

Cutting student loan payments in half? Yes, please.

The Biden administration yesterday rolled out its latest tool to tackle the student debt crisis, and as we discussed earlier this year, it’s a good one. While the administration is still working on a broader debt forgiveness plan that it hopes will survive the Trump/McConnell Supreme Court, the new income-driven repayment program, called the “Saving on a Valuable Education” (SAVE) plan, should drastically cut the amount of student loan payments for lower-income borrowers, and for many, will actually get those payments down to zero.

Currently, borrowers in Income-Driven Repayment (IDR) plans pay 10 percent of their “discretionary income” per month on federal student loans. When the SAVE plan is fully implemented in July 2024 (the rules first must go through the federal rule-making process), that will drop to five percent of discretionary income for undergraduate loans, effectively cutting payments in half for millions of borrowers. Folks with combined undergraduate and graduate debt will pay somewhere between five and 10 percent, based on the proportion of how much debt is one or t’other.

But wait! While that change won’t kick in until next July, borrowers in SAVE repayment plans won’t have to wait until then to start seeing savings, since another part of the plan will kick in right away: The formula for calculating “discretionary income” is changing too. That’ll mean lower monthly payments for most borrowers, with the bulk of the savings going to folks with lower incomes.

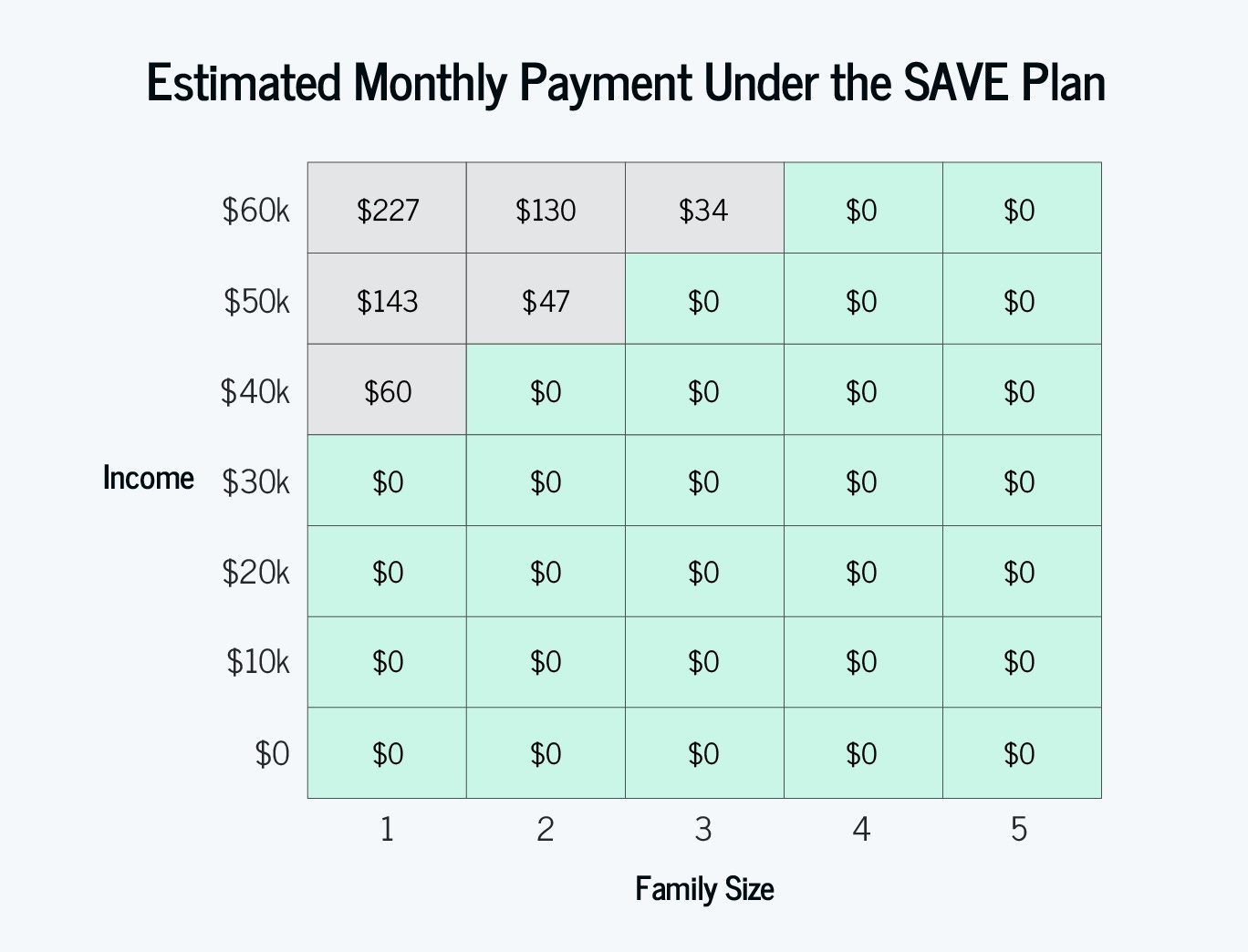

That’s because the amount of income exempt from being considered “discretionary” will increase to 225 percent of the poverty line for their family size, up from the current 150 percent. As a White House fact sheet ‘splains,

This means a single borrower who makes about $15 an hour will not have to make any monthly payments. Borrowers earning above that amount would save around $1,000 a year on their payments compared to other IDR plans. The Department of Education estimates that more than 1 million additional low-income borrowers will qualify for a $0 payment. This will allow them to focus on food, rent, and other basic needs instead of loan payments.

The Education Department provides a handy dandy table to illustrate:

And yes, the new discretionary income calculation and the five percent payment level will also apply to folks in the Public Service Loan Forgiveness Program, too, so the elementary school teachers red states keep chewing through will at least have a softer landing. Heck, maybe we’ll end the war on teachers and they can even make a career of it!

Okay, now here’s one of the bestest parts: With the SAVE plan, the Education Department will no longer charge any interest that isn’t covered by the monthly loan payment, putting an end to the interest-accumulating hamster wheel that so many of us know all too well, where you make your payments on time but your goddamn loan balance keeps growing. As the fact sheet explains:

For example, if a borrower has $50 in interest that accumulates each month and their payment is $30 per month under the new SAVE plan, the remaining $20 would not be charged as long as they make their $30 monthly payment. The Department of Education estimates that 70 percent of borrowers who were on an IDR plan before the payment pause would stand to benefit from this change.

That’s how it always should have been, damn it.

As with other income-driven plans, once a borrower has made payments for 20 years (for undergrad debt) or 25 years (for grad school debt), any remaining balance will be forgiven — yes, even if the monthly payment amount was zero for some or all of that period. Explain to your rightwing uncle that such forgiveness is not a new gimmick Joe Biden made up; it’s how IDR plans have worked since Congress authorized them in the 1990s.

That said, the SAVE plan does add a new rule aimed at helping borrowers with small loan balances — typically those who went to community college — reach that forgiveness threshold sooner. For folks whose original principal loan balance was $12,000 or less, the forgiveness threshold will be 120 payments, equal to 10 years of payments, and then you just get out of here and live your life. Also too,

For each additional $1,000 borrowed above that level, the plan adds an additional 12 payments (equivalent of 1 year of payments) for up to a maximum of 20 or 25 years. For example, if a borrower’s original principal balance is $14,000, they will see forgiveness after 12 years. Payments made previously (before 2024) and those made going forward will count toward these maximum forgiveness timeframes.

The whole process is meant to work as smoothly as possible, eliminating a lot of the paperwork hoops that borrowers had to go through. In fact, borrowers currently on the most common IDR plan, the REPAYE plan, will be automatically shifted to SAVE plans. To get the full benefit, borrowers with other types of repayment plans may need to consolidate their loans; more info and a sign-up linky here.

As The American Prospect’s David Dayen said when the plan was proposed, this will create an alternative to the usual idea that student loans will drag borrowers down forever if they don’t reap the benefits of an education (yeah, we know, that’s like a betrayal of the American Dream). Instead, it’ll become

a system where the lender would make its outlays back if the benefits of the college wage premium manifest. If the borrower has a successful career, they pay more; if it doesn’t work out, they would pay less, or even nothing. After 20 or 25 years, the relationship would end.

This is another big effin’ deal, from an administration that has really committed to fixing the student loan mess in every way it can, like clearing up the backlog of Public Service Loan Forgiveness applications that Donald Trump made worse, and getting IDR loan forgiveness to more than 800,000 borrowers who were eligible but hadn’t gotten the relief we were supposed to get.

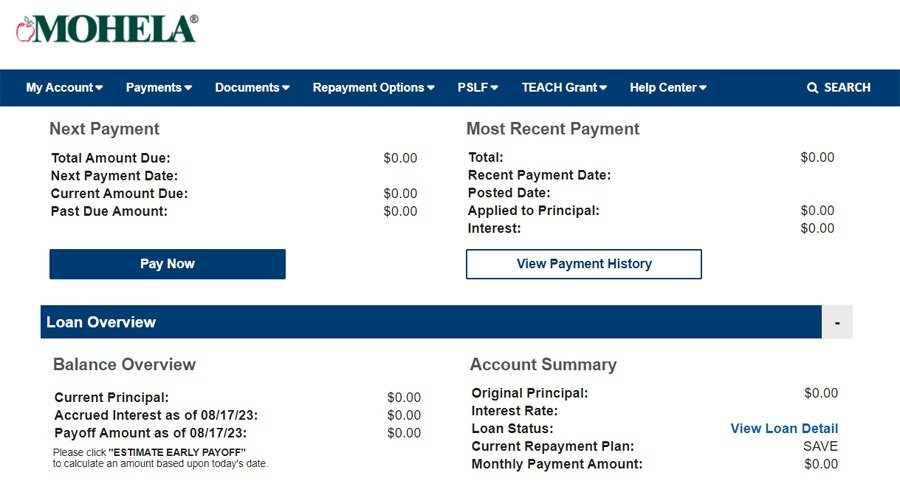

And when I say “we,” I mean me. Look at this lovely bunch of zeroes that greeted me last week.

Joe Biden wants a whole lot more of us to breathe just a little easier each month. Seems like a smart way to run a country!

[White House / Department of Education / CNBC / American Prospect]

Yr Wonkette is funded entirely by you, the readers, and we love you for it. If you can, please subscribe, or if you prefer, make a one-time donation right here!

Whoever had Wagner Group Thug Leader dying in a mysterious plane crash, you won the pool. I had window “accident.” If you think about it, a plane crash is like a giant window accident.

I was, thankfully, able to pay for my degree in History, so I can now have people constantly ignore my warnings without the additional burden of a student loan.