Trump Admin LENDS A HAND To Payday Lenders. Take That, Obama!

Eat the poor.

The increasingly misnamed Consumer Financial Protection Bureau, having been gutted and turned against its original mission by the Trump administration, announced today a proposal to effectively reverse an Obama administration rule that would have reined in the payday loan industry. It was the first major policy announcement from the zombified CFPB since director Kathy Kraninger was confirmed to her position in December. If this were a movie, the agency, created with the intent of protecting consumers from financial scams and unscrupulous lenders, would look piteously at the hero and whisper "Please ... kill ... me."

The Obama rule would have gone into effect in August, and would have required companies offering short term loans (of 45 days or less) to act more like real financial institutions. Talk about a radical plan, as the Wall Street Journal explains. The now-scrapped provision would

require an underwriting process for a loan that proves the borrower can afford the loan payments but still meet basic living expenses and obligation. Such requirements would have made payday loans out of reach for most borrowers, who tend to have a poor credit history and live paycheck to paycheck.

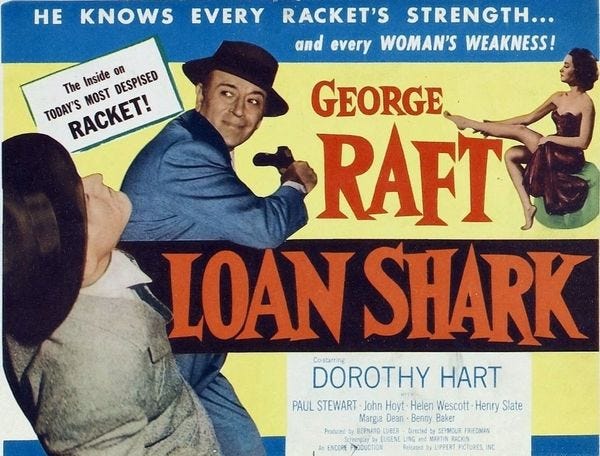

Totally unfair, burdensome regulations! How dare the government try to wipe out a perfectly legal business (at least in 33 states ) that merely preys on people willing to accept effective interest rates of 300 to 400 percent annually. The CFPB proposal mutters the Obama administration had "insufficient evidence and legal support for the mandatory underwriting provisions," and frets that federal limits on loan sharking would "would reduce access to credit and competition" in the states that do allow payday lending. See? They're looking out for consumers and their inalienable right to enter into a loan that will rip them off.

As for that unseemly feeding on poverty aspect of the payday loan business, the newly neutered CFPB isn't going to lose any sleep over it:

CFPB officials acknowledged that payday loans can be very costly, but said that does not make them legally questionable. " The high price of a product or not is not per se an indication that something is abusive or unfair," said CFPB official in a briefing with reporters.

Maybe people like having shitty options -- why do you suppose they're poor in the first place?

This may be the first major regulatory effort under the new leadership at CFPB, but it continues the agency's restructuring as a tool of pure evil under Trump. Last year, acting lead vampire Mick Mulvaney dropped a lawsuit against a group of payday lenders that hadn't been satisfied with merely obscene interest rates, but which had actually charged rates of nearly 1000 percent while failing to reveal just how high the rate was. Shit, that's less than the Mafia charges.

And of course, it's yet another Trump rule that takes a meataxe to an Obama-era regulation that had been very carefully constructed, notes WSJ:

The process for revising the rule is expected to be extensive. Under the Obama administration, the CFPB spent nearly six years conducting research and developing the regulation. Federal procedures generally require government agencies to conduct new analysis and hear public comments in order to undo a rule that was already completed.

Or what the hell, maybe they'll have Mnuchin scribble something on a napkin and hope for the best.

And as NPR reported last year, the payday lending industry has lobbied Team Trump extra hard for relief from the mean old regulators who hate hard work and stealing from poor people. The industry's trade association even held its 2018 annual convention, complete with a golf tournament, at Trump National Doral Golf Club. Not that there are any laws against that. They're ALL legitimate businessmen, you see.

As with other federal rule-making, the new CFPB rules are subject to a public comment period, after which the agency will roll over and ask loan sharks to pat its belly and feed it some snacks.

Yr Wonkette is supported by reader donations. Please send money to support the very best in snark and can-you-believe-this-shit still available to the general reader.

I compare Poverty Finance 101 to those game shows where you run an obstacle course and try to avoid getting knocked into the water

Only this pool has piranha, electric eels and brain-eating ameoba

"Gold is ever the best witness in Law Court" Uhtred of Bebbanberg, 871 A.D.

We've come a long way........NOT