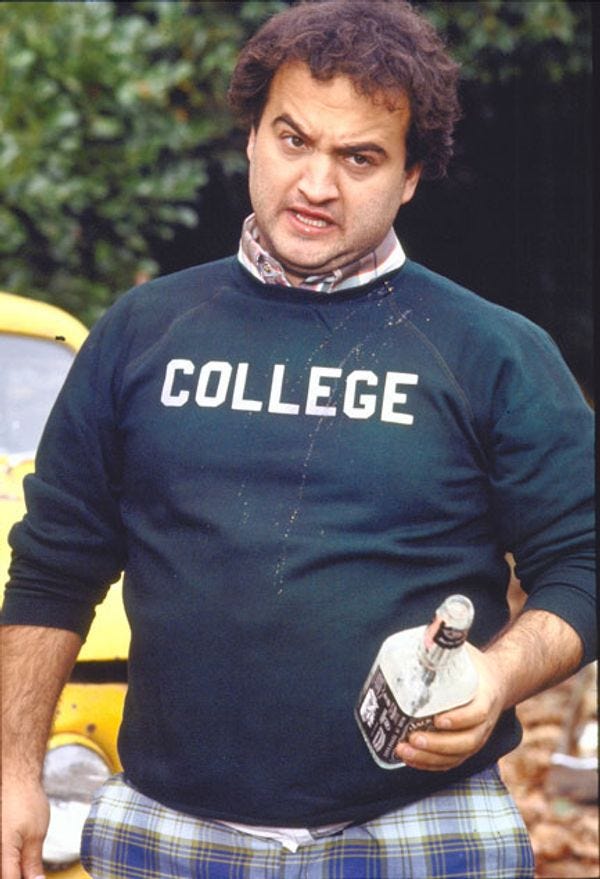

LOL The GOP Tax 'Cut' Bill REALLLLY Doesn't Want You To Get Edumacated!

Was it over when the Germans taxed Pearl Harbor? Hell no!

As we promised, we keep finding all sorts of wonderful new ways the Republicans will screw all sorts of ordinary Americans in order to pay for tax cuts for the richest among us, who deserve lower taxes because like Bullwinkle's magic hat trick, supply-side economics will definitely work this time, for sure, and make us all big rich guys, the very best. Or at least make the biggest backers of the Republicans more big and more rich, which will certainly be good enough. We've already looked at how the GOP tax plan will fuck over the middle class, sick people, and working poor parents, but there are plenty of other "special interests" who'll have to see their taxes go up to help the rich, too, like how about universities and colleges, and the smarty-pants elitists who attend them? Donald Trump loves the poorly educated, so clearly, it's time to make college even less affordable than it has been, so Donald Trump can share his love more broadly.

How will the GOP tax plan hit higher education? Chronicle of Higher Education counts the ways. For starters,

the bill would eliminate or consolidate a number of tax deductions meant to offset the costs of higher education for individuals and companies, including the Lifetime Learning Credit, which provides a tax deduction of up to $2,000 for tuition, a credit for student-loan interest, and a $5,250 corporate deduction for education-assistance plans.

But wait! There's more! The plan would treat as taxable income the tuition waivers that many graduate students receive when they get teaching or research assistantships, because if there's anyone who springs to mind when you think of someone scamming the taxpayers, it's that 20-something teaching assistant trying to explain to a bunch of first-year students why "world peace" may be a bit too broad a topic for a seven-page research paper. Get free tuition for your graduate degree while you're teaching? You just got taxed on an extra $50,000 a year in "income." Claus Wilke, a biology professor at the University of Texas at Austin, 'splainered on the Twitters why this would be "a disaster for US STEM PhD education," as if we really needed any more damn scientists to tell us stuff:

Currently, STEM PhDs make about $30K per year and get tuition wavers. They can do their PhD without taking on debt, but barely so. If they had to pay taxes on a calculated $50-$60K income (incl. tuition), the actual income would not cover living expenses anymore. At that point, a PhD would not be a viable choice anymore, except for the independently wealthy.

Maybe private schools could somehow work around this by charging different tuition for grad students and undergrads. But state schools would likely not be able to do that, due to various laws and regulations. So, no more STEM PhDs at state schools in the US.

On the upside, once the coal industry comes roaring back, we can get all the science knowledge we need from coal companies. Unless they want their science people to know stuff, too, but there are plenty of engineers out there already -- half the self-proclaimed science experts on Twitter say they're engineers.

Universities also fear that the bill's provisions will mean fewer people itemizing deductions, with a corresponding drop in donations to higher education. The portion of taxpayers who itemize their deduction is expected to drop from 30 percent to about 5 percent, which would hurt not just colleges and universities but charities across the board.

The tax bill would also impose taxes on college endowments and well-compensated administrators, which has a certain soak-the-rich appeal, we'll admit, but going after elite schools with big endowments would ultimately hurt low-income students, since there'd be less money available for scholarships. Meanwhile, Muffy and Trey would still be able to get into top private schools with their parents' cash -- heck, their parents will have more to spend. It's not even clear the increased taxes on elite schools would raise much revenue, according to the Chronicle:

Two provisions in the legislation take aim at higher education’s most popular targets — endowments and executive compensation. But the bill’s details mean that relatively few institutions and administrators would see a tax increase.

Republicans proposed a 1.4-percent tax on the endowments of private colleges that enroll more than 500 students and that have nest eggs of more than $100,000 per student. The proposal would generate an estimated $3 billion over 10 years.

A Chronicle analysis found that the tax would apply to fewer than 150 colleges.

Also, it's a deliberate slam at "the elite," the government expropriating donated funds from one specific kind of charity, thanks to its perceived ideology. Gotta make those un-American commies in higher education suffer, but no such taxation measures would be dreamed of for tiny-ass Bible colleges or church schools.

The Republican tax proposal, in its present form, will almost certainly make a college education much more expensive and remove many of the incentives that offset the cost of higher education. Guess that serves those damned Democrats right for running on making college more accessible. This should make Republicans very happy, since they know that universities are merely indoctrination factories for the left, and college is for snobs and people who hate God. Maybe if they can just drive enough colleges out of business, they can get rid of liberalism altogether.

[ Chronicle of Higher Education / Claus Wilke on Twitter]

I had a friend die unnecessarily in one. But you be you.

I thought you'd need a smaller, itty-bitty hammer.