Let's All Enjoy Watching AOC Just Absolutely Destroy A Healthcare Executive

We're not Ben Shapiro so we're not putting DESTROY in all caps, but we could, and we would not be wrong.

It is currently -6 degrees in Chicago right now, but I feel warm and toasty thanks to my electric blanket and the way Rep. Alexandria Ocasio Cortez just absolutely murdered the face off of CVS Health CEO David Joyner during a House Ways and Means committee hearing with healthcare CEOs on Thursday. I watched all three hours of the hearing, and while there were many other good moments, this was the best of all. Not only because she was good, but because as soon as she started in, Joyner’s entire demeanor changed into that of a teenage kid who knows they fucked up and is now getting properly reamed out in the principal’s office.

Truly, it was a thing of beauty.

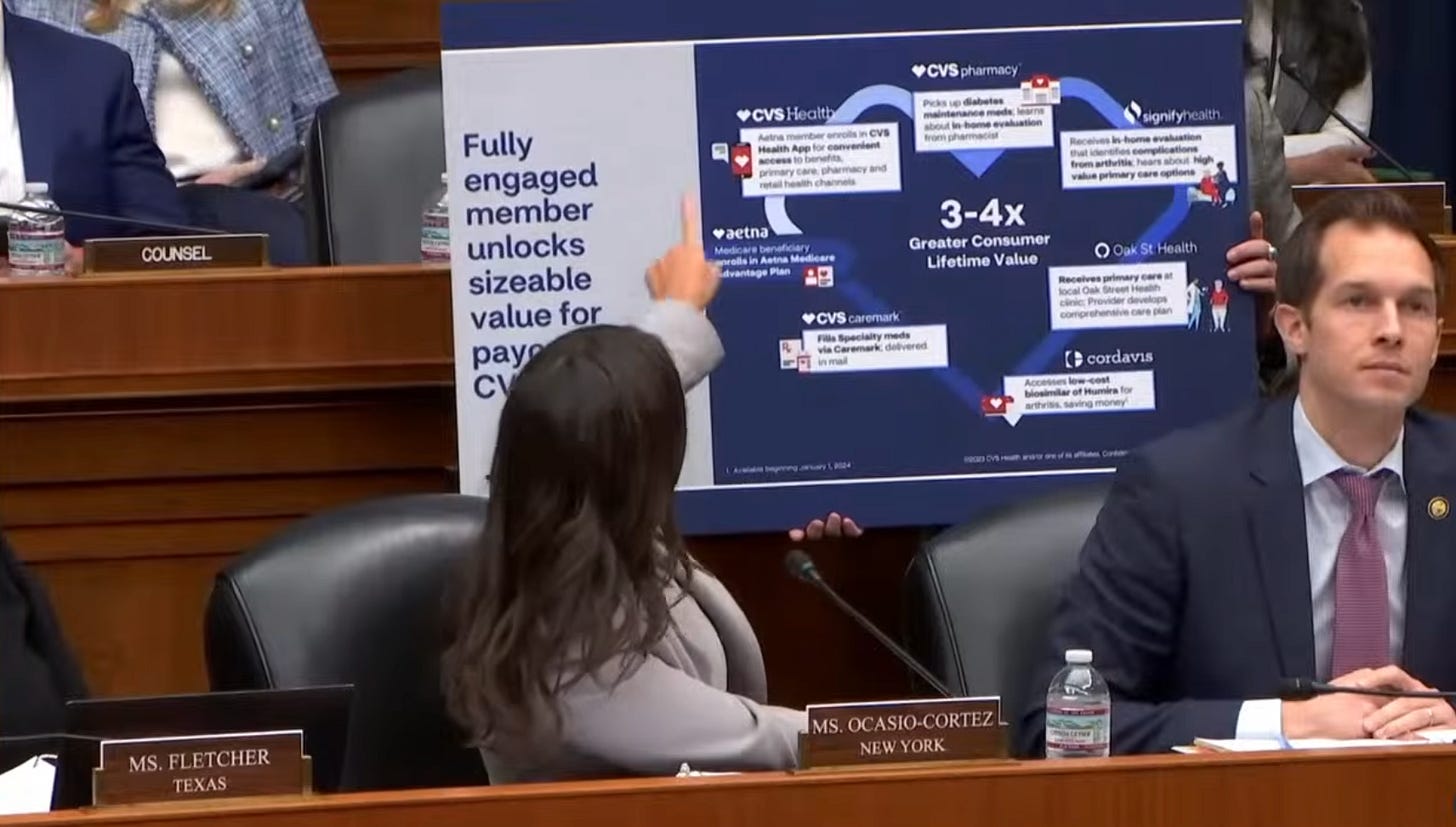

Ocasio-Cortez, perky as could be, laid out exactly how the “vertical integration” model allows CVS to have complete control over how much consumers pay for every part of their health care, from their premiums to their doctor’s visits to their prescriptions. Complete with a visual aid designed by CVS itself!

Behold, the transcript

AOC: Mr. Joyner, you are the CEO of CVS Health. Correct?

Joyner: Correct.

AOC: I actually don’t know how many Americans know this, but CVS Health owns Aetna, the health insurance company. Correct?

Joyner: Correct.AOC: And CVS, which owns Aetna, also owns Oak Street Health Medical Clinics. Correct?

Joyner: Yes, it does.

AOC: And in addition to that, they own, of course, CVS pharmacies and CVS Health, and also own CVS Caremark, the pharmacy benefit manager, which helps negotiate some of these rebates and prescription prices. Correct?

Joyner: That’s correct.

AOC: And CVS Caremark processes nearly 30 percent of all prescriptions in a given year. And so in other words, CVS Caremark helps determine the prices that patients pay for a third of all prescriptions in the US. In fact, I was following one of CVS’s recent investor calls where they really laid out quite clearly what this means if you are a patient.This is what’s known as a captive strategy. And CVS, in the investor call, used the example themselves of a patient known as Kate. Kate has an Aetna health insurance plan, right here, which is owned by CVS Health. She then goes to a CVS pharmacy. She’s connected to an Oak Street Health medical clinic. She sees a doctor at Oak Street Health who prescribes her medication and then she goes to fill that prescription at a CVS uh pharmacy. So the price Kate pays for that medication is dictated by Aetna, CVS, Caremark and they also own the drug manufacturer Cordivis. Um, Mr. Joyner, this is quite a bit of market concentration. Wouldn’t you agree?

Joyner: Um no, I wouldn’t agree that it’s market concentration. I would suggest it’s a model that works really well for the consumer.

AOC: Yeah. Um, I think it works very well for CVS. I think, in fact, you all said on the call that you all call it “a fully engaged member.” It’s great marketing there. “A fully engaged member unlocks sizable value for payers and CVS Health.”

She pointed to a sign citing this as a direct quote from someone on the investor call.

And continued …

AOC: So the health insurance gets a cut, the pharmacy benefit manager gets a cut, the drug manufacturer gets a cut, and the patient gets screwed. I think the Federal Trade Commission has also found that health care conglomerates like CVS Health charge more for medications filled at their pharmacies.

We’re talking about thousand percent markups on medications for cancer and HIV. And, you know, I think this is actually an interesting point of common ground that I may have with some of our Republican colleagues here in this hearing because whether you’re a blue-blooded capitalist or a card-carrying democratic socialist, I think corporate monopolies are a problem and this vertical integration is destroying people’s ability to access care. […]

I saw something that was interesting from the opening statement of Mr. Hemsley from United Health talking about how much United spends, what was it, 85 percent on care, Mr. Hemsley? Approaching 90 percent. But the ACA forces you all to spend a decent amount of that on care. But when you own the care, when the insurer owns the pharmacy, owns the PBM, owns the drug manufacturer, you also own the health care cost. You own a big chunk of the health care cost.

And so, you know, a hundred years ago, we had this type of market concentration in our banks and we did something about it when it crashed the economy and we passed the Glass-Steagall Act. We should be considering that in our healthcare system. And if we believe in competition, I think we should put our votes and our legislation in alignment with that and consider breaking up this industry in order to allow the competition that prevents this kind of vertical integration and abuse of power. And with that, I yield back.

BAM.

Now, I have to say, this was one of the most enjoyable House committee hearings I have seen in a while, because I hate health insurance companies and I definitely hate health insurance CEOs and it was just a pleasure watching them get dragged by practically every rep there — including the Republicans! Now, the Republicans were deeply incorrect about what they thought was the solution (giving people who are paying $2000 a month for health insurance $2000 for a year in an HSA they can’t spend on their premium to begin with) and much of the cause (the ACA, they very wrongly insisted), but other than that, pretty much everyone was in agreement with the fact that pharmacy benefit managers are the devil and this kind of vertical integration is bullshit that, very obviously, screws the customer.

(A pharmacy benefit manager negotiates the cost of drugs with pharmaceutical companies and also tells the insurance companies which drugs they should cover and which they shouldn't. They're hypothetically supposed to be in charge of keeping costs down, but they absolutely do not.)

Isn’t that nice? In fact, I’d say only two people sucked all the way through, one of them (unsurprisingly) being Dan Crenshaw, who wanted to get people to “admit” that somehow subsidizing people by giving them money to put in HSAs would mean that insurance companies would make less money somehow.

“I do want to ask one simple question,” he said. “Wouldn’t it make a lot more sense to subsidize low-income patients — which is the point of the ACA, right? — subsidize low-income patients directly through a health savings account that it, that they own, instead of subsidizing you, the insurance companies. You can answer that one. Anybody? Does anybody agree with that that concept? Subsidize patients through an, through a health savings account instead of subsidizing insurance companies?”

No one agreed, because of how his question did not make sense except in a case where someone does not actually have health insurance. Several said, generically, that they’d be happy to do anything that “puts the consumer more in control,” which Crenshaw counted as maybes, until one pointed out that “it makes no difference.” Because the patient would still be paying their premiums to the insurance company and likely using the HSA for co-pays and pharmaceuticals.

“Not even our patient advocate?” he asked Ellen Allen, executive director of West Virginians for Affordable Health Care, who was there to testify about how her own premiums had increased to $2000 a month without the subsidies. And no, obviously she did not think that was a great idea.

“Um, respectfully, I think that could undermine the healthcare system,” Allen said. Crenshaw, clearly disappointed, responded by dismissing her with an “Interesting, okay, no.”

The other failure was Rep. Cliff Bentz (R-Oregon), whose case for HSAs was that they would allow the consumer to “make money” on them (he mentioned interest, although people who are already solvent enough to not actually need to use their HSAs for their actual medical bills sometimes invest them instead) instead of the insurance companies. I looked it up, and $2000 would earn $3 a year in interest in a regular HSA account and $60 in a high-yield HSA account. And that would only be if you don’t actually spend it.

Bentz:

I’m really interested in the float and and that of course is what leads to people calling insurers banks doing a side business as healthcare because of course you charge the premium, you collect the money, you put the money in the bank, it earns interest, and then you pay it out. And so the the float is of extraordinary interest to those of us that support HSAs because a health savings account means that instead of paying the premium to you, the theory is the person with the account earns the money. Uh, starting you with you, Mr. Hemsley, is that true? If if HSAs were put into place, would the patients actually be earning the money instead of the insurance company?

Hemsley, CEO of UnitedHealth Group, did not understand the question and neither do I, which I assume is the only thing he and I will ever have in common. Is the plan just people not having health insurance at all and just having HSAs? Is that what they want to do? Just … everyone pays out of pocket and hopes it doesn’t come to more than $2000? Because that seems like a terrible idea. Even if it does earn one an extra $3.

So he tried again.

It’s simple enough. If HSAs were put in place and people could put their money into the HSA and have it earn interest from them instead of paying it to you as a premium, they would wait until I guess they had the the problem or or the deductible to pay, would they be earning the money instead of you? That’s the question.

Again, no one understood the question because why would there be a deductible for someone not paying a premium?

He tried again by asking that the insurance companies let him know later, in writing, how much interest they make on denying claims, which still did not make any sense. But hey, you know, he gave it a shot?

Still, there is something ultimately very heartwarming about seeing all different kinds of people find common ground in hating health insurance companies and the executives who make tens of millions of dollars off of our collective illnesses. You don’t get to see that too often, and it’s a gift.

Also a gift is the idea of a Glass-Steagall Act for health insurance companies, which is an excellent idea and should be the next step here (after reinstating the subsidies). Granted, I’d prefer they not exist at all, but if they have to exist for now, this vertical integration shit needs to be burned to the ground.

PREVIOUSLY ON WONKETTE!

For me the chef's kiss was AOC using a graphic from CVS's 𝘰𝘸𝘯 𝘦𝘢𝘳𝘯𝘪𝘯𝘨𝘴 𝘤𝘢𝘭𝘭. They can't exactly take issue with that.

If this fucking monster never faces trial, law is truly dead:

***

U.S. Border Patrol chief Gregory Bovino boasted about detaining a 5-year-old boy in conditions that he insisted don't get "any better."

During a press conference on Friday, a reporter asked about the boy and his father, who were detained in Minnesota.

"Another way of looking at that might be that we don't imprison or detain American children, penalizing them for the actions of their parents," the reporter noted. "So what do you say to those who are troubled by the contrast?"

"Well, I don't think there's a contrast, and the child could be without his parents somewhere, perhaps in social services care somewhere, and that's what we see oftentimes by children that are trafficked across the border," Bovino replied. "It's heartbreaking. They're not with any family."

"So the child is in the least restrictive setting with a family member," he added. "I don't think it gets any better than that."

"And as far as the care, the best care that I've seen is ICE/U.S. Border Patrol and the way we treat those illegal aliens that come across the border."