34 Things For Working People Republicans Will Cut So Trump Can Give Billionaires More Tax Cuts, Again

They hope to slash spending on SNAP, the ACA, TANF, Medicare, Medicaid ... and make the banks 'too big to fail'.

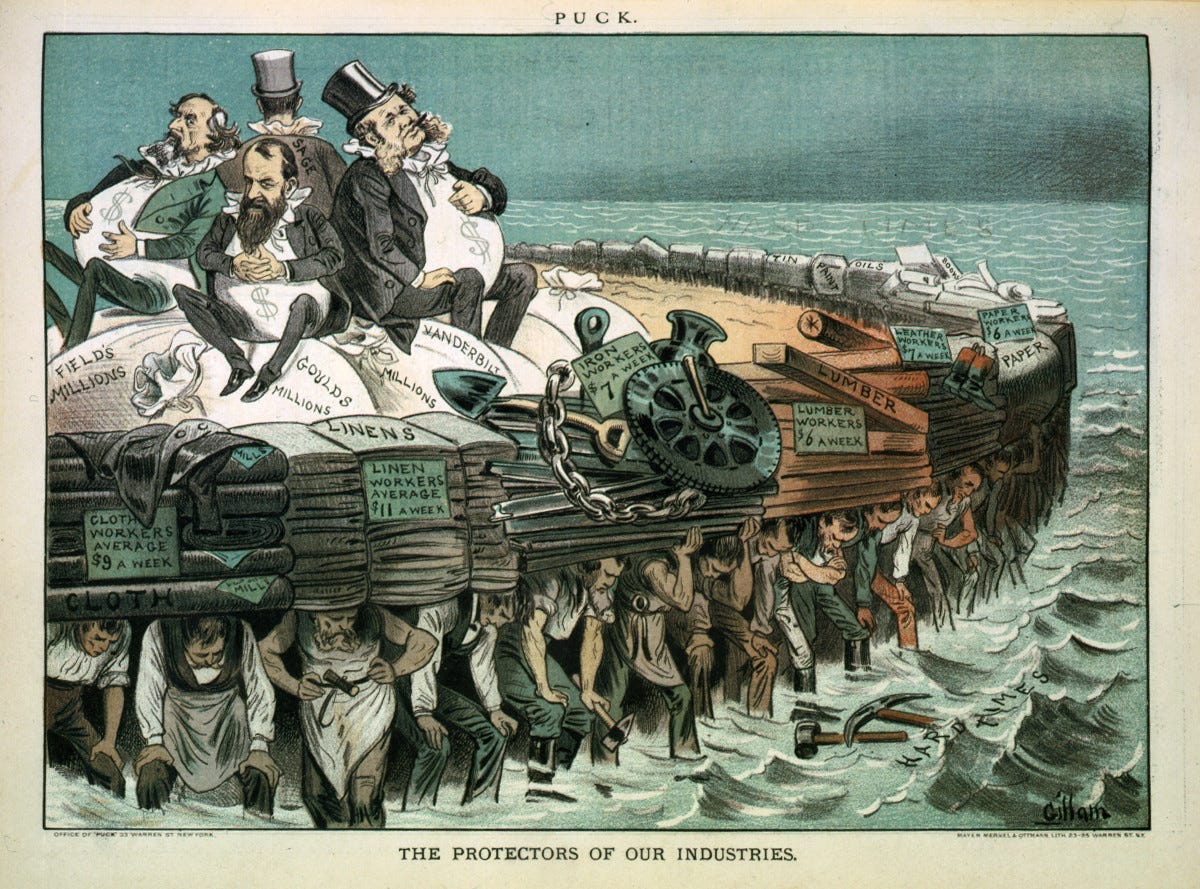

For the last couple months, we have never heard the end of how Republicans are totally the party of the working class now. It’s not an entirely wrongheaded assessment, given voting patterns, but it doesn’t mean they’re actually doing anything for the working class or the poor — it just means they’re donning trucker hats while they rip up the social safety net.

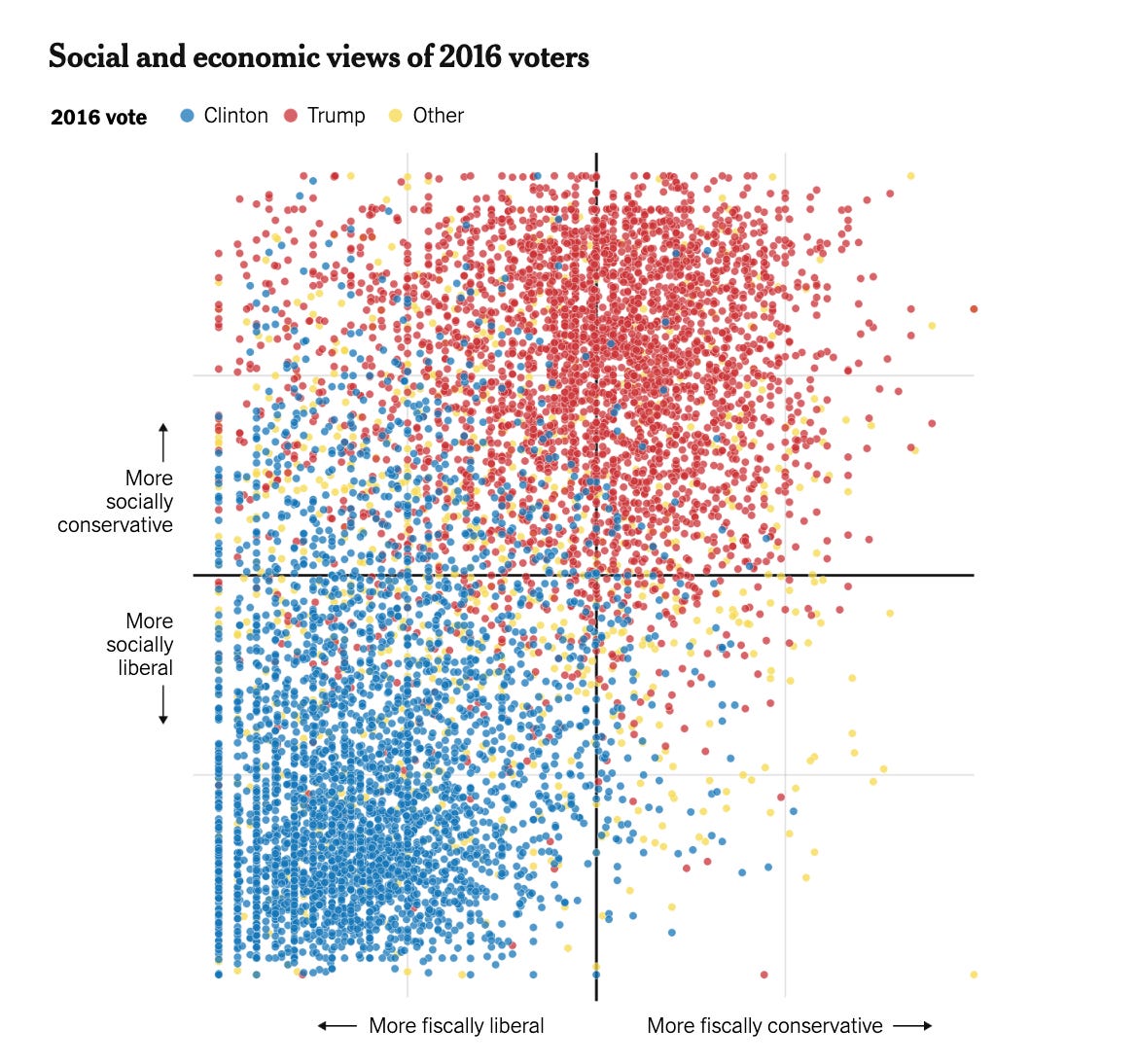

Despite the fact that Democrats lost pretty badly in the last election, there seems to be more vocal support than ever for left-wing economic ideas like socialized health care, universal basic income, a strong social safety net, strong labor laws, and strong unions — including on the Right. The “socially conservative and fiscally liberal” contingent has vastly outnumbered the statistically non-existent “socially liberal and fiscally conservative” contingent for basically a decade at this point.

We’ve certainly seen an unfortunate number of economically insecure Trump supporters swear to high heaven that he’d never cut the programs that help them (like he did in his first term).

Well, unfortunately for them, it looks like they backed the wrong horses. Republicans in the House — specifically the House Budget Committee, led by Rep. Jodey Arrington (R-Texas) — are already laying out their plans to gut pretty much everything that helps the poor and bring back all kinds of things that help the rich. Whoops!

A list of these desired cuts, along with how much they would save over 10 years (all together, about $5.7 trillion), was obtained last week by Politico — so let’s take a look and talk about what they would mean, shall we?

1. REPEAL MAJOR BIDEN HEALTH RULES ($420B)

What major health rules you ask? According to a report from Fierce Health Care, this could include a lot of things I’d sure like to think every decent human supports.

For example, the Centers for Medicare & Medicaid Services alone released final rules imposing mandatory staffing minimums in nursing homes, new managed care wait time and quality rating standards, prohibitions of discrimination in Affordable Care Act (ACA) plans, telehealth and AI, increased protections for people with disabilities and restrictions on broker compensation and new network requirements for behavioral health that could all be in jeopardy if the legislation passes, said Dan Goldbeck, director of regulatory policy for right-leaning think tank the American Action Forum. These rules cost more than $85 billion, the agencies project.

One has to wonder, given that this barely represents a quarter of what Republicans want to cut: If guys like this are that open about wanting to decrease the quality of nursing homes, what are they not mentioning?

2. STRENGTHEN MEDICARE FOR SENIORS ($479B)

Site Neutral – $146B

Uncompensated Care – $229B

Bad Debt – $42B

BCA Mandatory Sequester Extension - $62B

Gotta love the Orwellian doublespeak here, no?

The first “cut” is “site neutral” payment, which means that Medicare would stop paying hospitals and hospital-owned physician practices double what they pay other doctors and facilities. Whether or not this would be a good thing would largely depend on how it’s implemented, which we certainly cannot trust Republicans to do. If it were implemented badly, that could mean a lot of rural hospital closures, as they tend to rely on the extra payments to stay afloat.

Next up are uncompensated care and bad debt. Medicare provides some increased payment to “Disproportionate Share Hospitals” that serve a large number of uninsured patients and therefore incur a lot of uncompensated care costs, including charity care (provided to patients who are too poor to pay) and bad debt (incurred by patients who refuse to pay). Major cuts to this would very likely lead to a lot of hospital closures in underserved areas.

Under a BCA Mandatory Sequester, Medicare benefit payments and Medicare Integrity Program spending can’t be reduced by more than 2 percent — I suppose we can assume that they mean to not extend this program so that they can make larger cuts to Medicare.

3. MAKING MEDICAID WORK FOR THE MOST VULNERABLE ($2.3T)

Per Capita Caps - up to $918B

Equalize Medicaid Payments for Able Bodied Adults - up to $690B

Limit Medicaid Provider Taxes - $175B

Lower FMAP Floor - $387B

Special FMAP Treatment for DC – $8B

Repeal American Rescue Plan FMAP Incentive – $18B

Medicaid Work Requirements - $120B

What does all of this mean? It means that tens of millions of people will lose their access to Medicaid and, thus, their access to healthcare. All of this, taken together, would pretty much mean the end of the ACA’s Medicaid expansion, which made it so that adults making 138 percent of the federal poverty line (about $20K a year for a single person) or less could qualify.

4. REIMAGINING THE AFFORDABLE CARE ACT (ACA) ($151B)

Recapture Excess Premium Tax Credit – $46B

Limit Health Program Eligibility Based on Citizenship Status - $35B

Repeal the Prevention Public Health Fund – $15B

Appropriate Cost Sharing Reductions - $55B

Incredibly enough, this “reimagining” is just cuts to the ACA that are largely going to hurt the poorest among us. They’re not terribly creative!

5. ENDING CRADLE-TO-GRAVE DEPENDENCE ($347B)

Reinstate the Trump-era Public Charge Rule - $15B

Reduce TANF by 10 Percent – $15B

Eliminate the TANF Contingency Fund - $6B

Reform the Thrifty Food Plan - up to $274B

Eliminate the Social Services Block Grant - $15B

SNAP Reforms – $22B

Fun fact about the TANF program — it costs us only $16.5 billion a year, and it’s cost us only exactly $16.5 billion a year since it was first implemented in 1996 (replacing the significantly more helpful Aid to Families with Dependent Children (AFDC)). This means it has actually decreased in value by 50 percent since then. And Republicans would like to spend less!

Not only that, only about 22 percent of the TANF block grants distributed to states actually even go to cash assistance for low-income families anyway. The rest of it is often treated as a slush fund with which the state can do whatever it wants and there is practically zero accountability for how it is used (which is how Mississippi ended up using it to pay NFL player Brett Favre $1 million for a speaking engagement).

TANF is absolute garbage and I could scream about it all day. We should set it on fire and go back to something closer to AFDC, which was far more successful at lifting families out of poverty and required states to actually be accountable for the money given to them — but the problem isn’t that we’re spending too much on it, it’s that we’re spending too little and there’s no accountability for how it’s used.

The rest of it is also obviously horrific, especially the provision about reforming the Thrifty Food Plan — the Thrifty Food Plan being the plan on which SNAP payouts are based. So these rich motherfuckers are seriously sitting around, looking at the amount of food deemed the least anyone could live on and still get some nutrition, and going “That’s too much!”

By the way, the average per-person payout for SNAP is $187 a month. Which is … not very much.

6. REVERSING BIDEN CLIMATE POLICIES ($468B)

Discontinue the Green New Deal Provisions in the 2021 Infrastructure Bill – $300B Repeal EV Mandate – $112B

Repeal IRA green energy grants– $56B

Sure! Why not destroy the planet while they’re at it?

7. OTHER: ($917B-$1T)

End the Student Loan Bailout – $200-330B

Rescind all Unspent COVID Money – $11B

Auction Spectrum – $60 billion

Repeal Orderly Liquidation Authority – $22 billion

Increase FERS Contributions – $45 billion

Other federal employee benefit reforms – $32 billion

Restrict emergency spending to recent average - $500B

Eliminate the TSP G Fund Subsidy – $47B

There is a lot that is bad here, but allow me to draw your attention to “Repeal Orderly Liquidation Authority.” Remember in 2007, when we had to bail out the banks because they were “too big to fail”? Well, in order to keep that from happening again, Dodd-Frank included a provision called Orderly Liquidation Authority. This means that when it looks like a financial institution is headed towards failure, the US government can step in and temporarily use tax money to keep everything afloat while they liquidate assets in a safe and orderly manner that won’t topple our entire economy. Get rid of this, and we have to go back to bailing out banks when they fail, which would be bad.

8. POTENTIAL TAX OFFSETS: ($227-$527B)

Green energy tax credits – $200 - $500B, depending on political viability

SSN CTC Requirement – $27B

Because, again, fuck the planet and also fuck the children — although in this case, recipients of a Child Tax Credit already have to have a child with a Social Security number, so I’m not sure why they think that would save money.

While one House Republican said it was more of a menu of things they could cut than a definitive list of things they want to cut, the Trump tax cuts for the rich alone are set to cost us about $4 trillion over the next decade — and that money’s going to have to come from somewhere. But hey! When they’re hungry or finding themselves without any health care, low-income Trump voters can take heart in knowing that they really stuck it to trans people, immigrants, and the concept of “woke” and definitely were not tricked into frothing at the mouth over these things in order to ensure they’d vote for people who would cut all of the programs they rely on in order to fund tax cuts for people too rich to even feel the impact of whatever small amount of taxes they won’t be paying anymore.

PREVIOUSLY ON WONKETTE!

Never mind that 𝐒𝐍𝐀𝐏 𝐌𝐀𝐊𝐄𝐒 𝐓𝐇𝐄 𝐂𝐎𝐔𝐍𝐓𝐑𝐘 𝐌𝐎𝐍𝐄𝐘.

SNAP generates more economic activity then the government pays out.

But, hey, the cruelty has always been the point.

This was all on the ballot.

Lysenkoism and fanfiction win out though. And a lot of these people vote to slit their own throats so long as Black people get it worse. That bears repeating.