Senate Republicans Want You To Have All The Children, Don't Want You To Have Child Tax Credit. Again.

'Bipartisan tax compromise that easily passed the House? No thanks, we're assholes.'

Republicans in the Senate plan today to kill a bipartisan tax cut bill that would expand the Child Tax Credit for the poorest Americans, giving working class people a little breathing room to pay for school expenses or maybe even clothes or a nice treat for their kids.

The bill easily passed the Republican-controlled House back in February, in that rarest of maneuvers in modern Congressing, a good old-fashioned bipartisan compromise. Democrats got a little of something they wanted, restoring some of the Child Tax Credit that in 2021 lifted millions of kids out of poverty (until it expired), while Republicans got a package of (not actually terribly offensive) expired tax breaks for businesses reinstated. As we said at the time, horses were traded, backs were scratched, and both sides got at least some of the legislative priorities they’ve wanted for quite a while.

In the Senate, though, the bill just never gained traction with Republicans, who made clear they would never let it get past a filibuster. Never mind the goodies built into the bill to attract Republican support, as the Wall Street Journal summarizes thusly (gift link):

The bill would revive expired tax provisions that help businesses making capital investments or conducting research, and it would expand the low-income housing tax credit and the child tax credit for low-income families. The legislation would also cut off the employee-retention tax credit, a pandemic-era program riddled with fraud and ineligible claims that has cost more than triple the original estimates. It attracted support from progressive antipoverty groups and the U.S. Chamber of Commerce.

At the Journal notes, the nearly $80 billion package had effectively been dead in the water for months, because (as the Journal would never admit) Republicans would rather lose some tax benefits for their donors than allow any kind of election-year legislative victory for a top Democratic priority. Besides, maybe Donald Trump and a Republican trifecta will be elected this fall, and then the Senate can pass a tax bill with all the advantages for businesses and nothing for poor families, except maybe drug tests and work requirements for any social spending that’s not eliminated altogether.

The bill would be far more modest than the version that passed as part of the American Rescue Plan in 2021; it wouldn’t actually increase the annual $2,000 CTC, but it makes changes for lower income earners who are currently only able to get up to $1600 in “partly refundable” credits because they don’t make enough money for the full credit. Starting with the 2023 tax year, the “partly refundable” credit would increase to $1800 per child, then $1900 in 2024, and finally in 2025 even filers with little or no taxable income will be able to get the full $2000 refund. Unlike the 2021 version, there won’t be any monthly payments; it would remain a single credit that comes after people file their 1040s each year.

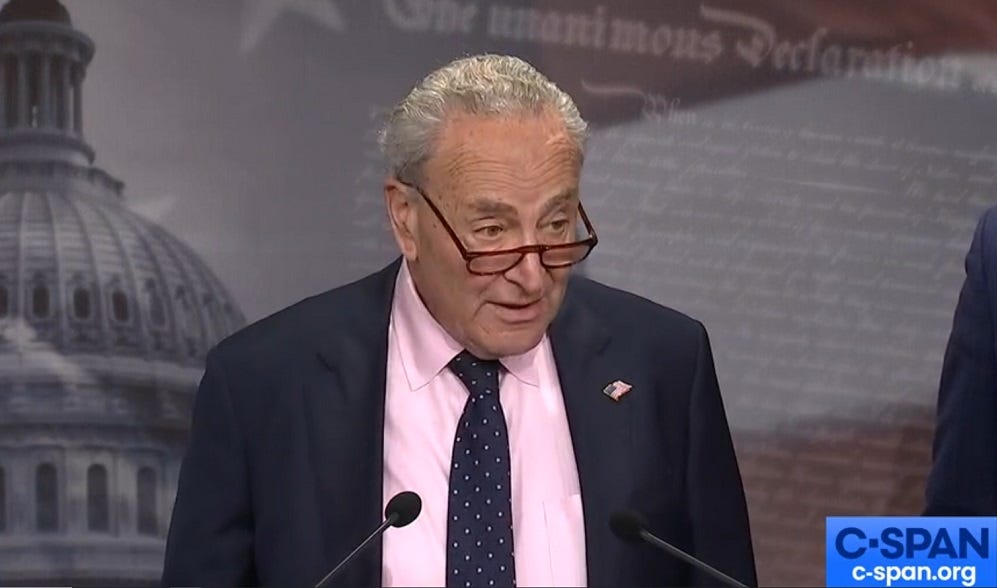

So with the legislation doomed, Majority Leader Chuck Schumer is bringing it to the floor today to force Republicans to get them on the record. It would be way better to actually lift 400,000 children out of poverty, but if the bastards aren’t going to let that happen, then at least the vote can generated some campaign ads pointing out that Sen. [insert Republican bastard’s name here] voted against lifting 400,000 children out of poverty, and Democrats approve that message.

Senate Finance Committee Chairman Ron Wyden (D-Oregon), a steadfast advocate of expanding the Child Tax Credit, said, “Senate Republicans have been giving all these flowery speeches about how much they care about kids and families, and then when it comes to actually doing something, they’re AWOL.”

In a floor speech yesterday, Schumer excoriated Republican senators, saying,

“Senate Republicans are looking at the calendar, and they have decided they care more about the results of the election than in passing a law. […] They hope that if things go their way, they can get a more conservative package sometime in the future. And they’re willing to walk away from expanding programs like the Child Tax Credit along the way.

With many parts of the Republicans’ 2017 Big Fat Tax Cuts for Rich Fuckwads set to expire in the next year — resulting in automatic tax increases for many voters because that’s how the legislation was written to pass under “reconciliation” rules — Republicans are hoping an electoral sweep this fall will let them make the Trump tax cuts permanent while everyone is looking at democracy being dismantled.

Meanwhile, as the Washington Post notes (gift link), Vice President Kamala Harris has so far supported Joe Biden’s plan to keep the 2017 law’s tax cuts for individuals in place, at least for folks making less than $400,000 annually, while raising the rates on businesses and people making over that amount.

Trump, on the other hand, has pledged to keep the low rates for the richest individuals while slashing corporate rates even further, from the existing law’s 21 percent to as low as 15 percent. But don’t worry, he’d raise tariffs on imports and make inflation explode to offset the lost revenue.

In an extremely rare case of a Republican almost making a damn bit of sense, Sen. Markwayne Mullin (R-Oklahoma), who’s almost always a despicable asshole, actually said there’s no reason not to go ahead and pass this bill now in order to get the tax cuts:

If the argument is, “We can get a better deal later,” that’s if we win the Senate, if we win the House, and if we win the White House — if that’s the argument for not doing it, then why can’t, if those ifs come true, we do a better tax bill? […] I like the sure thing.

We’ll temper our “that makes sense” with the caution that if Republicans actually did take power, they, and Mullin too, would undoubtedly strip out the Child Tax Credit help, so no, we are not accusing him of having a soul or anything. No worries there.

But with the bill now doomed, Democrats can at least campaign on bringing back some version of an expanded Child Tax Credit, and even making it permanent, because voters should have no illusions that Republicans will ever ever vote to make life more affordable for working parents.

[WSJ (gift link) / WaPo (gift link) / ABC News]

Yr Wonkette is funded entirely by reader donations. If you can, please become a paid subscriber, or if you prefer a one-time donation, we can help with that, too!

"Supreme Court Justice Samuel Alito is considering retirement amid pushback he has received in recent months, according to a new report."

I was going to ask if today was my birthday, and then I realized today IS my birthday!!!!!! Fuck yeah it is.

The Republicans are essentially "deadbeat dads"- they love children very much, but they just don't want to support or pay for them.