Why Aren't You Dummies Feeling 'Bidenomics'?

It's complicated.

We try to do democracy’s work here and talk up the economy, which has steadily improved under President Joe Biden’s watch. Unfortunately, modern politics often operates under Janet Jackson’s “What Have You Done For Me Lately?” principle.

According to a CNN poll taken in July, 63 percent of American disapprove of how Biden’s handled the economy, which continues an unpleasant trend of majority disapproval since late 2021, when Republicans specifically seized on pandemic-related supply chain issues and inflation to paint a Carter-esque narrative of economic malaise.

Consumer confidence in the economy has improved, yet just 15 percent of voters believe the economy is going in the right direction. Joe Biden literally helped prevent not just a major recession but a sepia-toned depression. Yet, voters are still “What have you done for me lately?”

The cheerily named misery index — that lustful union between US unemployment and inflation rates — has fallen over the past year and, in June, reached its lowest point since March 2020, when the economy literally shut down. So, why are so many Americans sour on the current economy?

Emily Stewart at Vox broke down the discrepancy:

“As families started to adjust their lives to this new world of inflation, higher-income folks were also being hit by a volatile stock market,” Hsu said. “That’s something that doesn’t really affect people at the bottom income distribution; they’re not really exposed to stock markets directly.”

Most Americans who earn more than $100,000 a year own stocks, compared to 29 percent of Americans with annual incomes under $40,000. However, due to the so-called “wealth effect,” people in general feel more bullish about their spending and personal finances when the stock market is performing well. consumers feel better about their spending and finances when the stock market is doing well.

Donald Trump, while squatting in the Oval Office, would often rave about the stock market, taking unwarranted credit when the market rose and remaining silent whenever it fell. The stock market’s performance during the Biden administration trails both Trump and Barack Obama’s.

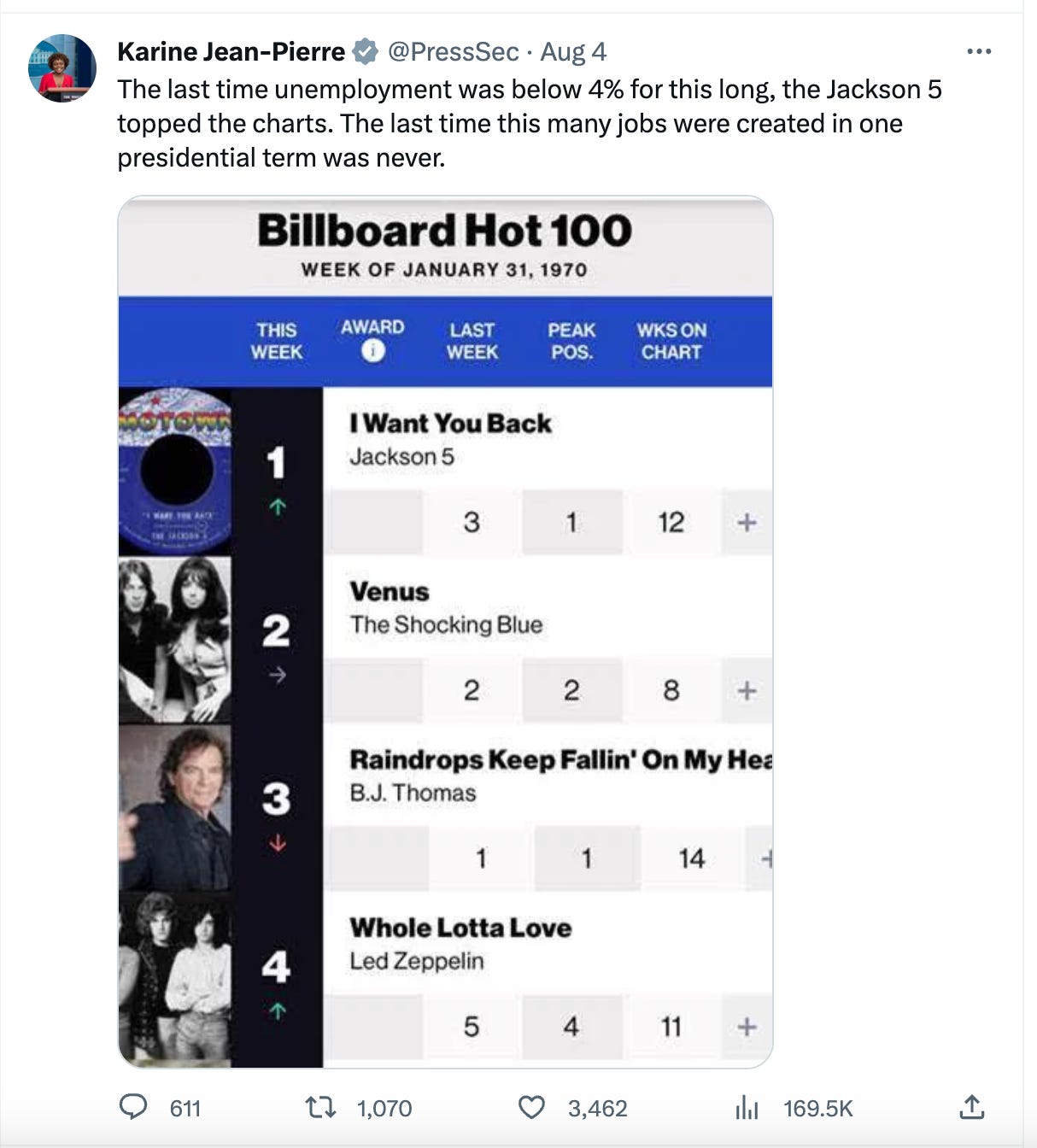

However, Biden had added far more jobs than his predecessors. Friday, White House Press Secretary Karine Jean-Pierre tweeted, “The last time unemployment was below four percent for this long, the Jackson 5 topped the charts. The last time this many jobs were created in one presidential term was never.”

The Jackson 5 factoid is interesting and probably why Jean-Pierre is fun at parties, but this does raise a larger question of why people have jobs in the first place. It’s not just for the thrill of serving strangers vanilla lattes. Jobs ideally make us feel somewhat financially secure. If you have a job but still struggle to pay your rent or buy groceries, you can’t help feeling cranky. It’s like how you’re more optimistic about life when you’re single than when you’re stuck a lousy relationship. When you’re single, at least there’s hope.

Interest rates are currently about seven percent, which negatively impacts middle and working class people the most. Just months before the pandemic, the Federal Reserve had reduced interest rates to 1.5 to 1.75 percent (Trump insisted that the “boneheads” at the Fed lower if to zero “or less”).

Reporter Rebecca Chen wrote, “The share of home loans taken out by low-income borrowers falls by 16 percent when interest rates rise by one percentage point.”

Getting shut out of homeownership can hurt many low-income households’ long-term financial prospects because home equity wealth can be used for retirement, funding education, or financing a small business among other opportunities.

If you spent years saving up for a down payment on a house prior 2020, you feel a longterm impact from the pandemic — high interests rates mean you’re now looking at either a much smaller house or one in a less desirable neighborhood. You’re also paying significantly more in interest and not building immediate home equity. Overall home inventory has also decreased because people are reticent about selling their current ones and getting stuck with a worse mortgage rate for a new one (even late-life downsizing).

Sarah Coles, head of personal finance at Hargreaves Lansdown, explained to CNBC, “As a rough rule of thumb, when rates are high, the banks will charge us more for borrowing, and pay a better return on savings. When rates are low, borrowing gets cheaper, but saving gets less rewarding.”

If you’re living paycheck to paycheck, you are more likely borrowing more than you’re saving and will appreciate low interest rates. High interest rates usually benefit people with longterm savings, but that usually doesn’t offer the immediate hit of the stock market. (The average 401(k) balance, though, fell 20.5 percent in 2022.)

Health care costs have also risen in 2023.

Politico argues that “Biden’s hopes for a second term could well depend” on perceived economic success, but does it? Voters thought the economy was a mess in 2022 and Democrats still resisted a red wave. Democrats might have even held the House if New York Democrats hadn’t been too sleepy to run effective campaigns.

It was the fall of Roe and far-right abortion bans that put Democrats in the offensive last year. Biden’s first 2024 campaign ad set the appropriate stakes.

Biden’s major advantage in 2024 is that he’s likely running against a twice-impeached, thrice-indicted, confirmed rapist. Debating economy politic with such an opponent would miss the point.

No, this time it’s not “the economy, stupid” but democracy itself.

Follow Stephen Robinson on Bluesky and Threads.

Subscribe to his YouTube channel for more fun content.

Catch SER on his podcast, The Play Typer Guy.

The problem with low interest rates though, particularly in relation to housing loans, is that housing stock tends to get snapped up by speculators using cheap credit to turn real estate into an investment instrument (this is especially the case when more traditional savings investments have very low returns).

This results in a decrease of residential inventory, and an increase in absolute housing prices. It means that first-time buyers have a harder time finding any suitable properties at all, and that empty-nesters have a harder time downsizing (using existing property as a source of credit in lieu of more traditional retirement investments contributes to this as well). It also puts inflationary pressure on the rental market, which fucks poor people especially. This is compounded by private developers focusing on high-value, high-return projects, rather than affordable housing (not to mention NIMBYism, Prop 13 in California, etc.).

The North American housing market has been in a bubble inflated by cheap credit for the past 25 years, which the 2008 crisis slowed, but did almost nothing to correct. The way to "fix" housing is much stricter regulation of development and real estate, combined with massive public investment into affordable, liveable housing.

IMO, the economy is doing well, but we still have the long-term structural inequality, with the super-rich owning virtually everything. The only way to reverse this is push up the marginal tax rate back up to like 70 percent, raise the minimum wage to keep up with inflation, and encourage more unions. And the only way to do that is to get all of Congress and POTUS - and even then, we still have neo-liberal Democrats like Sineman and Manchin obstructing everything.

And then we still have major stressors like the skyrocketing costs of healthcare, higher ed, and real estate. It will take a generation of progressives to turn this ship around.