If Republicans Pass Child Tax Credit After Joe Manchin Killed It, We Should Definitely Be Meaner To Trans People

You're killing us, smalls.

A brief paragraph in this NBC News story about Republicans’ plans to extend expiring Trump tax cuts (and add a bunch of new ones) made a whole bunch of cartoony question marks sprout above our heads. The story mentions that a still-developing grab bag of GOP tax and spending measures just might include a modest expansion of the child tax credit (CTC), a longtime Democratic priority, but not something you’d expect Republicans to advance unless they’re Mitt Romney.

Y’see, Republicans want to start off 2025 with a big reconciliation bill that would use that weird old Senate rule letting bills dealing only with spending and taxation to pass with a simple majority, immune from the filibuster. It’s the mechanism used by Democrats to pass Obamacare, the American Rescue Plan, and the Inflation Reduction Act, and most recently by Republicans in 2017 to pass the GOP’s Big Fat Tax Cuts For Rich Fuckwads bill, usually called “Trump’s tax cuts” although he really had little to do with the legislation other than signing it. (Remember, he wanted to call it the “Cut Cut Cut Act.”)

Whatever shape the eventual GOP bill takes, Trump will probably want to call it the “Best Cut Cut Cuts And They Can’t Eat The Dogs Or Eat The Cats Anymore Act of 2025, Also Mass Deportations Now.”

Here’s the not-terribly-detailed paragraph we’re talking about:

Sen. Tommy Tuberville, R-Ala., said the GOP is “100%” committed to extending the Trump tax cuts but with “some deviations” from existing law. He said he wants to expand child tax credits, which Jason Smith, R-Mo., chair of the House’s tax-writing Ways and Means Committee, has unsuccessfully sought to enact into law. Smith's plan, which combined tax relief for families with children and renewing Trump-era tax breaks for businesses, passed the House early this year, but Senate Republicans, including Tuberville, rejected it.

Yes, you read that right, Tuberville now wants Rich Fuckwads II to include the same child tax credit expansion he helped vote down in August. Or he says he does, at this preliminary stage.

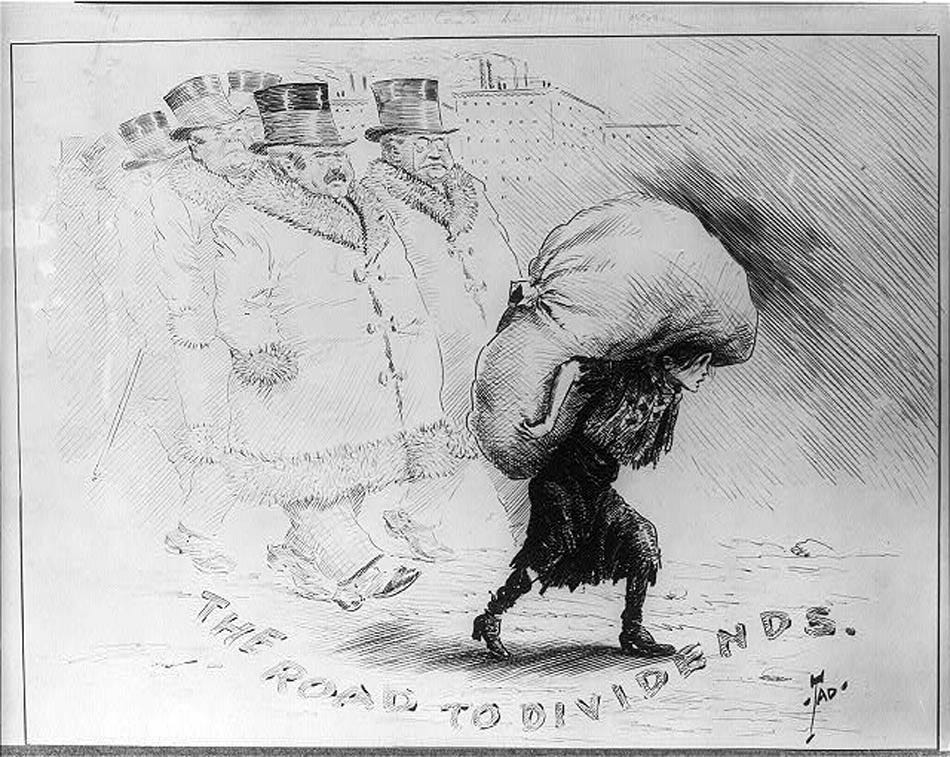

A quick recap of the expanded child tax credit that rolled out in the 2021 American Rescue Plan: It solved a major problem with tax credits, which is that to qualify for most of them, you have to have enough income that you need to pay income tax in the first place, which millions of people in poverty don’t, and you can’t deduct more than the amount of tax you owe (if any). As a result, fewer families in poverty get the CTC than rich and middle class families do, which is nuts.

2021’s expanded CTC boosted the credit from $2,000 per child to $3,600, and most importantly was “fully refundable,” meaning people could get the full $3,600 even if they didn’t pay any taxes. They could also get it in monthly installments, or choose to take a lump sum credit by filing a tax return (again, even if they didn’t need to pay taxes).

While it was in place, from August through December of 2021, the expanded credit led to a 46 percent reduction in child poverty, helping not only poor families but also folks in the middle class to get some of that economic “breathing room” that Joe Biden likes to talk about. Research into the program showed that not only did it make children’s lives better, it also didn't deter parents from working, despite the fears of conservatives.

But then then-Democrat and now “independent” Joe Manchin killed it in a fit of lies in 2021, when he fretted — against all the evidence — that parents were simply blowing the extra funds on booze and drugs instead of on their children. Thanks a whole fucking lot, Mr. Coal Lobbyist-to-be.

Damn good policy, and not surprisingly, Kamala Harris ran on bringing it back permanently, but we know how that turned out. Anybody who isn’t currently screaming that Democrats lost by focusing on “pronouns” (that’s shorthand for “recognizing the dignity of trans people, who by the way are under attack”) is trying to mildly point out that it seems what soured a lot of people on Joe Biden’s administration was the taking away of the temporary pandemic safety net. So maybe the people who took that safety net away in the name of “my constituents will let their children go hungry to do drugs if you give them money” have a lot more to do with the Democrats’ 2024 loss than whatever Tim Ryan and Other Tim Ryan are bitching about now. Plus, a tiny plurality of Americans preferred fascism, or at least thought Donald Trump would make eggs cheaper, so we can’t have nice things.

Which brings us back to the proposal introduced by Jason Smith in January of this year, about which Tuberville is saying nice things for a hot minute before Trump and a new GOP-majority Congress are sworn in come January.

Smith’s plan was considerably less expansive than the 2021 CTC reforms, but had some good ideas all the same: While keeping the credit at its current level of $2,000, it allowed low-income families to qualify for up to $1,800 per kid in its first year (even if they had less than that in tax liability), with that amount increasing incrementally to the full $2,000 over a few years. Oregon Sen. Ron Wyden (D), who has worked for decades to expand the CTC, said it would have helped as many as 15 million kids in low-income families.

To make the bill attractive to fellow Republicans, Smith’s bill renewed a whole bunch of expired or about-to-expire corporate tax cuts, but that was only enough to get the bill through the House. In August, the Senate killed it all the same, with the usual bromides about fostering government dependency and not forcing people to just stop being poor. Not even fostering business dependency on tax cuts was enough to save it.

In Wonkette’s Sekrit ChatCave this morning, Yr Editrix was understandably unchuffed at the prospect of Republicans doing a CTC expansion after Democrats have tried again and again to bring it back. She said that if the Smith proposal “passes after Joe Manchin boned us to literally make Republicans the party of child tax credit, I will be real mad!” She was not at her most eloquent. She is a very tired woman.

The odds of the Smith CTC expansion probably aren’t great, however. If it couldn’t pass this year as part of a “bipartisan compromise,” it seems unlikely that a GOP Senate, with more rightwing crazies than before, will manage the 51 votes needed to get it through the reconciliation process. Of course, one of the three votes needed to pass already said yay (that’s Tuberville, above), and now that it would be Trump’s Child Tax Credit instead of Joe Biden’s Child Tax Credit, they can all be JD Vance-style “populists.” The Editrix may be right after all. Why, maybe enough Republicans will be so delighted by all the other gifts to the already wealthy that they won’t mind a little help going to poor people, especially if it requires parents to endure a drug test, work requirements, and possibly sterilization in order to qualify.

[NBC News / USA Today (archived link)]

Yr Wonkette is funded entirely by reader donations. If you can, please become a paid subscriber, or if you’d rather make a one-time donation, here is your button!

This reminds me how many times Kyrsten Sinema has not been in the news cycle lately.

Tender mercies.

How I hate this pointy-bearded Spock universe.