Thank God Trump Here To Help The Real Victims: Payday Lenders Charging You One Thousand Percent

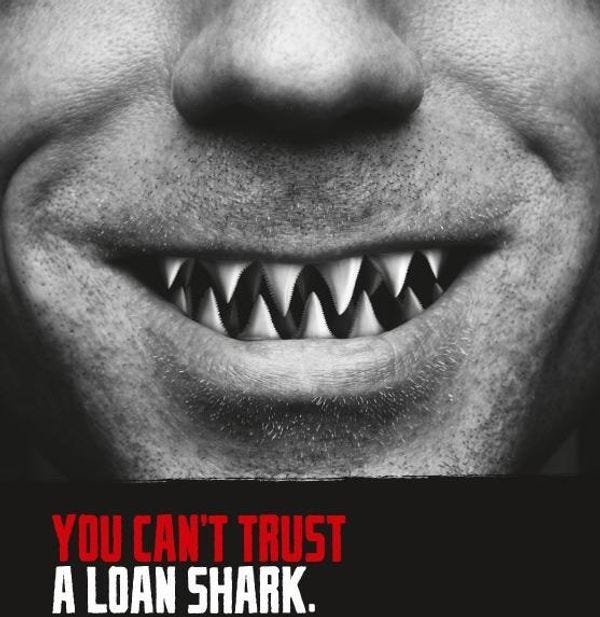

British public service ads have more teeth than Trump's financial regulators.

As we expected when Mick "Old People Don't Need Meals On Wheels" Mulvaney was appointed part-time interim head of the Consumer Financial Protection Bureau, the CFPB is no longer in the business of protecting consumers or their finances. Last week, the CFPB announced it would be killing off a new rule, set to go into effect in 2019, that would have protected people from predatory payday lenders. You see, that rule would have been bad for business, and the Trump administration is all about being good for business, no matter what the business. Hell, given how they're giving belly rubs to polluters and scammers, Team Trump seems intent on being nicest to the very worst businesses out there. Who'd have dreamed that a New York real estate developer would be so nice to bottom feeders?

LA Times business columnist David Lazarus notes a telling change that Mulvaney quietly made to the agency's self-description in press releases and other announcements:

Before he arrived, the bureau described itself as "a 21st century agency that helps consumer finance markets work by making rules more effective, by consistently and fairly enforcing those rules."

Now the bureau says it "helps consumer finance markets work by regularly identifying and addressing outdated, unnecessary or unduly burdensome regulations."

The consumers this crowd cares about have fins, soulless black eyes, and lots of pointy white teeth.

The doomed restrictions on payday lenders were a top priority for Richard Cordray, the CFPB's first director, who resigned late last year to run for governor of Ohio. (Can't blame him -- his term would have ended in July and congressional Rs were already dismantling existing regulations .) So here's what Mulvaney and company consider too harsh for the poor oppressed scum suckers at the lowest depths of the financial sector:

The payday lending rule limits how often indebted consumers can obtain short-term loans and how much money they can borrow. It applies to businesses, including banks and auto lenders, that offer loans with high interest rates that typically have to be repaid within two to four weeks. Until the CFPB took action, such lenders were mainly overseen by the states.

Technically, the rule became active January 16, the day the CFPB announced it would be rewriting it, but lenders would not be required to comply with it until August of 2019. The rule would have required payday lenders to determine whether borrowers really could pay back their small loans before granting them -- often only for between $100 and $500, with a huge interest rate, often upwards of 300 percent if expressed in annual terms. That would have been a big change for payday lenders, which seldom require anything more than a post-dated check for the loan amount plus the interest and fees. The intent of the rule was to keep people from continually rolling over their loans, each time with an additional fee, and getting trapped under an unpayable debt.

The payday loan industry has a much stronger lobby than the financially desperate people targeted by payday lenders. Members of the armed services and their families are often targeted by payday and auto-title lenders; groups representing vets and active duty military had been among the few truly effective voices in favor of cracking down on the industry. Guess you won't hear Donald Trump talking too much about this one -- as we noted last year, not even Dead Breitbart's Home For Getting The White Working Class To Vote Against Its Own Interests had much success getting its readers excited about helping out payday lenders. Thank God Trump's there to help the Forgotten Americans -- to be devoured by debt. Funny, they have a lot fewer options for skipping out on debt than he does.

Technically, this fluffing for payday lenders has to go through the normal rule-making process, so once the CFPB actually writes its new regulation, it will have to take public comments on the proposal before Mulvaney ignores those comments and forces through the change. We'll keep you updated.

But this wasn't CFPB's only gift last week to the most carnivorous part of the financial sector:

[The] CFPB also announced Thursday it was dropping a lawsuit against a group of payday lenders that allegedly duped customers by failing to reveal annual interest rates of nearly 1,000%.

Yep, not gonna harass those hard-working loan sharks. As the excellent Above The Law blog reminds us, "THE MOB DOESN’T CHARGE THAT MUCH."

One last Sign O' the Times at the CFPB: Mick Mulvaney is so intent on shutting down the agency he purportedly directs that he has managed something truly noteworthy: He has asked Congress to provide $0 in new funding for the CFPB in the second quarter of this fiscal year. He says that Cordray had some $177 million saved up in a reserve fund, so he'll just use that instead of using the second-quarter appropriation. It was probably for useless shit like suing bad actors in the financial sector, and that's not happening any more. Instead, Mulvaney asked for the $145 million already designated for his agency to go to the US Treasury, where it will be used to make an itty-bitty dimple in the national debt.

No need to worry about the debt exploding because of the $1.5 billion Tax Cut For Rich Fuckwads, then. We're sure wingnuts are over the moon at Mulvaney's excellent decision not to take any money to protect consumers. But we have to suspect Donald Trump isn't happy -- couldn't Mulvaney have found a way to spend at least some of that $145 million leasing offices in Trump Tower?

Yr Wonkette is supported by reader donations. Please click here to help us keep our heads above water. Goldfish are nibbling at our toes.

[ LAT / Bloomberg / USA Today / Above the Law ]

thank you for your work and your clarifications. had no idea.

see below (above?) in the thread. it's bs.