Toledo Cancels Everyone's Medical Debt. Good Job, Toledo!

See? Don't write off Ohio!

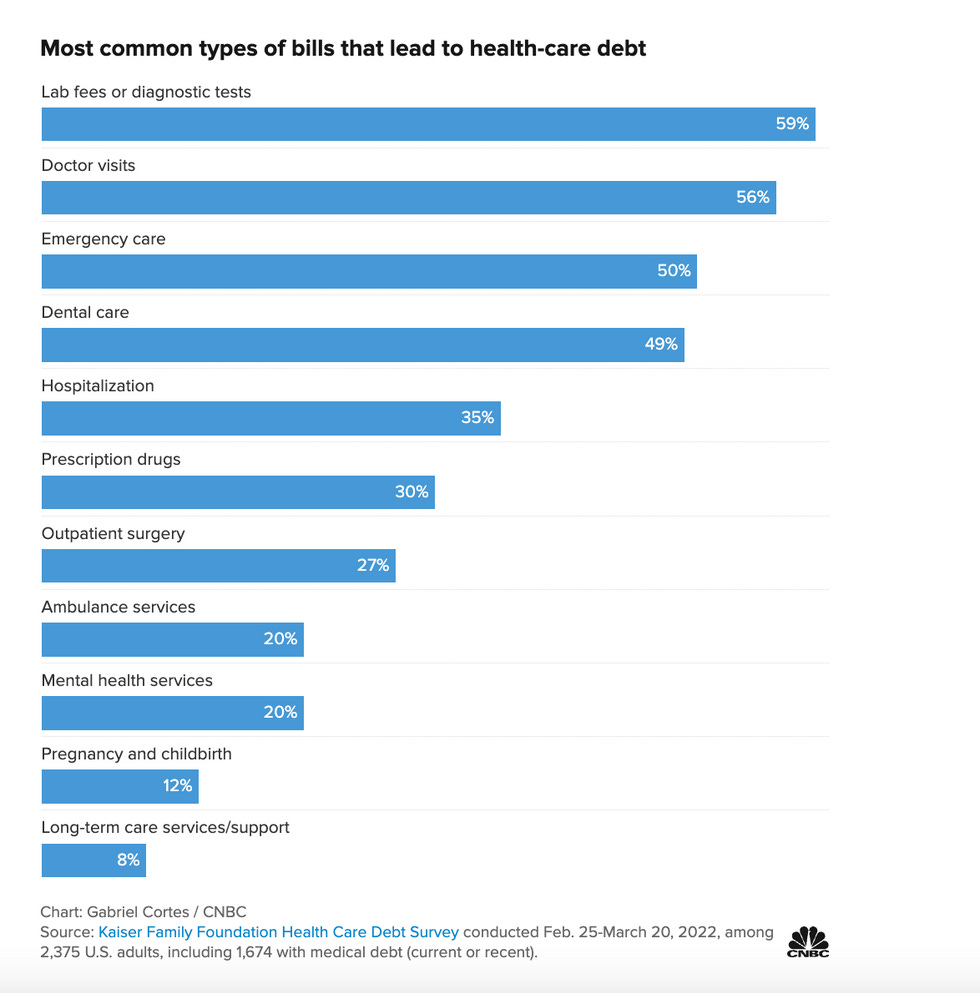

Too many people in this country avoid going to the doctor because they owe medical debt. (Including me at one point!) Too many people can't buy houses because they owe medical debt. Often, the reason for this medical debt was that they found out after the fact that their insurance didn't cover a very basic thing they needed, like blood tests. For some reason, a surprising number of insurance providers don't cover the very basic blood tests doctors ask for in order to determine if patients have anemia or a vitamin deficiency or a thyroid issue or whatever else.

So Toledo, Ohio, did something pretty awesome: it decided to take $800,000 it got from the American Rescue Plan Act , plus $800,000 of its own money, and cancel $120 to $200 million of medical debt for residents of Toledo and Lucas counties. As expensive as medical debt is to have, it's very inexpensive to buy.

Once the hospital or doctor's office (or credit card company or anything) gets tired of bugging you to pay your bill, they allow collection agencies to buy it for pennies on the dollar, allowing them to then harass you for the money and then profit.

According to RIP Medical Debt, the organization through which the city is working to buy up the debt, and which has been buying up medical debt around the country for several years now, one dollar can buy up $100 worth of medical debt.

Councilwoman Michele Grim, who spearheaded the measure, said it would use less than 1% of the city’s ARPA funds.

RIP Medical Debt would work with hospitals to purchase debt in bundles at a discounted rate, eliminating medical debt for many people. The longer debt goes unpaid, the cheaper it is for RIP Medical Debt to purchase. Grim said that could wipe out decades of debt.

“It’s not anyone’s fault that they get sick. It’s not anyone’s fault that they get injured. It’s not anyone’s fault that maybe their anesthesiologist for their surgery is out of network,” Grim previously told 13abc. “Everybody has the potential to have medical debt.”

Toledo actually got the idea from Chicago and Cook County, which in July decided to use $12 million of the funds they got from the American Rescue Plan Act to buy up $1 billion worth of medical debt for the city's residents.

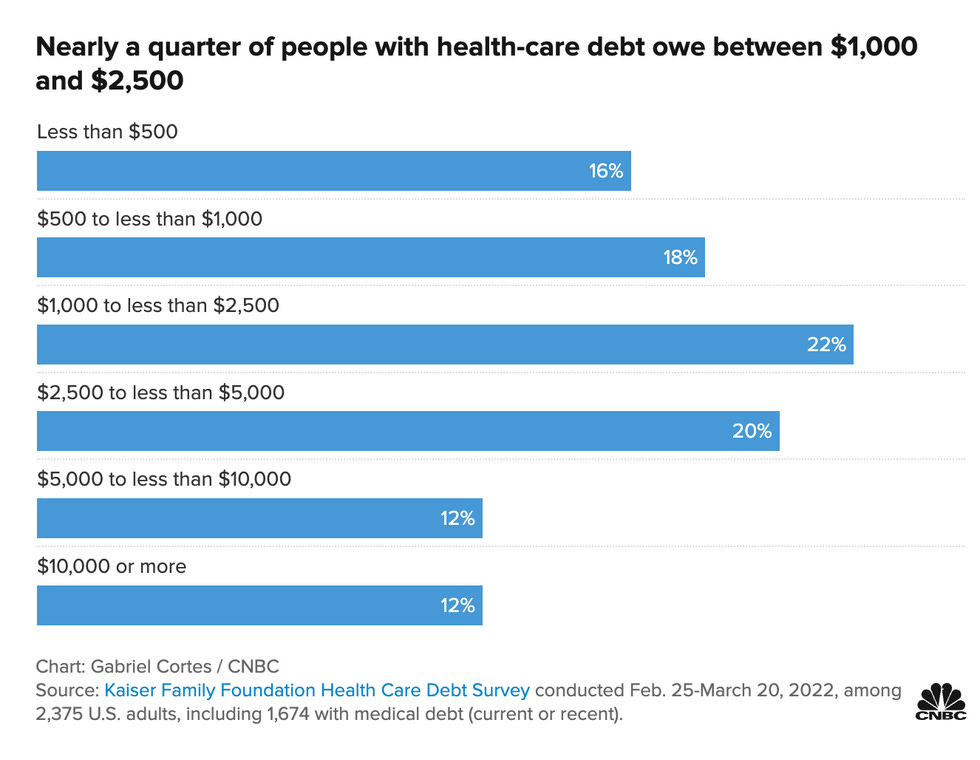

It's an incredibly smart way to use that money. One-hundred million people, 41 percent of all US adults, owe some amount of medical debt, with the average amount owed being about $2,400.

And those blood tests and labs I mentioned earlier? They're the most common source of health care debt. I'd be surprised, except for how many other people I know who were surprised with huge bills for lab tests that they later discovered were not covered by their insurance. Ambulance bills are another shockingly expensive one. Several people have made the news in the last few years after being severely injured and begging people to not call for an ambulance because they can't afford it.

As a result of this medical debt, people put off buying homes or getting an education, they have to declare bankruptcy, they have to take on other jobs. About one in 12 Americans with medical debt says it has caused them to lose their homes. It's an incredibly untenable situation. And as great as it is that these cities are buying up medical debt, that's not going to really prevent more people from incurring medical debt.

It sure is too bad there is literally no other way of dealing with that problem, a problem that for some unknown reason other countries don't seem to have.

shortcode-amazon-link]

Wonkette is independent and fully funded by readers like you. Click below to tip us!

Do you remember BS joining BC during the '50s?

Actually, no. I turned 10 years old in the last year of the 50s. I wasn't thinking about health insurance then. The Wiki article says they merged in 1982.