What Caused The SVB Collapse? Could It Be ... WOKENESS?

No, it's not wokeness.

The Silicon Valley Bank, based in Santa Clara, California, was shut down Friday after a massive run on deposits. The Federal Deposit Insurance Corporation (FDIC) was appointed as receiver and has transferred all SVB assets to the newly created Deposit Insurance National Bank of Santa Clara (DINB) to protect depositors.

However, the insurance limit on deposits is $250,000, which is fine for you paupers, but it's potentially catastrophic for even small businesses. For instance, streaming company Roku revealed in a SEC filing Friday that it had $487 million or 26 percent of its cash or cash equivalents in uninsured deposits at the failed SVB (not SBF, that's some other asshole). Investors were informed that Roku's "deposits with SVB are largely uninsured … At this time, the company does not know to what extent it will be able to recover its cash.”

This is an issue for many tech startups that appear unlikely to meet near-term payroll obligations. Wow, what a mess. Fortunately, Democrats are rolling up their sleeves and seeing how they can prevent corporate stupidity from crashing the economy ... again . Some reasonable Republicans will probably try to help. However, it's not a shock that the usual gang of idiots are just hurling blame like wet feces, hoping it will stick on the people they already hate.

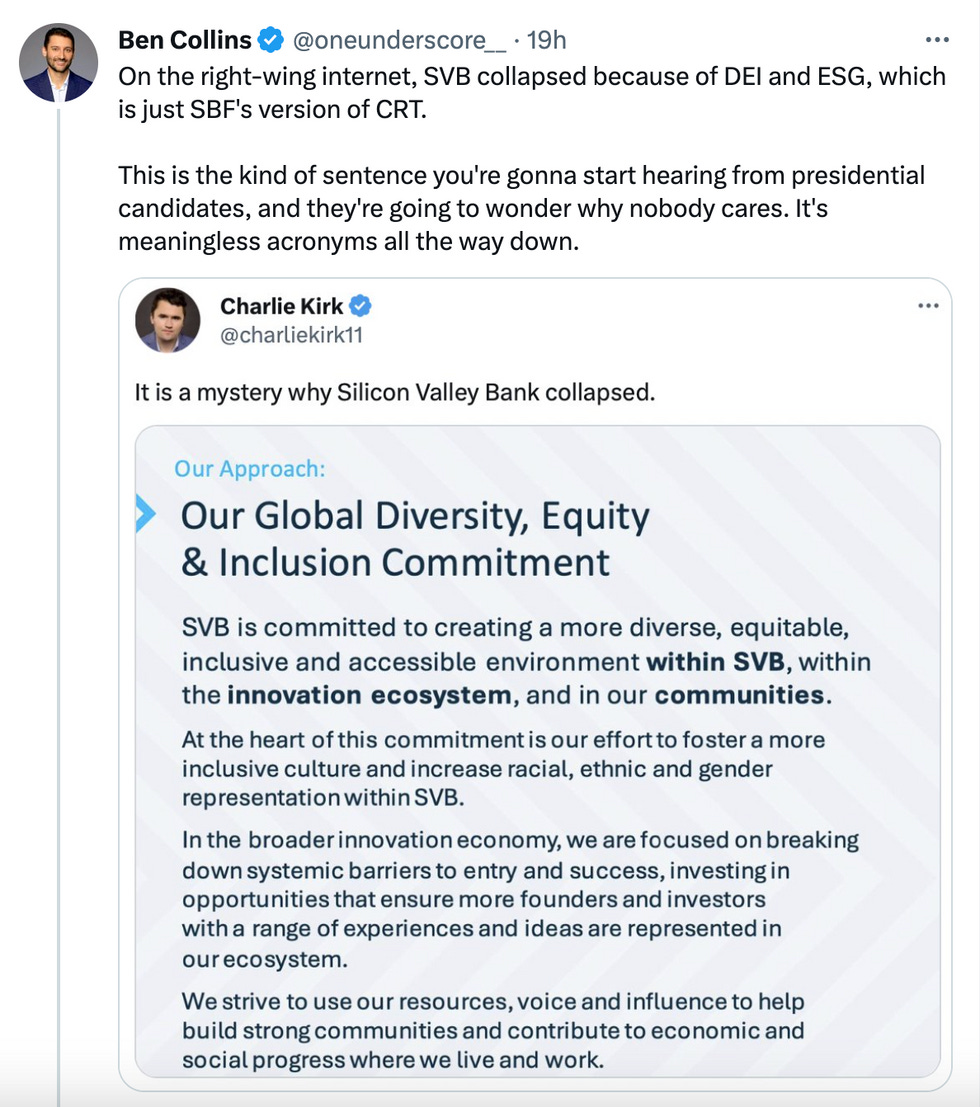

Ben Collins, senior reporter at NBC News, observes that on right-wing media, a narrative is already taking place: SVB collapsed because of an overdose of wokeness. He shared a tweet from conservative activist Charlie Kirk, who'd posted SVB's global diversity, equity, and inclusion statement with the snarky caption, "It's a mystery why Silicon Valley Bank collapsed."

Twitter

SVB's DEI statement claims the company "focused on breaking down systemic barriers to entry and success, investing in opportunities that ensure more founders and investors with a rang of experiences and ideas are represented in our ecosystem." These words might trigger conservatives or just plain confuse normal people, but it's not why the SVB failed. According to an analysis in Forbes,an "asset-liability mismatch" (not jazz and liquor) was SVB's downfall.

Most of their deposits came from large companies that were part of the tech sector. For example, a start-up receives $100 million from a venture capital fund. It parks that money at its local bank. Another company might have a treasurer who gets the best possible short-term interest rate by investing in commercial paper and other financial instruments. But the start-up’s chief financial officer is not hired to nurse an extra five basis points from the cash holding; the CFO has bigger issues to deal with and few staff members to help. So the CFO uses the bank.

SVB put most of its assets in US treasury securities. The best yields are found in long-term bonds but as interest rates rise, the value of old bonds start to tank. SVB was somewhat solvent but in trouble, and its corporate depositors started to bail. Obviously, this had nothing to do with SVB's stated commitment to diversity, equity, and inclusion. Maybe Kirk freaked out when he saw the bank's homepage.

SVB website

"Oh no! It's women working together! Two of them are minorities, and the white lady has a Rachel Maddow haircut. We're doomed!"

Of course, the photo illustration is perhaps misleading. The executive team — specifically, the president and CEO, chief financial officer, chief credit officers, and chief operations officer — is all white guys. But of course the queer woman of color is zeroed in as a convenient scapegoat.

The Daily Mail writes, “Jay Ersapah — who describes herself as a 'queer person of color from a working-class background' — organized a host of LGBTQ initiatives including a month-long Pride campaign and implemented 'safe space' catch-ups for staff. In a corporate video published just nine months ago, she said she 'could not be prouder' to work for SVB serving 'underrepresented entrepreneurs.'”

None

— (@)

Jay Ersapah didn’t successfully lobby Congress to exempt SVB from post-2008 financial crash regulations. That was President & CEO Greg Becker.

Also, from the New York Times:

Some banking experts on Friday pointed out that a bank as large as Silicon Valley Bank might have managed its interest rate risks better had parts of the Dodd-Frank financial-regulatory package, put in place after the 2008 crisis, not been rolled back under President Trump.

In 2018, Mr. Trump signed a bill that lessened regulatory scrutiny for many regional banks. Silicon Valley Bank’s chief executive, Greg Becker, was a strong supporter of the change, which reduced how frequently banks with assets between $100 billion and $250 billion had to submit to stress tests by the Fed.

However, these are simply facts. It just feels better for right-wingers to insist that everything goes to hell if companies even think about diversity, equity, and inclusion. After the Norfolk Southern train derailment, Republican Rep. Mike Collins from Georgia suggested that the company's commitment to DEI was somehow responsible.

None

— (@)

Although Donald Trump's regulatory rollbacks aren't directly responsible for the East Palestine, Ohio disaster, Republicans — including Collins — haven't collectively stepped up to help repair the country's crumbling infrastructure. But they blame the impact of their own flawed policies on "wokeness" and "diversity." It's overtly racist but it's all they've got.

[ Forbes ]

Follow Stephen Robinson on Twitter if it still exists.

Did you know SER has his own YouTube Channel? Well, now you do, so go subscribe right now!

Subscribe to the Wonkette YouTube Channel for nifty video content!

Click the widget to keep your Wonkette ad-free and feisty.

Cripes they’ve preached free market Laffer curve and supply side for decades

So yes they know zilch about economics or at least non snake oil Grifty economics

I like how panicked the worst people in America are. I wanna see David Sacks cry.