October Inflation Report: Inflation Levels Off, Run For Your Lives!

Reports from the permacrisis.

The Labor Department’s monthly inflation report is out, showing that the Consumer Price Index rose an eensy bit in September, by .4 percent, down from August’s CPI increase of .6 percent. The seasonally adjusted annual rate works out to 3.7 percent, still above the Federal Reserve’s target two percent rate but way down from last September’s 8.2 percent.

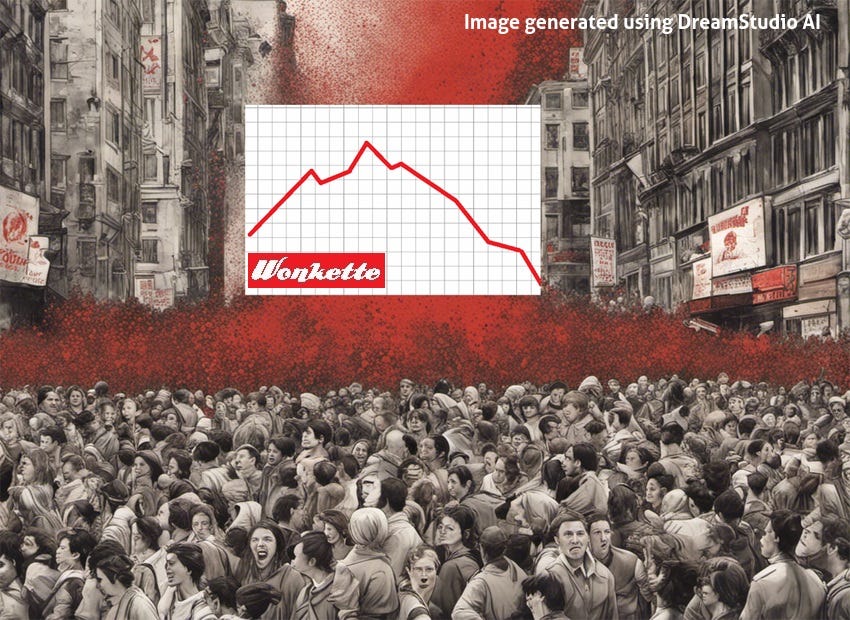

Depending on which branch of the Comcast Cinematic Universe you looked at, that’s either pretty good or pretty troubling news! NBC News went with a happy face emoji, because inflation is leveling off, and the long-term trend is a slowdown in the CPI:

CNBC, in its story on the exact same inflation report, went with the anxious-face emoji instead, because even if the stock market isn’t crashing, maybe it should be with this persistent inflation:

The one-month rise was a skosh higher than the Dow Jones estimates of .3 percent for the month and 3.6 percent annualized inflation. Gasoline prices had driven the August average up, and their decline in September helped bring down the average. Yes, this is where we remind you yet again that political agita over gas prices will someday be a thing of the past when we’re all driving electrical nerd cars.

“Core inflation,” which measures prices without the volatile stuff like food, energy prices, and Taylor Swift tickets on the dark web, was up 4.1 percent, right where economists expected it to be, so we bet they’re pretty insufferable today, pumping their fists and wearing graph-paper hats.

The biggest single factor in the monthly increase was again the cost of shelter, especially rent, which is too damn high. But used car and truck prices keep declining from last year, when they were unusually high because the long-term microchip shortage was making new cars hard to find.

While inflation is starting to level off, prices overall are still high, but the good news is that wages have continued rising faster than inflation, increasing buying power for many folks.

Time for the mandatory quote from an economist, and this month we’ll go with smiling NBC News instead of those dour pricks at CNBC:

"Inflation is easing, it's edging lower. However, food and energy prices remain elevated, and the average American lives in an environment in which food and energy are basics for their budget. And that budget is climbing higher," said Quincy Krosby, Chief Global Strategist for LPL Financial.

Also feeling pretty good about things is Economist Paul Krugman, who says we may as well declare victory in the war on inflation and go home, which made all the Blue Checkmark people very angry because they happen to know that inflation is worse now than ever, because duh a Democrat is president. My personal favorite was a guy who wrote “tell it to my mortgage,” because while I am not a metallurgist, I do at least know that fixed-rate mortgages are more common than variable rates ones, and also even the latter are pegged to the prime interest rate, not to monthly inflation stats.

Will the Fed raise interest rates at its next meeting at the end of this month? It left rates unchanged at its September meeting, so that could mean the Fed will remain in wait-and-see mode, or maybe that means it’ll feel more free to ratchet rates up another quarter of a percent. We can predict with some certainty that the Fed will definitely do or not do something, and that it will be either very troubling or no big deal, probably both. For all we know the Fed might even accompany its rate decision with a seasonably appropriate spoooooky pun. Probably not though, since that’s usually left to economics reporters.

In conclusion, if used car prices keep dropping I might start thinking next year about getting a used EV, or maybe not if interest is still high, and isn’t the economy something? A BMW i3 might be fun, because even if the range isn’t great, I don’t take long road trips anyway.

[Bureau of Labor Statistics / CNBC / NBC News / WaPo]

Yr Wonkette is funded entirely by reader donations. If you can, please subscribe, or if a one-time donation is more your style, we have just the button for you to click. If you’re a professional economist, you could even donate while fretting that we’re on the edge of a precipice while winds remain clam and steady.

This seems very bad for Trump. Very good for the book industry though as I expect a few new book deals to be signed.

"Judge Frees All Trump Campaign Staffers From NDAs

All former campaign staffers, independent contractors, and volunteers are now free to speak their minds about Donald Trump and his campaign without fear of lawsuit or legal threats. Denson was represented by Protect Democracy, Bowles & Johnson PLLC, and Ballard Spahr LLP."

https://www.joemygod.com/2023/10/judge-frees-all-trump-campaign-staffers-from-ndas/

Once again, reporters don’t understand shit about the economy. I know that because I used to be a reporter who didn’t know shit about the economy. Then I got a job working with top economists, who took me aside and gently explained that even they’re just guessing.