California Wildfire Victim Fund Overhead Would Make Those WALL Grifters Blush!

Look, eventually helping people is expensive, OK?

You probably remember the 2018 Camp Fire that wiped out the town of Paradise, California. It killed at least 85 people, destroyed nearly 19,000 homes, and caused billions of dollars in damage. Also, Donald Trump blamed it on the forests not being raked, and couldn't be bothered to even learn the name of the town when he visited: "Pleasure — what a name."

In reality, the fire was sparked by equipment belonging to Pacific Gas & Electric, which filed for Chapter 11 bankruptcy in January 2019, just ten weeks after the fire. As part of the bankruptcy, the utility reached a nearly $25 billion settlement in December 2019, to compensate people and businesses harmed by the fire. And everyone was made whole again and all was well! Unless you read the headline, of course.

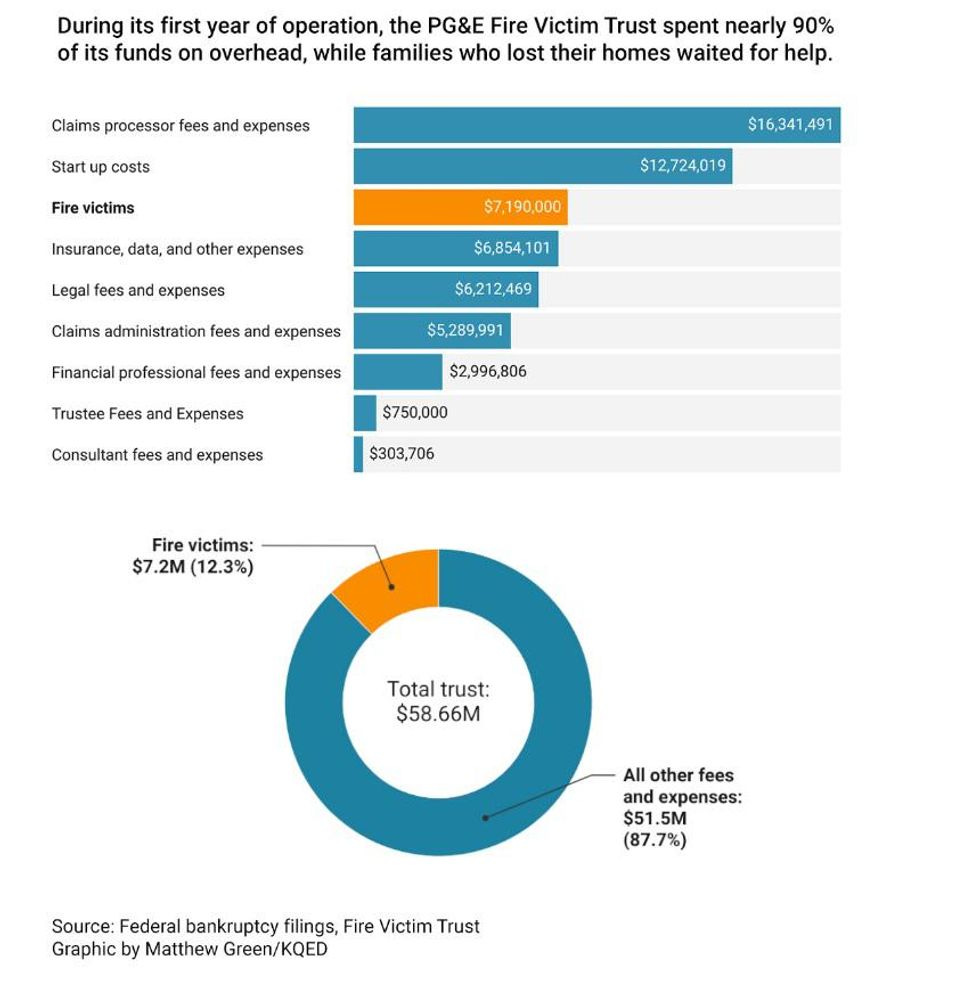

Instead, an investigation by KQED has found that in its first year of operation, the trust that's supposed to be compensating the fire victims has paid far more to administrators and lawyers than it has to survivors. It's just so ugly:

A KQED investigation found that while they waited, a special Fire Victim Trust in charge of compensating survivors racked up $51 million in overhead costs last year. During that same period, the Trust disbursed just $7 million to fire victims – less than 0.1% of the $13.5 billion promised – according to an analysis of federal bankruptcy court filings, court transcripts and correspondence between staff of the Fire Victim Trust and the victims themselves.

During its first year of operation, the Trust spent nearly 90% of its funds on overhead, while fire victims waited for help, KQED found.

Isn't America neat?

Nobody at the Fire Victim Trust would talk to KQED about any of it, but there were plenty of public records to dig into, like an annual report for the bankruptcy court and other documents. Trustee John Trotter "reported $38.7 million spent on financial professionals, claims administrators, consultants and other operating expenses between July 1 and the end of 2020."

KQED also found that Trotter and another top administrator appear to have done fairly well for themselves while not quite getting around to paying the survivors.

Trotter, a retired California Appeals Court judge, charges $1,500 an hour, according to another court filing , while claims administrator Cathy Yanni bills $1,250 an hour. Both work at Irvine-based JAMS, previously known as Judicial Arbitration and Mediation Services, Inc, one of the nation's largest private dispute resolution provider firms.

"They're paying themselves very well. They have these enormous legal costs and there's not much to show for it," [Former Paradise resident Bill ] Cook said. "It's like everything is a black hole and nothing moves, and there's nothing you can do about it."

Oh, look, the nice folks at KQED even made a nice graphic to underline where the trust's money has gone so far. The shortest answer is "mostly not to survivors."

Last spring, federal bankruptcy judge Dennis Montali worried that the trust was likely to have high overhead costs, KQED reports:

"Tell me why I shouldn't think this is just a risk to have a very large amount of money be paid out without any kind of control over what happens," Montali said at a hearing last April. Attorneys representing fire victims pleaded with Montali to approve Trotter's appointment. Minutes later, Montali relented.

One of the attorneys for the survivors, Gerald Singleton, agreed that the trustees are making a hell of a lot of money, but said that's just what it costs to run a big victims' compensation fund, calling the fees charged by Trotter and Yanni "reasonable" for the work they do. "The amounts they make are phenomenal. They're just incredible amounts. [...] But that's what people at their level make."

For an Excuse me, are you out of your fucking mind? counterpoint, KQED spoke to bankruptcy attorney Scott McNutt, who formerly served as California State Bar governor. He said that

the amounts are excessive for the meager results obtained so far and that the Trust "has been completely non-transparent about what it's doing for this money."

"One of the hallmarks of the bankruptcy process is transparency," he said. "One of the hallmarks of trust administration is transparency. That's why they're called trusts."

Also complicating the picture is the weird nature of the settlement with PG&E: Victims were compensated with equal amounts of cash and PG&E stock, which means that the trust now holds about a quarter of the utility's shares now that the company is out of Chapter 11. And oops, it seems PG&E stock isn't worth a hell of a lot these days, so the trust hasn't actually liquidated any of the shares yet. Thank goodness the trust is at least paying its financial advisors' fees (about $3 million so far) so it knows that stock isn't worth letting go of yet.

Happily a spokesperson for the Fire Victims Trust did give a statement to KQED Tuesday, saying that so far in 2021, the amount of money paid to fire victims has increased, all the way up to $195.2 million in total. But don't break out the champagne just yet, especially if your refrigerator was left behind in the ashes of your house:

That figure still comes to less than 2% of the amount promised to families when they voted on the settlement last year. The spokesman also said the Trust had begun to make partial payments to a small percentage of families. Those partial payments, which average approximately $13,000, have gone to 9,532 of the 67,170 eligible families, a spokesperson for the Trust said.

Only 334 families have had their claims fully processed. Those families are getting 30% of what they're owed , the Trust said, while the Trust collects its own fees in full.

Well yeah, but again, if you didn't pay the administrators top dollar, they wouldn't be able to do such a bang-up job of compensating people who need the help.

This also seems like a good spot to mention that AccuWeather predicts 2021 is likely to bring another record season for wildfires, with 75 percent of the western US in drought conditions. Better get to raking, everyone, it's gonna be a scorcher. And maybe start a cuss jar for legal fees. There'll be lots of both.

Oh yes, and perhaps we should give some thought to getting climate change under control. There's a bright fellow in Washington who has some ideas about that .

[ KQED / AccuWeather / Photo: California National Guard .

Yr Wonkette is funded entirely by reader donations. If you can, please give $5 to $10 a month to help compensate Dok for all the times he dutifully followed English spelling rules and typed the San Francisco public station's call sign as "KQUED," then had to fix it.

Do your Amazon shopping through this link, because reasons .

There is now a female CEO

Ah, yes, a perfect example of the classic glass cliff. Of course.

$1500 an HOUR? Holy shit. To manage a trust whose single purpose is to compensate victims? And he spent 38 million on himself and his cronies? America is backwards and a total mess. It’s hard to read stories like these and not feel like everything is a grift, so take what you can, while you can. It’s disheartening.